Riyad Bank Issues Perpetual SAR2bn (USD530mn) Benchmark Additional Tier 1 Capital Sukuk Offering Through a Private Placement to Boost its Capital Under Basel III Requirements

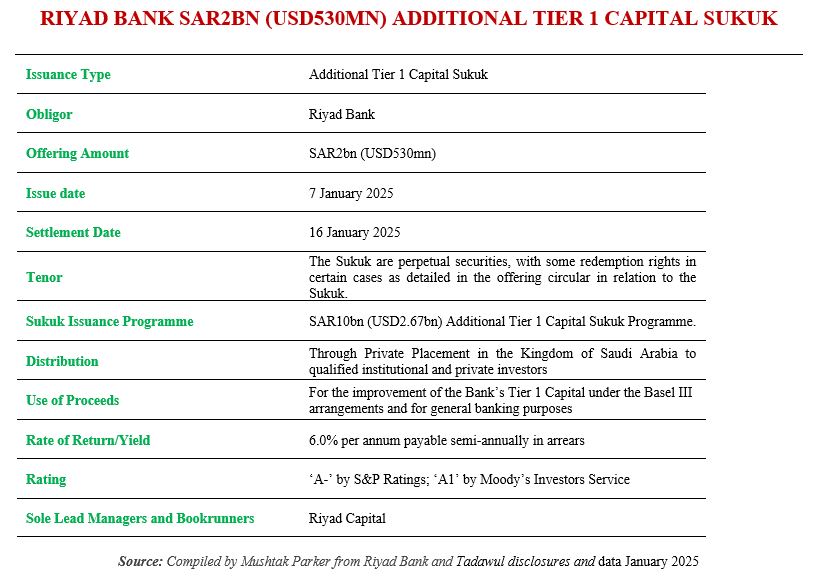

Another Saudi bank which raised funds in January 2025 from the local market to boost its capital is Riyad Bank through a benchmark SAR2bn (USD530mn) Additional Tier 1 Capital Sukuk offering also by way of a private placement to qualified institutional and individual investors in the Kingdom.

Following approval from its Board, Riyad Bank announced its intention to issue a Saudi riyal-denominated Additional Tier 1 Sukuk through a private placement on 1 January 2025.

In a disclosure to Tadawul (the Saudi Exchange), the Sukuk were issued under Riyad Bank’s SAR10bn (USD2.67bn) Additional Tier 1 Capital Sukuk Programme. The transaction was successfully completed on 23 January 2025 and the Sukuk certificates, rated ‘A-’ by Fitch Ratings, were priced at 6.00 % per annum fixed profit rate, payable semi-annually in arrears, starting from the settlement date.

The Sukuk are perpetual securities and accordingly do not have a fixed or final redemption date. However, they may be redeemed in certain cases as detailed in the base offering circular and the applicable final terms in relation to the Sukuk.

The Bank mandated Riyad Capital on 7 January 2025 as sole lead manager in relation to the offer and issuance of the Sukuk certificates. The offering started on 7 January 2025 and closed on 16 January 2025.

The proceeds from the Sukuk, according to the disclosure, will be used to strengthen the Bank’s Tier 1 Capital under the Basel III arrangements and for general banking purposes.

Meanwhile, Riyad Bank, through its special purpose vehicle listed on the London Stock Exchange, Riyad Sukuk Limited, has announced its intention to call (redeem) its USD1.5bn fixed rate reset Tier 2 Trust Certificates issued in 25 February 2020 and due in 2030 in full and at face value on 25 February 2025.

The Sukuk was issued with an original maturity of ten (10) years due on 25 February 2030 and, in accordance with the Sukuk’s terms and conditions, Riyad Bank may require Riyad Sukuk Limited as issuer to call the Sukuk on 25 February 2025. Regulatory approval has already been obtained in this regard.

“The redemption amount together with any periodic distribution accrued but unpaid will be paid by or on behalf of, Riyad Sukuk Limited on 25 February 2025 to the relevant holders of the Sukuk in accordance with the terms and conditions of the Sukuk,” said the LSEG in a statement.