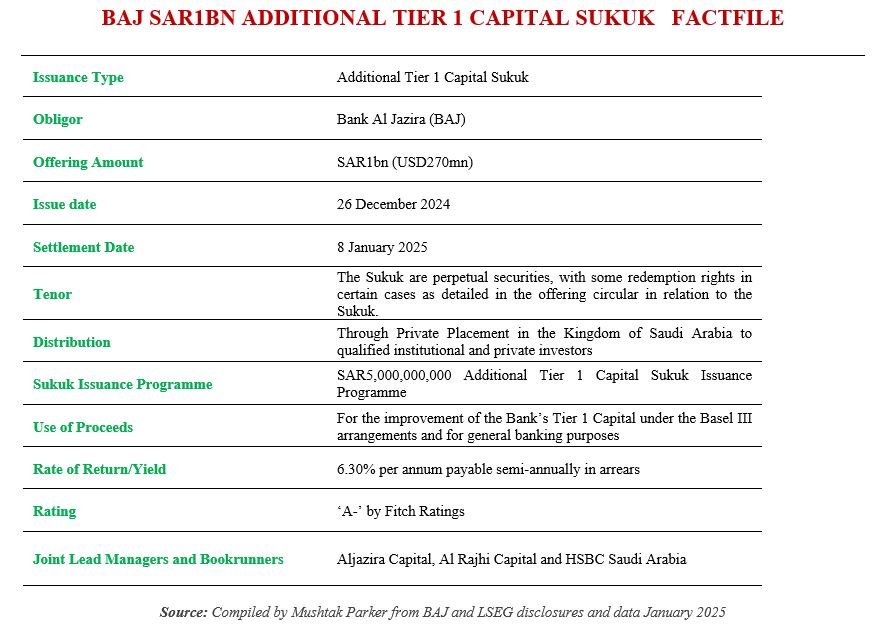

Bank Al Jazira Taps Local Market for a Perpetual SAR1bn (USD270mn) Additional Tier 1 Capital Sukuk Offering Through a Private Placement to Boost its Capital under Basel III

Bank Al Jazira (BAJ) is the latest bank in the Gulf Cooperation Council (GCC) region to raise funds through an Additional Tier 1 Capital Sukuk, which in this case was a SAR1bn (USD270mn) transaction distributed through a private placement to qualified local investors.

The proceeds from the issuance from the issuance will be used towards the improvement of the Bank’s Tier 1 Capital under the Basel III arrangements and for general banking purposes. The bank mandated Aljazira Capital, Al Rajhi Capital and HSBC Saudi Arabia as joint lead managers and dealers to the transaction.

In a disclosure to Tadawul (The Saudi Exchange) BAJ announced its intention to issue a Saudi riyal-denominated Sukuk by way of a private placement on 25 December 2024. The issuance commenced on the next day 26 December 2024. The Sukuk was issued under Bank AlJazira’s SAR5,000,000,000 Additional Tier 1 Capital Sukuk Issuance Programme and closed on 8th January 2025.

The Sukuk are perpetual securities, with some redemption rights in certain cases as detailed in the offering circular in relation to the Sukuk. The Sukuk certificates, rated ‘A-’ by Fitch Ratings, were priced at 6.30 % per annum fixed profit rate, payable semi-annually in arrears, starting from the settlement date.