NEWS in BRIEF

IsDB Board Approves USD1.4bn of New Financing to Significantly Advance Progress Towards Achieving UN SDGs in 8 Member Countries

Jeddah – The Board of Executive Directors of Islamic Development Bank (IsDB) at its 359th meeting convened at IsDB headquarters in Jeddah on 16 March 2025 under the chairmanship of Dr Muhammad Al Jasser, approved over USD1.4bn of new financing to “significantly advance Sustainable Development Goals (SDGs) in 8 Member Countries.”

The approved development projects cover the food security, health, education, transport, sanitation, and urban development sectors, contributing towards the attainment of the UN Sustainable Development Goals. The approvals include:

i) €500mn in financing for the “Disaster-Resilient Health Infrastructure Development Project” in Türkiye. This initiative aims to address the additional need for accessible and resilient healthcare services and to complement the Bank’s previous interventions in the sector.

ii) €200.2mn financing facility for the “Municipal Infrastructure for Recovery and Resilience Project” in Türkiye, which will improve urban regeneration and municipal services in water, and wastewater management as well as transport services that would potentially benefit about 3 million people.

iii) USD241.3mn financing to build five climate-resilient bridges in Bangladesh’s Mymensingh Division. This project aims to improve the lives of the population by reducing vehicle operating costs, travel time, and greenhouse gas emissions.

iv) €141.44mn financing facility for Togo in West Africa to enhance regional connectivity by supporting the “Rehabilitation of the WAEMU CU18-Ghana-Benin Border Road Project.” The road will significantly improve travel between Ghana, Togo, and Benin, spurring economic efficiency, reducing transport costs, and supporting food security activities.

v) USD102.38mn in financing to Nigeria comprising a USD52.38mn facility to enhance food security in Zamfara State and a USD50mn facility to improve healthcare infrastructure and promote excellence in medical education in Sokoto State.

vi) USD92.98mn in financing to Uzbekistan’s health sector, thus contributing to enhancing health care services in the Kashkadarya region. In addition, USD10mn has also been approved to support the Development of Oncology Services Project in Uzbekistan (Phase-II).

vii) A Joint €36.80mn facility from the IsDB and the Islamic Solidarity Fund (ISFD) to improve basic education in Cameroon under the SMART-Ed Initiative would help enhance the capacity and efficiency of the country’s educational system ensuring inclusive quality basic education for around 154,000 children.

viii) €35.07mn million financing for Burkina Faso’s Ouagadougou Suburban Sanitation Project to improve rainwater drainage and address flooding in the capital. It will also help upgrade public sanitation and healthcare while creating green jobs especially for women and youth.

xi) USD30.48mn of financing towards poverty reduction and enhancing food and nutrition security of rural households in Sierra Leone under the aegis of the “Livestock and Livelihoods Development Project”. The initiative is also aimed at creating employment opportunities for rural women and youth while promoting livestock production, productivity and market access.

These projects, says Dr Al Jasser, “are envisaged to foster sustainable and inclusive development, positively impacting on the quality of life in communities across our member countries.

Tasaheel for Finance Successfully Closes Egypt’s and Africa’s Largest Non-Sovereign Social Sustainable EGP7bn (USD140mn) Sukuk Mudaraba

Cairo – The Commercial International Bank (CIB), Egypt’s leading private-sector bank, successfully closed a groundbreaking EGP7bn (USD140mn) Sukuk Mudaraba for Tasaheel for Financing (S.A.E). The Sukuk certificates were issued by Alkan Finance Sukuk on behalf of the Obligor Tasaheel for Finance.

This transaction is the largest non-sovereign social sustainable Sukuk issuance in Africa and the first of its kind in the Egyptian market. Furthermore, it is the first non-sovereign Sukuk to be issued in the Egyptian market in accordance with AAOIFI standards.

CIB played a pivotal role in this transaction as the financial advisor, lead arranger, manager, and promoter. The bank also served as the payment agent and underwriter, reinforcing its leadership in the financial market.

The Sukuk, according to CIB, received a ‘A’ credit rating from MERIS (Middle East Rating and Investor Service) and an “excellent” sustainability score under the SQS1 framework from Moody’s Ratings, reflecting Tasaheel’s strong alignment with the social Sukuk principles of the International Capital Market Association “ICMA”.

The issuance said CIB, experienced a strong demand from investors, achieving an oversubscription of 1.2 x, a testament to its appeal and significance in the market.

Mr. Amr El-Ganainy, Deputy CEO & Executive Board Member at CIB, commented: “This landmark Sukuk transaction underscores our unwavering commitment to innovation and sustainable finance in Egypt. By partnering with Tasaheel, we are reshaping the future of structured and Islamic finance, breaking barriers to promote financial inclusion, and addressing critical market challenges. CIB’s leadership in launching the first social sukuk demonstrates our dedication to delivering impactful, transformative solutions to empower businesses and uplift communities.”

Similarly, Ms. Heba Abdel Latif, Head of Financial Institutions & Debt Capital Markets at CIB, stressed that “the success of Tasaheel’s social sukuk not only solidifies our position as a trusted financial partner but also highlights the confidence that investors have in Egypt’s microfinance sector. This milestone reflects the potential for sustainable financing to drive positive societal and economic change. Since our relationship with Tasaheel began in 2021, we have worked closely to address the market’s need for innovative and sustainable financing instruments, evidenced by our successful closure of the 1st Social Securitization in the Egyptian market in December 2023 and now the closure of this landmark Sukuk transaction, setting a new benchmark for growth and collaboration.”

Commercial International Bank (CIB), Arab African International Bank (AAIB), Banque Du Caire (BDC), Al Baraka Bank Egypt were the underwriters of this transaction, while First Abu Dhabi Bank Misr (FAB Misr), Abu Dhabi Commercial Bank (ADCB), Société Arabe Internationale de Banque (SAIB), and Arab Banking Corporation (ABC) were participants. CI Capital acted as co-advisor and co-arranger, Alkan Sukuk Finance as the Issuer of the Sukuk.

Consortium of Local Banks Arrange a Rescheduled SAR8.1bn (USD2.1bn) Syndicated Murabaha Facility for Saudi Kayan Petrochemical Company

Jeddah – Saudi Kayan Petrochemical Company signed an agreement with a consortium of local banks on 16 March 2025 to refinance and increase an existing Murabaha credit facility amounting to SAR8.1bn (USD2.1bn).

According to Saudi Kayan in a disclosure to Tadawul (the Saudi Exchange), this refinancing agreement would help achieve several strategic objectives, including:

- Sustainable financial planning by maximizing cash liquidity, supporting the financial position and providing greater financial flexibility.

- The refinancing will improve solvency to achieve rewarding financial returns that help the company to overcome challenges, manage risks, respond to market fluctuations and manage liquidity with better flexibility to support maximizing shareholders value.

The agreement to reschedule Saudi Kayan’s debt was signed with Saudi National Bank, Banque Saudi Fransi and Alinma Bank.

The new refinancing agreement, said Saudi Kayan, reflects the company’s creditworthiness and the trust it has gained with financial institutions over the past years, which shows the strength and durability of the financial position. This agreement reflects the company’s commitment by maintaining the financial position and ensuring its sustainability and achieving optimal capital, allowing us to focus on strategic priorities, achieve added value for its shareholders and enhance the position of the company to achieve continuous success, despite the difficulties and challenges facing the petrochemical sector.

The refinanced facility has a tenor of 10years and is guaranteed by Order Notes and Receivables Pledges. An amortization schedule was developed in a sculpted manner and a tenor of 10 years with a grace period until end of 2025. The debt schedule starts with low principal payments which gradually increase to 13% of the principal amount in 2028 and continues through 2034.

ICIEC Provides Credit Risk Cover for SCB’s €75mn Murabaha Facility to The Black Sea Trade and Development Bank to Support Diverse Projects

Dubai – The Islamic Corporation for the Insurance of Investment and Export Credit (ICIEC), the Shariah-compliant multilateral insurer and member of the Islamic Development Bank (IsDB) Group, signed an agreement in February 2025 for the provision of credit risk cover for Standard Chartered Bank’s €75mn (USD81.14mn) long-term Murabaha financing facility to the Black Sea Trade and Development Bank (BSTDB).

The long-term financing facility extended to BSTDB, was secured from Standard Chartered Bank (SCB) to support a diverse portfolio of development projects across Albania, Azerbaijan, and Türkiye. ICIEC is providing credit risk protection of up to 95% of the facility through its Non-Honouring of Sovereign Financial Obligation Policy (NHSFO) for Multilateral Development Banks, with a coverage period of seven years. This initiative exemplifies a multi-institutional partnership aimed at delivering high-impact outcomes through targeted investments in infrastructure, energy, and industrial sectors – reinforcing BSTDB’s role as a regional development catalyst and advancing ICIEC’s mission to support sustainable growth across its member states.

ICIEC’s involvement in this transaction is a strategic role in supporting sustainable development and regional cooperation to facilitate investments and trade among member states. This NHFO-MDB coverage will enable broader capital mobilization for development-oriented projects and enhance the capacity in delivering impactful development finance. The credit facility is expected to have substantial economic, social, and environmental impacts across the recipient countries, with outcomes in regional cooperation, environmental sustainability and economic growth.

The facility is aligned to UN Sustainable Development Goals (SDG) 9 which promotes Industry, Innovation and Infrastructure; SDG 13 which supports Climate Action; and SDG 17 which promotes Partnerships for the Goals.

ITFC Pens Master Murabaha Agreement with Mutual Trust Bank to Strengthen Trade Finance Support for Small and Medium Enterprises (SMEs) and the Private Sector in Bangladesh

Dhaka – The International Islamic Trade Finance Corporation (ITFC), the trade finance fund of the Islamic Development Bank (IsDB) Group, and Mutual Trust Bank (MTB) of Bangladesh signed a Master Murabaha Agreement on 16 March 2025 to strengthen trade finance support for Small and Medium Enterprises (SMEs) and the private sector in Bangladesh.

The agreement will enable ITFC to provide trade financing facilities against Letters of Credit (LCs) issued by Mutual Trust Bank, enhancing the bank’s capacity to support cross-border trade and contribute to the growth of SMEs. This collaboration underscores both institutions’ commitment to fostering economic development and private sector growth in Bangladesh.

The signing ceremony was held at Dhaka and attended by senior executives from both organizations. Mr. Syed Mahbubur Rahman, Managing Director and CEO of Mutual Trust Bank, and Mr. Nazeem Noordali, Officer-in-Charge, CEO of ITFC, led the signing on behalf of their respective institutions.

Mr. Nazeem Noordali emphasized the strategic importance of the partnership, stating, “We are proud to partner with Mutual Trust Bank to provide trade financing facilities that will support SME growth and the import of essential commodities in Bangladesh. Private sector development is a cornerstone of the country’s economic progress, and enabling SMEs to access trade finance is central to ITFC’s strategy. This initiative will also help SMEs integrate into global value chains, fostering sustainable economic growth.”

Mr. Syed Mahbubur Rahman, Managing Director and CEO of Mutual Trust Bank, similarly commented: “The partnership with ITFC under this trade finance facility agreement is significant, especially given the current economic challenges faced by Bangladesh. This collaboration will enhance MTB’s reputation among correspondent banks globally, highlighting its resilience, commitment to best practices, and dedication to sustainable growth. Furthermore, it will provide our SME customers with greater access to financing and help facilitate the import of essential raw materials and soft commodities”.

The Master Murabaha Agreement reflects the shared vision of ITFC and Mutual Trust Bank to drive economic growth by supporting SMEs and the private sector. By facilitating access to trade finance, the partnership aims to empower businesses, create employment opportunities, and contribute to the sustainable development of Bangladesh.

IsDB President Dr Muhammad Al Jasser Reaffirms MDB’s Commitment to Gender Empowerment and Equality, Marking International Women’s Day and Their Shared Role in Inclusive and Sustainable Development

Jeddah – Dr Muhammad Al Jasser, President of the Islamic Development Bank (IsDB) has strongly reiterated the Bank’s commitment to gender empowerment and balance, and the important role of women in development.

On the occasion of International Women’s Day (IWD) on March 8, he emphasised that the IsDB Group “join the world in celebrating International Women’s Day, honouring the vital role of women in shaping societies and driving socioeconomic progress.” Women, he stressed, have always been catalysts for transformation—uplifting their communities with resilience, compassion, and determination. Across all sectors, they contribute to a more inclusive, prosperous, and sustainable future.

“On behalf of the Islamic Development Bank (IsDB) Group, I extend my sincere appreciation to all women – our sisters, mothers, daughters, and colleagues – who strengthen our societies with their leadership and contributions. While we celebrate, we must also acknowledge the challenges many women face especially in fragile regions. In conflict zones and disaster-affected areas, women disproportionately bear the burden of crises yet remain at the forefront of recovery and resilience,” he added.

This year’s IWD theme – “For ALL Women and Girls: Rights. Equality. Empowerment,” – could not be more opportune. To Dr Al Jasser it “reaffirms our commitment to gender equality. At the IsDB Group, we integrate women’s empowerment into our policies, projects, and partnerships to ensure equal access to opportunities. Through Flagship initiatives such as the BRAVE Women Programme, SheTrades Initiative, and Women in Tech Programme, we actively support women entrepreneurs, enhance digital skills, and create sustainable economic opportunities.”

Women’s empowerment he maintained, is not just a women’s issue—it is a shared responsibility requiring the collective efforts of men, institutions, and society. True progress comes from equity, partnership, and mutual respect. “As we mark this day, let us commit to concrete actions that unlock the full potential of women and girls, fostering inclusive and sustainable development,” he concluded.

Flagship Islamic financial Institution Bank Islam Malaysia Issues RM250mn (USD56.34mn) Subordinated Sukuk Murabahah – the Seventh Tranche under its RM10bn (USD2.25bn) Sukuk Murabaha Programme

Kuala Lumpur – Malaysia’s flagship Islamic financial institution, Bank Islam Malaysia Berhad issued its seventh tranche of RM250mn (USD56.34mn) Subordinated Sukuk Murabahah under its RM10bn (USD2.25bn) Sukuk Murabahah Programme on 24 March 2025.

In a disclosure to Bursa Malaysia, it revealed that the Sukuk Murabahah would qualify as Tier 2 regulatory capital of Bank Islam in compliance with Bank Negara Malaysia’s Capital Adequacy Framework for Islamic Banks (Capital Components).

The Sukuk which have a tenor of 10 years, will enhance the capital adequacy of Bank Islam in line with the Basel III requirements.

“The Sukuk Murabahah, which will be redeemed at its full nominal value upon maturity, comes with a call option on its fifth anniversary and is rated ‘A1/stable’ by RAM Rating Services Bhd. Bank Islam is the principal adviser, lead arranger, lead manager and Shariah adviser for the Sukuk Murabahah Programme,” said Bank Islam.

ICIEC Underwrites Sovreign Risk Policy Cover for SCB/SMBC’s €194.9mn Murabaha Facility to Uzbekistan’s Agrobank Aimed at Supporting SMEs

Jeddah – The Islamic Corporation for the Insurance of Investment and Export Credit (ICIEC), a Shariah-compliant multilateral insurer and a member of the IsDB Group, provided a Non-Honouring of Sovereign Financial Obligation – State Owned Enterprise (NHSFO-SOE) Policy to Standard Chartered Bank (SCB) and SMBC Bank International Plc (UK) to provide insurance coverage for its financing facility to Joint-Stock Commercial Bank ‘Agrobank’ in Uzbekistan, and to underwrite the political and commercial risks associated with the transaction.

The Shariah-compliant facility aims to provide financing for microfinance (retail) and SME projects through two digital platforms: “OPEN” and “B2B Marketplace”, both owned by Agrobank. The initiative will enhance access to Islamic finance for retail consumers and SMEs, supporting entrepreneurship, business growth, and financial inclusion in Uzbekistan.

The policy, which has a tenor of 7 years, became effective on 27 February 2025 and covers 95% of the risk of the facility totalling €194,835,797.30. ICIEC’s role was to provide risk mitigation for the transaction, thus enhancing financial inclusion, supporting the expansion of Shariah-compliant financial products in Uzbekistan, and aligning with Uzbekistan’s financial sector reforms and market transition strategy.

The project, says ICIEC, will introduce Islamic financing options to retail and SME customers, enhance the local financial infrastructure, strengthen the SME sector, boost employment through increased access to financing opportunities, expand economic activities, and support economic modernization aligned with Uzbekistan’s economic reforms aimed at transitioning to a market economy.

The transaction is also aligned to UN Sustainable Development Goals (SDG) 1 which promotes financial inclusion for underserved populations, SDG 8 which enhances SME financing and job creation, SDG 9 which supports financial platforms and market access for businesses, SDG 10 which enhances access to financing for small businesses and individuals, and SDG 17 which strengthens international cooperation and partnerships in financial sector development.

International Finance Corporation and Cagamas Pen MoU to Drive Green Building Finance and Sustainability

Kuala Lumpur – The International Finance Corporation (IFC), the largest global development institution focused on the private sector in emerging markets and a member of the World Bank Group, signed a memorandum of understanding (MoU) with Cagamas Berhad, the National Mortgage Corporation of Malaysia, on 16 March to advance green building finance in Malaysia, further supporting the country’s sustainable development goals.

The collaboration aims to promote climate-smart investments in the housing and broader building sector and improve the capacity of financial institutions to issue green building finance products aligned with Malaysia’s climate goals, including green bonds, green credit lines, and financing for sustainable cooling technologies. It also aims to help financial institutions to build pipelines of bankable projects and manage environmental, social, and climate risks in the building sector, as well as facilitating dialogue and knowledge exchange on addressing barriers to sustainable housing development between the public sector and banking sector, among other initiatives.

The collaboration also seeks to make green housing more affordable and accessible to lower-income groups and women in Malaysia by growing the market for green mortgage products and addressing other housing finance gaps. Expanding the growing market for green building finance is essential for Malaysia to realise its goal of achieving net-zero emissions by 2050, presenting significant opportunities in this sector.

Cagamas is a major player in the mortgage securitisation market and issues bonds and Sukuk regularly to buy housing finance bundles from the market, thus increasing liquidity in the housing finance sector and reaffirming the Corporation’s role as a secondary mortgage corporation in providing liquidity to primary lenders of home financing and housing loans. Cagamas plays an important role in Sukuk origination and continues to be an innovator in the mortgage finance and securitisation market. The Cagamas papers are listed and traded under the Scripless Securities Trading System of Bursa Malaysia. Cagamas’ corporate bonds and Sukuk continue to be assigned the highest ratings of AAA and P1 by RAM Rating Services Berhad and AAA/AAAIS and MARC-1/MARC-1IS by Malaysian Rating Corporation Berhad, denoting its strong credit quality. Cagamas is also well regarded internationally and has been assigned local and foreign currency long-term issuer ratings of A3 by Moody’s Investors Service Inc. that are in line with Malaysia’s sovereign ratings.

The Cagamas model is well regarded by the World Bank as the most successful secondary mortgage liquidity facility. Cagamas is the second largest issuer of debt instruments after the Government of Malaysia and the largest issuer of AAA corporate bonds and Sukuk in the market. Since incorporation in 1986, Cagamas has cumulatively issued circa RM413.76 billion (US$88.16 billion) worth of corporate bonds and Sukuk.

Similarly, the IFC has a longstanding involvement in the Islamic housing finance and mortgage securitisation sector, where developers have teamed up with AAA-rated partners to offer finance for affordable housing. In Saudi Arabia, for instance, there is the Saudi Home Loans Company (SHLC), which was established in 2007, in which the International Finance Corporation (IFC), the private sector funding arm of the World Bank Group, is a major shareholder together with Arab National Bank, Kingdom Instalment Company and Dar Al-Arkan Real Estate Development Company, one of the largest housing developers in Saudi Arabia and a regular issuer of Sukuk. SHLC was designed to promote home ownership by making housing finance more available and affordable for the country’s middle-and-lower-income residents.

On this latest collaboration between IFC and Cagamas, Judith Green, Country Manager for the World Bank Group in Malaysia commented: “We are delighted to collaborate with Cagamas on this engagement, which will play a critical role in supporting not only the increasing need for green housing in Malaysia, but also the country’s inclusivity agenda. Together, we aim to improve access to housing and reduce emissions, encouraging climate-smart investment in the building sector, and strengthen the financial sector’s capacity to support Malaysia in achieving its climate commitments under the Paris Agreement.”

“This collaboration marks another milestone in Cagamas’ commitment to driving sustainable development to promote green and affordable housing for all Malaysians, and we are excited to partner with IFC towards making this a reality. At Cagamas, we understand that the transition to green practices across sectors requires significant financial resources and innovative approaches. Through this partnership, we aim to expand access to green mortgage options and collaborate with financial institutions to create a more inclusive and sustainable housing market that contributes to a greener Malaysia,” said Kameel Abdul Halim, President and Chief Executive Officer of Cagamas. This collaboration is the first engagement in the green first engagement in the green building sector in Malaysia for IFC, which established a presence in the country in 2023.

IILM Continues Short Term Sukuk Issuance Momentum with Two Auctions in March 2025 with an Aggregate Reissuance of USD2.02bn and for the First Quarter of 2025 of USD5.05bn Amid Robust Investor Demand

Kuala Lumpur – The International Islamic Liquidity Management Corporation (IILM), the multilateral international industry organisation that develops and issues short-term Sharia’a-compliant liquidity management instruments, continued its short-term Sukuk issuance momentum with two auctions in March 2025 – the first one was a reissuance of USD1.21bn of short-term Sukuk on 11 March and the second one a reissuance of USD810mn of short term Sukuk on 25 March.

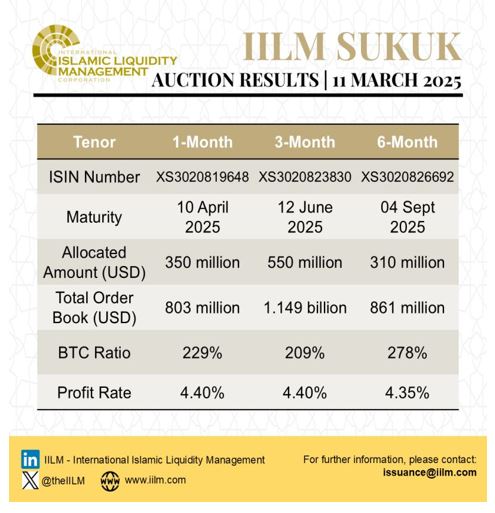

These transactions follow the Corporation’s first auction for 2025 in January with a reissuance of an aggregate USD1.27bn short-term Sukuk across three different tenors of one, three, and six-month respectively; and an aggregate USD1.76bn Sukuk issued in February with the same tenors. With the March auctions, the total volume of Sukuk issued in the first quarter of 2025 amounted to USD5.05bn. The first auction on 11 March 2025 saw the successful completion of the reissuance of an aggregate USD1.21 billion short-term Sukuk across three different tenors of one, three, and six-month respectively. The three series reissued on 11 March 2025, says the IILM, were priced competitively at:

i) 4.40% for USD350mn for the 1-month tenor

ii) 4.40% for USD550mn for the 3-month tenor

iii) 4.35% for USD310mn for the 6-month tenor.

The auction saw a competitive tender amongst the Primary Dealers and Investors globally, with a strong orderbook of USD2.813bn, representing an average bid-to-cover ratio of 232.5%.

Mohamad Safri Shahul Hamid, Chief Executive Officer of the IILM, commented: “Against a backdrop of ongoing macroeconomic volatility, amplified by global trade tensions and evolving expectations surrounding the Federal Reserve’s interest rates, IILM’s USD 1.21 billion Sukuk issuance reaffirms our commitment to supporting stability in the Islamic financial markets. The strong demand underscores the continued and growing investors’ confidence in the IILM’s ‘A-1’ and ‘F1’ rated short-term instruments. IILM’s Sukuk serves as reliable and secure liquidity management tools, positioning it as a safe haven for investors seeking stability amidst uncertainty, especially during these turbulent times.

“Amidst a global market environment marked by the sell-off of risky assets, institutions are increasingly prioritising flexible short-term liquidity solutions and high-quality assets. IILM remains committed to consistently issuing and offering an increased volume of Sukuk, at least once a month to meet the growing needs of Islamic investors in particular, backed by the prolific group of global Primary Dealers. With a proven track record in navigating market-averse conditions, our regular issuances, supported by a strong global network, reinforces the IILM’s dedication to providing essential liquidity management tools while ensuring a reliable distribution framework that serves both investors and the broader Islamic finance ecosystem.”

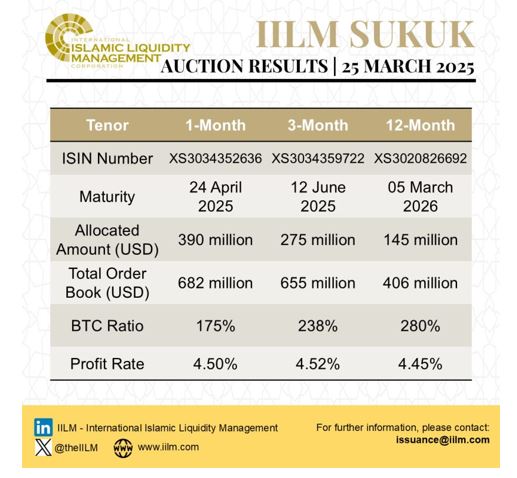

In the second transaction on 25 March 2025, the IILM also successfully completed the reissuance and issuance of an aggregate USD810mn short-term Sukuk across three different tenors of one, three, and twelve-month respectively. In this transaction, according to the IILM, the Corporation “secured a new high-quality underlying asset worth USD500mn in its portfolio as it expands its pool of assets to meet the growing demand for the IILM’s short-term Islamic papers.”

The three series were priced competitively at:

i) 4.50% for USD390mn for the 1-month tenor

ii) 4.52% for USD275mn for the 3-month tenor

iii) 4.45% for USD145mn for the 12-month tenor.

The short-term Sukuk transaction on 25 March marked the IILM’s fifth auction year-to-date, with cumulative issuances totalling USD 5.05 billion across 14 Sukuk series of varying tenors. The auction saw a competitive tender amongst the Primary Dealers and Investors globally, with a strong orderbook of USD 1.74 billion, representing an impressive average bid-to-cover ratio 215%.

Mohamad Safri Shahul Hamid, Chief Executive Officer of the IILM, commented on the 25 March issuance: “We are pleased to announce an inclusion of a USD500mn high-quality asset into our portfolio, bringing the total IILM outstanding Ṣukuk to an all-time high of USD 4.69bn. The inclusion of this new asset not only strengthens our liquidity offerings but also reaffirms the role of IILM as a plausible provider of long-term funding solutions for eligible issuers and obligors. We are in a very exciting phase of our growth and expecting to see a steady increase in our outstanding Ṣukuk asset pool in the coming months with at least a couple more new assets to be onboarded by the end of first half of the year.

The IILM’s short-term Sukuk is distributed by a diversified and growing network of 14 primary dealers globally, namely Abu Dhabi Islamic Bank, Al Baraka Turk, Affin Islamic Bank, Boubyan Bank, CIMB Islamic Bank Berhad, Dukhan Bank, First Abu Dhabi Bank, Golden Global Investment Bank, Kuwait Finance House, Kuwait International Bank, Maybank Islamic Berhad, Golden Global Investment Bank, Meethaq Islamic Banking from Bank Muscat, Qatar Islamic Bank, and Standard Chartered Bank.

The Corporation is a regular issuer of short-term Sukuk across varying tenors and amounts to cater to the liquidity needs of institutions offering Islamic financial services. The Corporation says it will continue to reissue its short-term liquidity instruments monthly as scheduled in its issuance calendar. The issuance forms part of the IILM’s “A-1” (S&P Ratings) and “F1” (Fitch Ratings) rated USD6bn short-term Sukuk issuance programme.

Looking ahead into 2025, the IILM plans to boost its asset origination activities through bespoke and attractive offerings to address the diverse needs of global sovereign and sovereign-linked Sukuk issuers, as well as rolling out alternative to Sukuk assets to allow further growth of supply and meet the growing market demand.

The IILM will also continue to expand its investor base and network of primary dealers as it looks to expand regional collaborations and enter new markets to further integrate Islamic liquidity solutions into the global financial system. The Corporation, says Mr Mohamad Safri, remains committed to developing the Islamic liquidity management infrastructure and enhancing the Sharia’a-compliant liquidity tools available to the market, working closely with scholars, regulators, and industry stakeholders to resolve inconsistencies that may hinder growth.

The IILM says it will also continue to reissue its short-term liquidity instruments monthly as scheduled in its issuance calendar. The IILM’s ongoing commitment to innovation and impact, according to the Corporation, continues to bolster the liquidity management capabilities of Islamic financial institutions. By providing highly rated tools that are increasingly traded in secondary markets, the IILM helps these institutions meet their Liquidity Coverage Ratio (LCR) requirements while offering sustainable returns.

The IILM consistently issues short-term Sukuk across 1-month, 3-month, 6-month, as well as 12-month tenors, tailored to the liquidity needs of Islamic financial institutions. Since its inaugural issuance in 2013, the IILM has successfully issued a cumulative of USD118.25bn worth of short-term Sukuk across 284 series.

The current members of the IILM Board are the central banks of Indonesia, Kuwait, Malaysia, Mauritius, Nigeria, Qatar, Türkiye, the United Arab Emirates, as well as the multilateral Islamic Corporation for the Development of the Private Sector, the private sector funding arm of the Islamic Development Bank Group.