Kingdom of Bahrain Returns to International Financial Market with 7-Year USD1.25bn Sukuk Wakala/Murabaha/Ijara Issuance

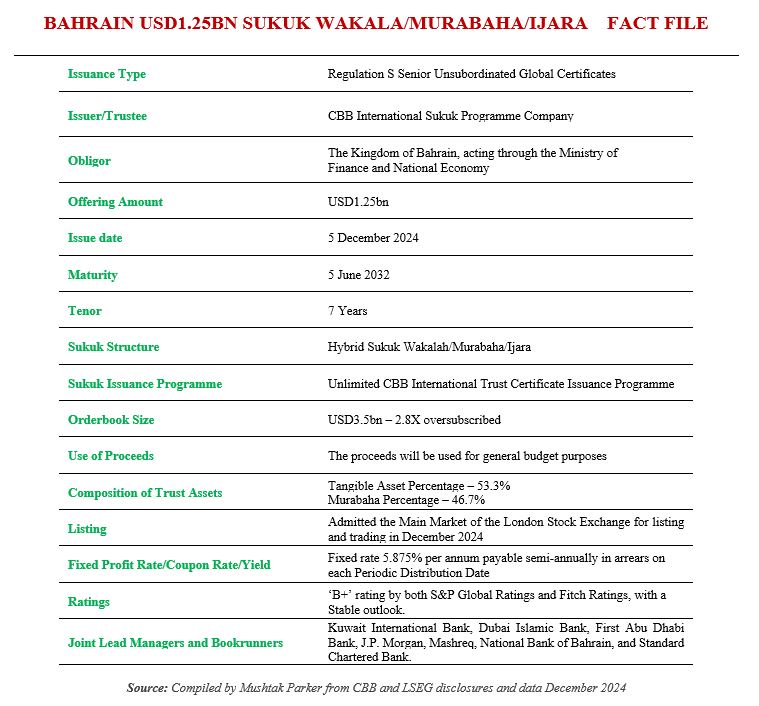

The Kingdom of Bahrain acting through the Ministry of Finance and National Economy, is the latest sovereign to tap the international financial market before the year-end in 2024 with a USD Sukuk issuance. The Central Bank of Bahrain (CBB) mandated a group of banks to arrange a USD1.25bn senior unsecured 144A/Regulation S Sukuk Wakala/Ijara/Murabaha offering on behalf of the Kingdom of Bahrain.

The CBB mandated KIB Invest, Dubai Islamic Bank, First Abu Dhabi Bank, JP Morgan, Mashreqbank, National Bank of Bahrain and Standard Chartered Bank on 4 December 2024 to act as joint lead managers and bookrunners to the transaction, and to arrange a series of investor calls and meetings in the UK, Europe, Offshore US Accounts, the GCC and Asia.

The result was a 7-year Sukuk Wakala/Ijara/Murabaha transaction maturing on 5 June 2032 and priced at a fixed coupon rate of 5.875% per annum to be paid semi-annually in arrears. The Sukuk were issued through CBB International Sukuk Programme Company on behalf of The Kingdom of Bahrain, acting through the Ministry of Finance and National Economy.

The certificates were issued under the Unlimited CBB International Trust Certificate Issuance Programme. The Composition of Trust Assets, according to the Final Terms and Base Prospectus, include a Tangible Asset Percentage of 53.3% and a Murabaha Percentage of 46.7%.

The Sukuk certificates which are rated ‘B+’ with a Stable Outlook by both S&P Global Ratings and Fitch Ratings have been admitted for listing to Main Market of the London Stock Exchange. According to KIB Invest, the investment banking arm of Kuwait International Bank (KIB), one of the lead managers and bookrunners, the issuance garnered exceptional market interest, reflecting strong investor confidence. The orderbook attracted orders exceeding USD3.5bn, an oversubscription of 2.8 times.

“Shariah-compliant banking and investments offer solutions to the modern market’s most pressing sustainability concerns regarding the industry’s impact on the local and global communities. That’s why more and more stakeholders worldwide are turning their attention to the investment opportunities that Islamic banking offers. With the traction Shariah-compliant investments have today, we are proud to remain a trusted partner for some of the world’s biggest investors and market players,” commented Raed Jawad Bukhamseen, Vice Chairman and CEO of KIB, formerly Kuwait Real Estate Bank, which transitioned into a fully-fledged commercial Islamic bank.

Jamal Hamad Al-Barrak, CEO of KIB Invest, reminded that this was KIB Invest’s first transaction in which it acted as joint lead manager and bookrunner. The aim is to establish KIB Invest as a trusted investment partner in the regional and global markets.

“KIB Invest is committed to delivering Sharia’a compliant investment products and services through a diversified suite of investment solutions tailored to meet clients’ evolving needs. In adherence to KIB’s commitment to international market standards of Islamic investment excellence, KIB Invest relies on a team of seasoned professionals with extensive experience in local and global markets.,” he added.

Note to Newsletter readers from DDCAP Group™: In addition to the above details, we were pleased that the Group was involved in the new issuance by The Kingdom of Bahrain, with the Murabaha tranche being facilitated by DD&Co Limited and utilisation of its multiple award-winning platform ETHOS AFP™.