NDMC Starts 2025 with a SAR3,723.5mn (USD992.76mn) 4-trance Sukuk Offering and Further Secures a USD2.5bn (SAR9.4bn) Murabaha Revolving Credit Facility to Help Meet the Kingdom’s 2025 Budgetary Requirements

These are exciting times for Sukuk origination in Saudi Arabia. With the top three rating agencies projecting that Sukuk outstanding in 2025 could well pass the USD1 trillion mark, much of which is in the three core markets Saudi Arabia, Malaysia and the UAE where Islamic finance is of systemic importance, the market dynamics are firmly on an upward trend.

These are also supported by the Kingdom’s massive infrastructure building programme under the Saudi Vision 2030 centred around the NEOM megaprojects, and hence demand for financing, of which over USD1.6 trillion have already been earmarked. The government-linked entities in fact are on a fund-raising spree which will continue well into the next decade following FIFA’s awarding of the 2034 World Cup to Saudi Arabia. The message from various Saudi officials is clear and present that Murabaha syndicated credit facilities and Sukuk are now firmly part of the Kingdom’s fund-raising mix both in terms of diversification of sources of funding and developing the depth and sophistication of the Islamic capital market.

The Public Investment Fund (PIF) indeed has been actively engaging in credit arrangements to support its investment initiatives and the Kingdom’s Vision 2030 economic diversification plan.

The National Debt Management Centre (NDMC) of the Saudi Ministry of Finance (MoF) in fact doubled down on its Sukuk ambitions by releasing its annual calendar of Riyal-denominated Sukuk issuances in early January 2025. Not surprisingly, the NDMC plans to issue Sukuk through auctions held by SAMA, the central bank, in every month of 2025 – the only country in the world that has committed to do so. Bank Negara Malaysia, the UAE Central Bank, the Bank of Indonesia, Central Bank of Tȕrkiye, Central Bank of Bahrain, and the Central Bank of Kuwait do issue Sukuk for liquidity management purposes of authorised Islamic banks in their jurisdictions, but apart from Malaysia, the UAE and Indonesia, the frequency is well short of the NDMC issuance activities.

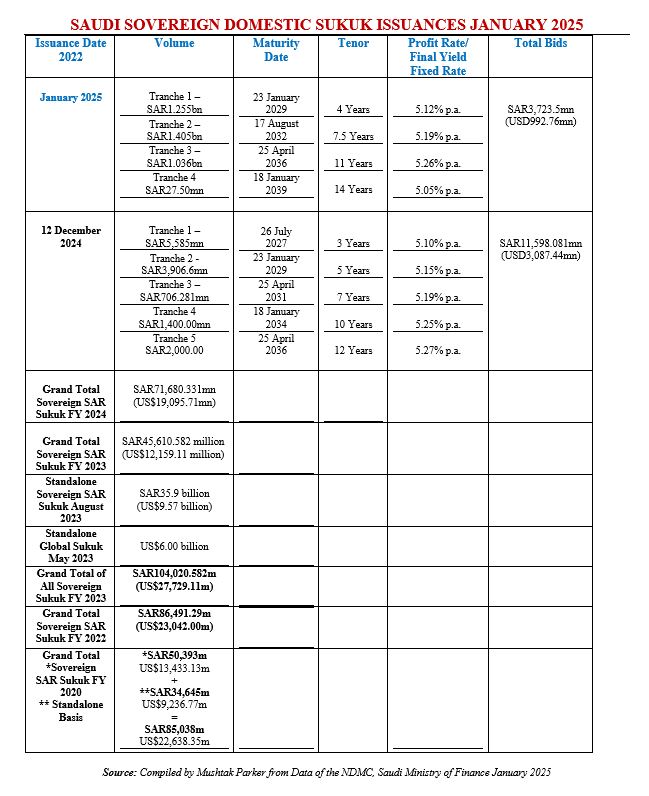

The NDMC started the year 2025 with a four-tranche auction on 23 January 2025 which raised an aggregated SAR3,723.5mn (USD992.76mn). It continued its proactive sovereign Sukuk issuance momentum in the Saudi riyal-denominated domestic market following finishing the year 2024 with a flourish of activities resulting in an auction on 24 December 2024 amounting to SAR11,598.081mn (USD3,087.44mn) – its 12th consecutive monthly auctions of the year under its published issuance calendar and the NDMC’s SAR Sukuk Issuance Programme.

The Programme raised a staggering SAR71,680.33mn (USD19,095.71mn) in 2024; in 2023, SAR45,610.582mn (USD12,159.11mn) supplemented by an additional SAR35.9bn (US$9.57bn) through a standalone local currency Sukuk, bringing the total SAR-denominated Sukuk to SAR81.51bn for that year; and SAR86,491.29m (US$23,042.00m) in 2022. These pertain to local currency Sukuk issuances and do not include the NDMC’s forays into the international Sukuk market and syndicated Murabaha markets.

Earlier in January 2025, for instance, the NDMC secured a Shariah-compliant revolving Murabaha credit facility worth USD2.5bn (SAR9.4bn equivalent). The three-year facility, supported by three regional and international financial institutions, according to the NDMC, is designed to meet the Kingdom’s general budgetary requirements, which is forecast at USD37bn for FY2025. Aligned with Saudi Arabia’s medium-term public debt strategy, the arrangement focuses on diversifying funding sources to meet financing needs at competitive terms. It also adheres to robust risk management frameworks and the Kingdom’s approved annual borrowing plan (ABP 2025) by leveraging market opportunities to execute alternative government financing activities that promote economic growth, such as financing development and infrastructure projects.

The main features of the 2025 ABP Report is revealing:

i) The budget deficit as per the National Budget for FY2025 is expected to reach SAR101bn (USD26.93bn). In addition, outstanding debt maturities due in 2025 stand at SAR38bn (USD10.13bn). Therefore, total government funding needs for the year would reach more than SAR139bn (USD37.06bn).

ii) The sovereign outstanding debt portfolio reached a total of SAR1,216bn by the end of 2024, of which 61% represents domestic debt and 39% international debt. Furthermore, the split between fixed and floating rate debt of the total debt portfolio reached 88% fixed rate debt and 12% floating rate debt. The Debt-to-GDP ratio by end 2024 is estimated to reach to 29.7%.

iii) By 2024 year-end, total borrowing activities including the liability management transaction have reached a total of SAR245bn (USD65.32bn), of which SAR168bn (USD44.79bn) was secured locally and SAR77bn (USD20.53bn) was secured internationally.

iv) In alignment with the objectives of the Saudi Vision 2030, and as part of the strategy to support the continuity and completion of the developmental projects in the Kingdom, the NDMC have executed additional funding activities over the set Annual Borrowing Plan (ABP). In line with the NDMC’s objective of effectively managing and evaluating the future refinancing risk associated with the Kingdom’s debt portfolio, the NDMC successfully executed a domestic liability management transaction exceeding SAR64bn (USD17.06bn) in total value.

In the context of the above metrics, the January 2025 Sukuk issuance of SAR3723.5mn (USD992.76mn) comprised:

i) A 4 -Year Tranche of SAR1.255bn (USD330mn) priced at a yield on 5.12% p.a. maturing on 23 January 2029.

ii) A 7.5 -Year Tranche of SAR1.405bn (USD370mn) priced at a yield of 5.19% p.a. maturing on 17 August 2032.

iii) A 11-Year Tranche of SAR1.036bn (USD280mn) priced at a yield of 5.26% p.a. maturing on 25 April 2036.

iv) A 14-Year Tranche of SAR27.50mn (USD7.33mn) priced at a yield of 5.05% p.a. maturing on 18 January 2039.

Total bids for the 5-tranche transaction on 23 January amounted to SAR3,723.5mn (USD992.76mn) equal to the allocated amount.

The NDMC Sukuk are all issued under the unlimited Saudi Arabian Government SAR-denominated Sukuk Programme, which focuses on fixed-rate instruments “to hedge against risks of potential interest rate fluctuations.”

These issuances confirmed the NDMC will continue, in accordance with the approved Annual Borrowing Plan, to consider additional funding activities subject to market conditions and through available funding channels locally or internationally. This is to ensure the Kingdom’s continuous presence in debt markets and manage the debt repayments for the coming years while considering market movements and the government debt portfolio risk management.

The trajectory for Saudi Sovereign Sukuk issuance is even more promising than in 2024 given the need to finance the volatility of the 2024 and 2025 budget deficits and the huge infrastructure funding requirements especially associated with the giga NEOM projects and issuance under its newly launched Green Financing Framework (GFF) unveiled by the Saudi Ministry of Finance earlier this year. Sovereign Sukuk origination in tandem with corporate, bank and quasi-sovereign (PIF, Aramco, IsDB) issuers in fact, is set to increase given also the geopolitical and geo-environmental demands to finance mitigation, adaptation and transition projects towards achieving the UN SDG targets and the Paris Net Zero targets by 2030 to 2050.

The Kingdom is by far the single most proactive sovereign domestic Sukuk issuer in the world, partly also driven by the robust market demand for Saudi Arabian sovereign domestic Sukuk certificates from both local and international investors. The NDMC’s role is to secure Saudi Arabia’s debt financing needs with the most competitive financing costs. Saudi Arabia is ahead in tapping the domestic sovereign Sukuk market because it also has an established issuance infrastructure complete with a government policy framework under its ‘Fiscal Balance Programme and Financial Sector Development Programme, whose objectives are to add to a diversified public debt fund raising strategy and to the development of the Saudi Sukuk and Islamic Capital Market.

The NDMC says it is committed to ensuring the Kingdom’s sustainable access to various debt markets to issue sovereign debt instruments at fair prices while maintaining prudent risk levels. To achieve this objective, it will continue to diversify financing channels throughout 2025. This diversification will include expanding financing through export credit agencies (ECAs), financing infrastructure projects, and exploring tapping into new markets in new currencies. These initiatives aim to expand the investor base and enhance the Kingdom’s access to global capital markets.

In January 2025, the Saudi Ministry of Investment’s updated investment rules also came into effect, which according to the NDMC will make it easier for foreign investors to invest in the Kingdom to attract more international investment by streamlining the process and creating a more investor-friendly environment. The ministry highlighted that the updated regulations will eliminate the need for many licenses and prior approvals, as well as significantly reduce paperwork and bureaucratic hurdles.