FAB Closes 4th Annual Consecutive Offering in the International Market with a USD600mn Benchmark Sukuk Wakala/Murabaha

January is usually the month when Islamic banking majors scramble to access the international financial market as the first mover in issuing the first Sukuk of the new year. Usually, it is a race between the apex banks in the UAE, whether Dubai Islamic Bank, Abu Dhabi Islamic Bank, First Abu Dhabi Bank (FAB), or the major banks in Saudi Arabia.

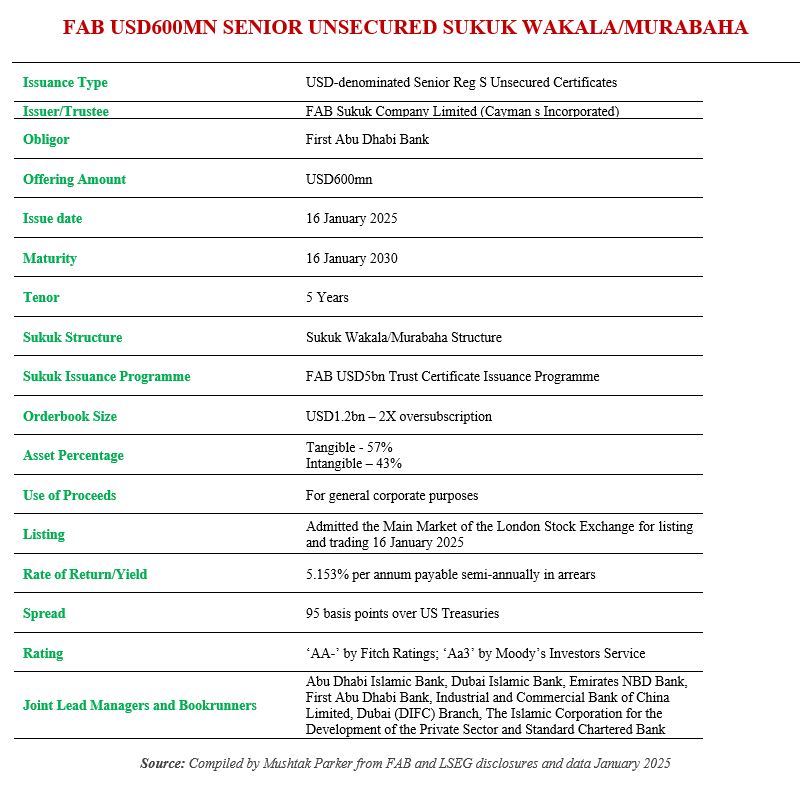

On 16th January 2025, it was FAB, the UAE’s largest bank in terms of assets, which successfully closed a benchmark USD600mn Sukuk Wakala/Murabaha offering. However, it was pipped by Kuwait Finance House which closed its Sukuk issuance on 7 January 2025. FAB had the first mover advantage in 2024 with a 5-year USD800mn RegS benchmark Sukuk, and in 2023 with a 5-year USD500mn RegS Sukuk.

FAB had mandated its own Capital market division and Standard Chartered Bank to arrange a series of investors meetings and calls in the UK, GCC, Europe, Asia and with Offshore US Accounts, for the issuance and managing the bookrunning exercise.

They were joined by Dubai Islamic Bank; Emirates NBD Bank; The Islamic Corporation for the Development of the Private Sector (ICD), the private sector funding arm of the Islamic Development Bank (IsDB) Group; and the Commercial Bank of China Limited, Dubai (DIFC) Branch, as joint lead managers and bookrunners to the transaction.

The 5-year Sukuk, which matures on 16 January 2030, was issued by FAB Sukuk Company Limited, a special purpose vehicle incorporated in the Cayman Islands, on behalf of the obligor, FAB, under its US$5 billion Trust Certificate Issuance Programme arranged by FAB and Standard Chartered Bank on 5 January 2023, and subsequently update in December 2024.

FAB, which is owned by UAE sovereign wealth fund (SWF) Mubadala Investment Company (37%), the Abu Dhabi ruling family (15.3%) and other UAE entities and individuals (31.6%), is a pacesetter in the GCC Sukuk and bond market with issuance forays into several overseas markets. It has pioneered Sukuk and bond issuances in the Malaysian ringgit, Formosa bond, Eurobond and US dollar markets.

The transaction was launched on 14th January 5 with the initial price guidance set at around 100 basis points over U.S. Treasuries. Due to robust demand from investors, the final spread for the Sukuk tightened and was set at 95 basis points (bps) over U.S. Treasuries. The orderbook reached more than USD1.3bn. This allowed some price tightening with the final rate of return/yield settling at 5.153% per annum payable semi-annually in arrears.

The subscription was represented by high quality investors, including international fund managers, supranationals, and banks, with orders from the GCC, Europe, UK, Asia and Offshore US Accounts. The Sukuk certificates are rated AA- by Fitch Ratings and Aa3 by Moody’s Investors Service and were admitted for listing on the main market of the London Stock Exchange on 16 January 2025. In line with its objective of promoting investor diversity, the allocation saw almost 75% directed towards dedicated Islamic investors and the remainder towards international counterparts.

The pricing contrasts with the rate of return of 4.779% per annum and a spread of at 85 basis points (bps) over U.S. Treasuries for the USD800mn Sukuk issuance in 2024; and the spread of 90 bps over the U.S. Treasury Rate which is equivalent to a fixed profit rate of 4.581% per annum for the 5-year USD500mn Sukuk offering in January 2023.

Note to Newsletter readers from DDCAP Group™: In addition to the above details, we were pleased that the Group was involved in the new issuance by First Abu Dhabi Bank, with the Murabaha issuance being facilitated by DD&Co Limited and utilisation of its multiple award-winning platform ETHOS AFP™.