NEWS in BRIEF

Al Rajhi Bank’s SAR3bn (USD800mn) Murabaha Facility for PIF-affiliated Bahri Underpins Close Synergy Between Corporates and Islamic Banks

Riyadh – The synergy and collaboration between Saudi corporates and the Islamic banking sector are a major reason why Islamic corporate finance is a dominant feature of the Saudi and GCC commercial funding playbook.

The interaction is uncanny. No sooner had Al Rajhi Bank closed its latest offering of an USD1.5bn AT1 Capital Sustainable Sukuk Wakala/Mudaraba in January 2025 than the Bank arranged a SAR3bn (USD800mn) Murabaha revolving credit facility for the National Shipping Company of Saudi Arabia (Bahri), an affiliated company of the Saudi sovereign wealth fund, Public Investment Fund (PIF), and a global leader in maritime transportation and logistics.

Only a few months earlier, on 16 October 2024, Bahri had obtained a similar 10-year Murabaha financing facility from Alinma Bank, whose proceeds were used to fund approximately 70% of the purchase value for acquisition of nine (9) VLCCs (Very Large Crude Carriers). It is such collaboration that drives the Saudi Islamic corporate finance market, a feature which is nowhere as visible and prominent as in the Kingdom. The only other market in which Islamic finance is of systemic importance that comes near to the Saudi dominance of Shariah-compliant corporate finance is the UAE in terms of per capita per population.

The multi-faceted projects incorporated in the ambitious Saudi Vision 2030 and the recent awarding of the 2034 FIFA World Cup to the Kingdom, will ensure that the increasing demand for Islamic finance, especially Murabaha credit facilities, Sukuk issuance and leasing, will be sustainable for the next decade or so.

In a disclosure to Tadawul (the Saudi Exchange), Bahri confirmed the closing of the transaction with Al Rajhi Bank on 14 January 2025, which has a tenor of 5 years and is guaranteed by an order note to the value of the credit facility. The credit facility, said Bahri, will be used to support and strengthen the company’s financial position and cover the working capital and CAPEX requirements.

This agreement, said Bahri, reflects the strategic partnership between Bahri and Al Rajhi Bank and supports the company’s development goals by enhancing financial liquidity and funding its operational and capital needs. The move aligns with Bahri’s efforts to maintain its leadership position in the maritime sector on the regional and global levels.

Additionally, the Murabaha Revolving Credit Facility agreement provides Bahri with financial flexibility to achieve sustainable growth and drive innovation in the shipping and logistics sector. It also contributes to Saudi Arabia’s transformation into a global logistics hub, leveraging its unique geographical location, while supporting economic diversification and fostering the development of national talent.

The two parties’ commitment to each other was best articulated by Mr. Basil Abu Al-Hamayel, Chief Financial Officer at Bahri, who commented: “We are pleased to sign this agreement with Al Rajhi Bank, which we anticipate will play a pivotal role in enhancing the efficiency of our operations and financial position, while delivering seamless shipping services that comply with the highest international standards. This collaboration reaffirms the value we create for our customers, the global maritime sector, and the industry at large.”

Mr. Hussam Al-Basrawi, General Manager of Corporate Banking Group at Alrajhi Bank, reiterated: “We are delighted to sign this agreement with Bahri, a leading company in the maritime sector. This partnership reflects the bank’s commitment to supporting prominent companies and providing the necessary financial facilities to enhance their growth and sustainability, this collaboration strengthens Al Rajhi Bank’s pioneering role in offering innovative financial solutions that contribute to achieving Saudi Vision 2030, which aims to diversify the economy and enhance investments.”

Bahri is one of the world’s largest shipping and logistics companies, with ambitions as lofty as its fleet expansion plans. As such, the agreement provides Bahri with greater opportunities to achieve its long-term growth strategy, strengthening its position among the leading global players in maritime sector. It also supports efforts to expand its market share into new locations and sectors, enhances its competitiveness, and bolsters its profitability.

IsDB Board of Directors Approve USD575.7mn of New Financing for Development Projects in African and Central Asian Member Countries

Jeddah – The Islamic Development Bank (IsDB’s) Board of Executive Directors at its 358th meeting in Jeddah on 15 December 2024, approved USD575.63mn in new financing to foster education, energy, regional and international connectivity as well as job creation and food security in African and Central Asian member countries. The approvals, said Dr. Muhammad Al Jasser, IsDB President who also chaired the meeting, will contribute to the achievement of the UN SDGs in line with the national development plans and priorities of the recipient member countries.

The financing approvals aimed at boosting the energy and grid connectivity, transport and agri-business sectors comprised:

- EUR140mn (USD145.61mn) to Guinea and Senegal towards financing the Guinea-Senegal Road Corridor Construction Project which aims to strengthen Guinea’s connectivity with Senegal. The project will enhance livelihoods by facilitating efficient market and service access, improving roads, lowering transport costs, boosting agriculture, and elevating regional economic integration across West Africa.

- USD85mn to Kazakhstan to facilitate the construction of the Kyzylorda Bypass Road Project. Once operational, the 4-way bypass road will ease urban and international transit traffic in and around Kyzylorda City, improving transport services for 350,000 people, ameliorating road traffic safety by 50%, reducing travel time by 40%, and increasing average speed by 30%.

- USD80mn to Guinea towards the construction of a 40 MW Thermal Power Plant in Kankan, the second largest city in Guinea, aiming to extend the electricity distribution grid from the Fomi Substation to the town of Kouroussa and 16 other neighbouring localities, thereby enhancing people’s lives by improving the stability and reliability of electricity supply.

- An EUR48.04mn (USD49.96mn) contribution from the IsDB to fund the Youth and Women MSMEs and Entrepreneurship Support Project (YWESP) in Tunisia. The project will create jobs for young women and men by providing a blended line of financing. It seeks to improve access to affordable finance for Micro Small and Medium enterprises (MSMEs) especially in agri-food systems, which are vital to providing food security and alleviating poverty.

- EUR32mn (USD33.2mn) to Benin towards financing a Rural Electrification Project that will contribute to the country’s targets for increasing access to modern energy services, scaling up renewable energy, increasing energy efficiency, and improving knowledge services. This is expected to increase the national electricity access rate by 6% and improve rural energy access by 14.5% by serving 9,200 households or nearly 49,000 citizens.

- 25mn co-financing contribution to Kyrgystan for a similar joint Smart-Ed Project by IsDB/ISFD/GPE which will target Improving Access to and Quality of Inclusive Learning Opportunities for All Children in Kyrgyzstan. The school population in the country has surged by 15% in the past 5 years, necessitating substantial investments in educational infrastructure and reforms. The IsDB’s USD10.25mn financing contribution is part of a USD76.31mn joint project with GPE which will provide girls and boys with equitable access to quality competency-based learning opportunities that will prepare them for the evolving labour market demands.

“This round of financing approvals represents a milestone in the history of our institution as our annual development approvals have exceeded USS5bn. This achievement is a testament to our continued commitment to serving our member countries and contributing to their national plans and priorities to foster inclusive economic growth and sustainable socio-economic development. These approvals also in line with the IsDB’s vision and commitment towards harnessing greater resources and forging partnerships to contribute to the UN SDGs attainment and to the socio-economic development of its member countries,” maintained Dr. Muhammad Al Jasser.

Women’s Representation on Boards of UAE Public Joint-Stock Companies Record a Significant 200% Growth in Just Three Years

Abu Dhabi – Women’s representation on the boards of listed public joint-stock companies in the UAE in the past three years have increased by a record 200%, says the Securities and Commodities Authority (SCA). In a report in January 2025, the SCA hailed this as a “landmark achievement” that demonstrates the firm commitment of the Authority (SCA) to promoting the role of women in the securities sector in the UAE.

According to the SCA, in 2024, women held 141 seats in boardrooms compared to only 47 seats in 2021. This is largely attributed to the amendment introduced by the SCA Board of Directors in 2021 to Decision No. (3/Chairman) of 2020, which approved the Public Joint-Stock Company Governance Guide.

The decision requires listed public joint-stock companies to have at least one female member on their boards—a step that underscores the SCA’s commitment to advancing gender equality and promoting the role of women in leadership and decision-making positions within the corporate sector, thereby contributing to this impressive achievement.

Dr. Maryam Buti Al Suwaidi, CEO of the SCA, stressed that such a significant increase in women’s representation on the boards of public joint-stock companies highlights the UAE’s instrumental role in empowering women as key contributors to sustainable economic development, and the SCA’s dedication to adopting global best practices in corporate governance in alignment with its ambitious vision to create an inclusive and sustainable national economy centred on diverse leadership and a greater presence of women in decision-making positions, supported by the introduction of effective and robust regulatory and legislative measures.

Al Suwaidi added that the Public Joint-Stock Company Governance Guide, applicable across the UAE, is a significant advancement in enhancing women’s representation on corporate boards. It has been instrumental in encouraging companies to introduce selection mechanisms that enable competent women to actively contribute to corporate success and stability. This move has contributed to achieving gender equality, which is necessary for improving the efficiency of corporate boards and fostering a harmonious collaboration among board members. This will enhance strategic decision-making and ensure the optimal utilization of all available talent and expertise.

Al Suwaidi called on companies to continue their efforts to open more opportunities for women to assume leading positions that support government objectives and drive overall economic development, thereby promoting the UAE’s global standing and competitiveness.

The SCA has been collaborating with Aurora 50, an initiative dedicated to the advancement of women in the UAE corporate sector. The two entities signed an MoU in 2020 in this respect.

Sheikha Shamma bint Sultan bin Khalifa Al Nahyan, Co-Founder of Aurora 50, commented: “I am deeply honoured to witness this remarkable milestone – a threefold increase in women’s representation on the boards of public joint-stock companies in the UAE over the past three years. The collaboration between Aurora 50 and the SCA has been central in making this shift. Driven by our shared vision, we have worked tirelessly to create opportunities, develop leadership capacities, and provide a clear pathway for women to assume their rightful places on corporate boards. This emphasizes that national partnerships are powerful tools in pursuing development goals,” she said.

“This is just the beginning. As we celebrate this milestone achievement, we reiterate our commitment to enhancing diversity on corporate boards, promoting corporate governance, and reinforcing the UAE’s position as a leader in gender equality,” she concluded.

Dubai-based Real Estate Investment Trust Emirates REIT Issues New USD205mn Sukuk to Refinance an Existing Sukuk Due in December 2025

Dubai – Emirates REIT, one of the world’s largest listed Shariah-compliant real estate investment trusts, has fully refinanced its existing Sukuk, due December 2025, with a new USD205mn Sukuk due 2028, and rate ‘BB+’ by Fitch Ratings.

The new Sukuk was priced a profit rate/yield of 7.5% per annum in years 1-3 with a step up to 8.25% in year 4. The company mandated HSBC to act as the lead arranger through its Private Credit and Debt Capital Markets teams. The lower cost of the new financing, said Emirates Reits reflected the company’s solid credit profile, strong cash flow generation and operational performance – all evidenced in the assigned BB+ credit rating.

Thierry Delvaux, CEO of Equitativa (Dubai) Ltd, the REIT manager, commented: “Over the past year, Emirates REIT has reduced its outstanding financings by over USD190mn, bringing its Financing to Value ratio below 26%. This, combined with its strong operating results, allowed the REIT to obtain our target rating for the new Sukuk of BB+.

“The positive reaction from both domestic and international investors to the new Sukuk issuance is a clear testament to the quality of the REIT’s assets, and the REIT manager’s strategy. With the refinancing now firmly in place, our efforts will focus on capitalizing on Dubai’s dynamic growth to create shareholder value.”

Emirates REIT is a Dubai-based real estate investment trust investing principally in income-producing real estate in line with Shariah principles. It currently owns a well-balanced portfolio of eight assets in the commercial, education and retail sector. Emirates REIT also benefits from an exclusive Rulers’ Decrees permitting it to purchase properties in onshore Dubai and Ras Al Khaimah.

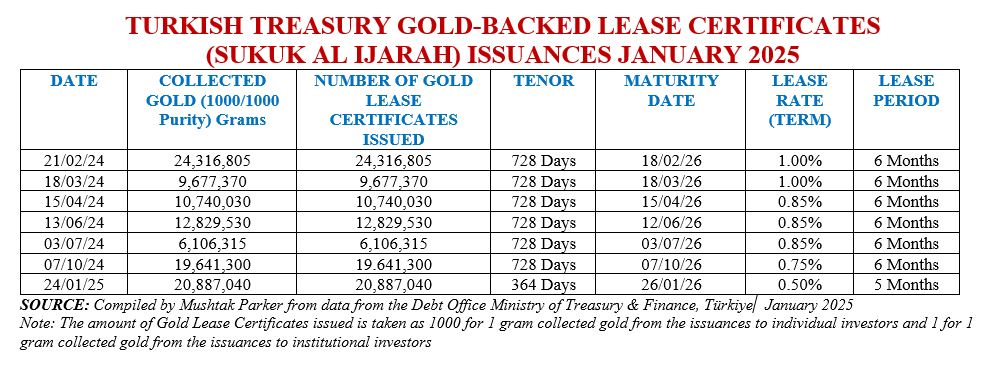

Türkiye Treasury Continues Domestic Sovereign Lease Certificates Issuance in January 2025 Through Fixed Rate Leasing Certificates and Gold Offerings in Two Auctions in December 2024/January 2025

Ankara – Türkiye’s sovereign domestic Sukuk issuance continued its momentum in January 2025 with two auctions raising an aggregate USD (Eq) 557.01mn as the Türkiye Treasury further consolidated its regular issuance of Sukuk Al-Ijarah in the domestic markets on the back of improving macro-economic fundamentals. Türkiye’s annual inflation rate dipped to 44.38% in December, posting the seventh consecutive decline since June 2024, according to TurkStat. December’s figure is below the market expectation of 45.21%, also down from November’s 47.09%.

The Treasury’s public debt issuance domain includes domestic fixed rate and CP Indexed lease certificates (Sukuk Al Ijarah), FX-linked lease certificates and Gold-linked lease certificates as part of the country’s public debt fund raising strategy in addition to the Treasury’s regular forays into the US Dollar and Eurobond markets. The FX-linked certificates are primarily issued in the US Dollar and the Euro Fixed Rent Rate Lease Certificates (Sukuk Al-Ijarah) market.

On 24 January 2025, the Treasury issued Gold-backed Lease Certificates (Sukuk Ijarah) with a tenor of 364 days maturing on 26 January 2026 and priced at a Lease Rate of 0.50% payable over the 6 Month lease period. The amount of gold collected, according to the Treasury, amounted to 20,887,040 grams of gold (995/1000 purity) from institutional investors for issuance of an aggregate 20,887,040 gold lease certificates (at a nominal value).

The amount of Gold Lease Certificates issued, according to the Treasury, is taken as 1,000 for 1 gram collected gold from the issuances to individual investors and 1 for 1 gram collected gold from the issuances to institutional investors. The direct sale auction of its latest Gold-backed Lease Certificates (Sukuk Ijarah) offering was conducted by the Central Bank of Türkiye via AS (Auction System under Central Bank Payment Systems).

According to Turkish Treasury “citizens are provided with a safe investment tool for gold savings. With the gold bond and gold-denominated lease certificate issuance through five banks, our citizens will win themselves and contribute to the economy.” Investors will be paid TL-denominated returns on a semi-annual basis indexed to the gold price. On maturity, according to the Treasury, investors may request the principal payment as 1 kilogram of gold bar (produced by refineries) or Republic Gold Quarter Coins printed by the Turkish State Mint. The Ministry of Treasury & Finance also issues these gold-backed lease certificates “to diversify borrowing instruments, broaden the investor base and bring the idle gold into the economy.”

The Fixed Rate Lease Certificate market however is the mainstay of the Treasury’s fund-raising in the Sukuk market. The Türkiye Treasury raised TRY1,469.001mn (USD40.96mn) in an auction on 18 December 2024 through the issuance of 2-year Fixed Rate Lease Certificates (Sukuk al Ijarah) maturing on 16 December 2026 priced at a fixed profit rate of 18.50% over a 6-month rental period. The total bids for this issuance matched the allocated amount.

This follows the TRY12,079.71mn raised by the Türkiye Treasury in an auction on 13 November 2024 through the issuance 2-year Fixed Rate Lease Certificates (Sukuk al Ijarah) maturing on 11 November 2026 priced at a fixed profit rate of 18.50% over a 6-month rental period.

The Türkiye Treasury in the twelve months of 2024 have issued consecutive monthly Sukuk Al Ijarah aggregating TRY83,272.161mn (US$2,321.83mn), suggesting that Sukuk Al Ijarah are now a fixed feature of the Treasury’s public debt fund raising strategy.

The Türkiye Treasury is a proactive issuer of lease certificates as part of a wider universe of government fund-raising instruments which include bonds and Sukuk – leasing certificates and bonds, FX denominated issuances and gold-backed certificates/bonds.

The usual mantra of the Turkish Treasury when announcing these auctions are “in order to increase the domestic savings, broaden the investor base and diversify the borrowing instruments, TRY denominated fixed rent rate lease certificates will be issue to the banks through direct sale method.”

All the lease certificates were issued by Hazine Mustesarligi Varlik Kiralama A.S., a special purpose vehicle owned by and on behalf of the Ministry of Treasury & Finance, the obligor. Both Auctions were conducted by the Central Bank of Turkey via its AS (Auction System under Central Bank Payment Systems).

ICIEC Provides Insurance Cover for EUR166mn (USD172.54mn) Club Financing Facility Arranged by Standard Chartered Bank and ING Bank for ISKI for Two Vritical Water Treatment Projects in Istanbul

Istanbul – The Islamic Corporation for the Insurance of Investment and Export Credit (ICIEC), the Shariah-compliant multilateral insurer and a member of the Islamic Development Bank (IsDB) Group, signed an agreement with Standard Chartered UK and ING Bank, a branch of ING-DiBa AG to provide an insurance cover policy for their EUR166mn (USD172.54mn) club financing facility to ISKI (Istanbul Water and Sewerage Administration) for two critical water treatment projects in Istanbul.

ICIEC’s FIIP (Financing Facility Insurance Policy) has a tenor of 7 years with the cover commencing on 14 November 2024 and covering 95% of the financing facility, and the risk of Non-Honouring of a Financial Obligation of a State-Owned Enterprise (NHFO-SOE) for a 7-year tenor. The financing will be used to fund the Cumhuriyet Drinking Water Treatment Plant (Second Stage) and the Paşaköy Advanced Biological Wastewater Treatment Plant (Third Stage).

ISKI, an affiliated entity of the Istanbul Metropolitan Municipality (IMM), is the exclusive provider of water and wastewater services in Istanbul, a city of over 16 million people. To finance these vital infrastructure projects, ISKI appointed Standard Chartered Bank as the structuring bank, global coordinator, and mandated lead arranger. The EUR166mn club facility includes equal participation by ING Bank (via its branch, ING-DiBa AG) and Standard Chartered Bank on a 50/50 basis.

The financing facility will enable ISKI to expand its infrastructure through the Cumhuriyet Drinking Water Treatment Plant (Second Stage), thus enhancing the city’s capacity to provide safe drinking water, and through the Paşaköy Advanced Biological Wastewater Treatment Plant (Third Stage), thus improving wastewater treatment to meet advanced environmental standards. ICIEC’s insurance coverage will enhance the risk profile of the financing structure, safeguarding the lenders against potential credit and political risks. The Cumhuriyet Drinking Water Treatment Plant will result in increased capacity to treat and supply an additional volume of clean drinking water to the population, while the Paşaköy Advanced Wastewater Treatment Plant will see increased capacity to process additional wastewater to advanced biological treatment standards.

Both projects also aim to achieve compliance with European and international environmental regulations for wastewater treatment and water quality standards, a Reduction in Environmental Footprint, and at Climate Resilience, thus strengthening Istanbul’s water and wastewater infrastructure to withstand climate-related challenges, such as water scarcity and flooding.

UNDP and IsDB Launch Global Takaful Alliance to Enhance the Financial Resilience of Muslim Communities to Rising Risks, Including Climate Change, Land Degradation, Drought and Environmental Challenges

Riyadh – In a potentially important development in the Takaful market, the United Nations Development Programme (UNDP) through its Insurance and Risk Finance Facility, and the Islamic Development Bank (IsDB) launched The Global Takaful Alliance (GTA) on 3 December 2024 during the COP16 hosted by UNCCD and the two founding partners.

UNDP’s vision to scale Takaful through the Alliance has recently been joined by the Islamic Development Bank Group (IsDBG), the Arab Gulf Programme for Development (AGFUND), Kuwait Finance House (KFH) Group, and the Mohammed Bin Rashid Al Maktoum Global Initiatives (MBRGI). The aim is attracting more partners in the coming months.

GTA, according to the two promoters, is a public-private partnership to enhance the financial resilience of Muslim communities to rising risks, including climate change, land degradation, drought and environmental challenges, through Takaful, a Shariah-compliant alternative to mutual insurance. The Alliance aims to build Takaful markets and products with an overarching goal of reaching 100 million people by 2030.

“The Global Takaful Alliance is a direct response to the challenges of weak financial resilience in Muslim countries and communities on this frontline of growing risk. A visionary public-private initiative, the Alliance will leverage country, regional and global expertise and capacity on Takaful at scale,” says UNDP.

Although Takaful has been around for almost five decades, it still only accounts for only approximately 2% of the total global Islamic finance assets, projected at USD3.5 trillion.

“Takaful, an often-overlooked cornerstone of financial resilience, holds immense potential that must be harnessed on a larger scale. While the growth of Sharia’a-compliant assets is expected to soar, reaching a global total of US$5 trillion by 2025, the Takaful sector lags within the expansive realm of Islamic finance, currently representing only 10% of the overall assets. And even while the global Takaful market is poised to grow, with a projected total market volume of USD97 billion by 2030, it remains small compared to some of the prominent conventional global insurance companies who underwrite that value in premium every year just on standalone basis. Takaful remains a vastly under-utilized tool for financial resilience,” said UNDFP in a report in December 2024.

The promoters of the GTA stress that Takaful can play a pivotal role in diminishing public losses and shielding the risks to livelihoods, health, agricultural yield, and livestock belonging to households, farmers, and small enterprises that confront shocks without the refuge of conventional risk protection or financial safety nets.

Takaful they further maintain, can reinforce resilience by diffusing risks and unlocking economic protection through the expansion of access to inclusive risk transfer tools aligned with Islamic values for millions of underserved individuals. “With low insurance penetration and the incongruence of traditional insurance with cultural values rendering numerous Muslim communities susceptible to uninsured risks,” said the report, “strategic utilization of Takaful solutions can broaden the scope of inclusive risk protection to underserved groups.Targeted nurturing of the Takaful sector can extend comprehensive climate risk protection to vulnerable Muslim populations typically underserved by conventional insurance models. Strategic collaborations capitalizing on Takaful’s growth trajectory can furnish scaled risk protection exactly where it is most essential. This may encompass solutions for sovereign-level risk transfer, the crop and livestock sectors, and the bundling of Takaful offerings with Sukuk, Islamic credit, and microfinance services.”

As such the challenge for much greater investment in product development, distribution infrastructure, and an enabling policy environment stands as imperative to realizing Takaful’s potential for just and sustainable development.

ICIEC Underwrites EUR80mn 7-Year Credit Facility for Black Sea Trade and Development Bank (BSTDB) from Standard Chartered Bank to Boost Sustainable Development and Economic Resilience in the Black Sea Region

Istanbul – The Islamic Corporation for the Insurance of Investment and Export Credit (ICIEC), a Shariah-compliant multilateral insurer and member of the Islamic Development Bank (IsDB) Group, is supporting an EUR80mn (USD83.13mn) seven-year term loan facility agreement between the Black Sea Trade and Development Bank (BSTDB) and Standard Chartered Bank. This initiative, says the Corporation, highlights ICIEC’s commitment to promoting sustainable development and economic resilience in the Black Sea Region.

Backed by ICIEC’s risk mitigation solutions, the facility will finance critical projects to drive economic growth and sustainability in BSTDB member countries. An innovative accordion feature allows for an additional EUR80mn tranche, broadening the scope for impactful development.

Dr. Khalid Khalafallah, Officer-in-Charge of ICIEC, commented: “This agreement reflects ICIEC’s dedication to fostering partnerships that address financing gaps, enhance economic resilience, and promote sustainable growth. It underscores our mission to deliver transformative solutions through innovative and Shariah-compliant financial support.”

This collaboration reinforces the strong partnership between ICIEC and BSTDB, aligning with their shared vision of addressing economic challenges and enabling transformative projects in sectors like infrastructure, energy, and trade. ICIEC’s involvement further enhances investor confidence and establishes a benchmark for sustainable financial solutions in the region.

Saudi Real Estate Refinance Company signs SAR1bn (USD270mn) Mortgage Portfolio Acquisition Agreement with Bidaya Finance to Inject Additional Liquidity in the Mortgage Securitisation Market in the Kingdom

Riyadh – The Saudi Real Estate Refinance Company (SRC), a subsidiary of the Public Investment Fud PIF company and a Shariah-compliant mortgage securitisation firm, signed an agreement on 22 December 2024 to acquire a SAR1bn (USD270mn) mortgage portfolio from Bidaya Finance, a Shariah-compliant mortgage finance company in Saudi Arabia.

The signing ceremony for the transaction took place in the presence of Majid bin Abdullah Al-Hogail, Minister of Municipalities and Housing and Chairman of the Board of Directors, and the Chairman of the Board of Directors of Bidaya Finance, Abdulaziz bin Saleh Al-Omair. The agreement, signed by SRC CEO Majeed bin Fahad Al-Abduljabbar, and the CEO of Bidaya Finance, Mahmoud Dahdouli, marks a continuation of SRC’s ongoing efforts to bolster the residential real estate finance market in the Kingdom and expand refinancing opportunities.

According to SRC, this portfolio, the largest among mortgage companies, underscores the commitment of both parties to deliver innovative mortgage solutions to citizens and to contribute to the goals of the Housing Program, a key initiative of Saudi Vision 2030, which aims to increase homeownership among Saudis.

Majeed bin Fahad Al-Abduljabbar, CEO of SRC, emphasized that this agreement is part of an expanded partnership with Bidaya Finance, aimed at injecting additional liquidity and strengthening stability in the Kingdom’s real estate finance market. He further noted that the agreement is a significant step toward achieving the strategic objectives of the Housing Program by offering flexible financing solutions to Saudi families. “This agreement is a key step in our efforts to forge strategic partnerships with leading financial institutions, aimed at developing an active secondary market for residential real estate financing in the Kingdom,” added Al-Abduljabbar.

Mahmoud Dahdouli, CEO of Bidaya Finance, stressed that “the transaction with SRC represents a strategic milestone in strengthening our role in providing innovative financing solutions that contribute to the development of the securities market through mortgage portfolios. It also aligns with our vision to empower a brighter financial future for our clients to achieve their aspirations and meet their needs, aligning with the objectives of the housing program under the Kingdom’s vision 2030 to increase homeownership among citizens.”

The Saudi Real Estate Refinance Company was established by the Public Investment Fund in 2017 with the aim of developing the Kingdom’s real estate finance market. Licensed by the Saudi Central Bank to operate in the field of real estate refinancing, SRC plays a pivotal role in achieving the objectives of the Housing Program under Saudi Vision 2030, which seeks to increase homeownership rates among Saudi citizens.

This, says SRC, is accomplished by providing liquidity to financiers, enabling them to offer affordable housing finance to individuals, and working closely with partners to support the Kingdom’s housing ecosystem.

IILM Kicks Off 2025 Sukuk Issuance Calendar with a Reissuance of a Three Tranche Aggregate USD1.27bn Short-term Sukuk Over Three Tenors

Kuala Lumpur – The International Islamic Liquidity Management Corporation (IILM), the multilateral international industry organisation that develops and issues short-term Shariah-compliant liquidity management instruments, successfully completed its first auction for 2025 with a reissuance of an aggregate USD1.27bn short-term Sukuk across three different tenors of one, three, and six-month respectively.

The January 2025 auction saw the successful completion of the reissuance of an aggregate USD1.27bn short-term Sukuk. The three series reissued on 14 January 2025, says the IILM, were priced competitively at:

i) 4.43% for the USD500mn Sukuk with a 1-month tenor.

ii) 4.55% for USD610mn Sukuk with a 3-month tenor.

iii) 4.43% for USD160mn Sukuk with a 6-month tenor.

The IILM’s Sukuk reissuance saw a competitive tender amongst the Primary Dealers and Investors globally, with a strong orderbook of USD2.75bn, representing an average bid-to-cover ratio of 216.5%.

Mohamad Safri Shahul Hamid, Chief Executive Officer of the IILM, commented: “We are delighted to kick off 2025 from where we left off last year with a successful auction, reflecting sustained market confidence in the IILM’s short-term Sukuk as high-quality Shariah-compliant liquidity management tools. The strong and robust demand across all tenors underscores the global Islamic investors’ appetite, for stable and reliable liquidity solutions amidst the ongoing market volatility and market uncertainty in recent weeks.”

The sell-off in the global bond market since the beginning of the month, observed Mohamad Safri, “intensified further post-strong US job report that was out last week, resulting in a recent surge in global yields. Despite all these, we welcome today’s auction results at competitive profit rates (compared to December 2024), with twice the size of total issuance month-on-month. For the record, today’s transaction totalling USD1.27bn also represents the IILM’s largest ever short-term Sukuk auction in the month of January, clearly reinforcing our strong commitment to deliver innovative short-term Sukuk offerings tailored to meeting the evolving needs of Islamic financial institutions worldwide”.

The issuance forms part of the IILM’s USD6 billion short-term Sukuk issuance programme, which is rated “A-1” by S&P Global and “F1” by Fitch Ratings. The total amount of IILM Sukuk outstanding stands at USD 4.14 billion.

The IILM’s short-term Sukuk is distributed by a diversified and growing network of 12 primary dealers globally, namely Abu Dhabi Islamic Bank, Al Baraka Turk, Affin Islamic Bank, Boubyan Bank, CIMB Islamic Bank Berhad, Dukhan Bank, First Abu Dhabi Bank, Kuwait Finance House, Maybank Islamic Berhad, Meethaq Islamic Banking from Bank Muscat, Qatar Islamic Bank, and Standard Chartered Bank.

The IILM is a regular issuer of short-term Sukuk across varying tenors and amounts to cater to the liquidity needs of institutions offering Islamic financial services. The IILM will continue to reissue its short-term liquidity instruments monthly as scheduled in its issuance calendar.

Looking ahead into 2025, the IILM plans to ramp up its asset origination activities through bespoke and attractive offerings to address the diverse needs of global sovereign and sovereign-linked Sukuk issuers, as well as rolling out alternative to Sukuk assets to allow further growth of supply and meet the growing market demand.

The IILM will also continue to expand its investor base and network of primary dealers as it looks to expand regional collaborations and enter new markets to further integrate Islamic liquidity solutions into the global financial system. The Corporation, says Mr Mohamdd Safri, remains committed to developing the Islamic liquidity management infrastructure and enhancing the Shariah-compliant liquidity tools available to the market, working closely with scholars, regulators, and industry stakeholders to resolve inconsistencies that may hinder growth.

The IILM says it will also continue to reissue its short-term liquidity instruments monthly as scheduled in its issuance calendar. The IILM’s ongoing commitment to innovation and impact, according to the Corporation, continues to bolster the liquidity management capabilities of Islamic financial institutions. By providing highly rated tools that are increasingly traded in secondary markets, the IILM helps these institutions meet their Liquidity Coverage Ratio (LCR) requirements while offering sustainable returns.

The IILM consistently issues short-term Sukuk across 1-month, 3-month, 6-month, as well as 12-month tenors, tailored to the liquidity needs of Islamic financial institutions. Since its inaugural issuance in 2013, the IILM has successfully issued a cumulative of USD115.22bn worth of short-term Sukuk across 279 series.

The current members of the IILM Board are the central banks of Indonesia, Kuwait, Malaysia, Mauritius, Nigeria, Qatar, Türkiye, the United Arab Emirates, as well as the multilateral Islamic Corporation for the Development of the Private Sector, the private sector funding arm of the Islamic Development Bank Group.