KFH Leverages First Mover Advantage to Issue First USD Global Sukuk of 2025, a USD1bn Sukuk Wakala/Murabaha Offering with a 5-Year Tenor

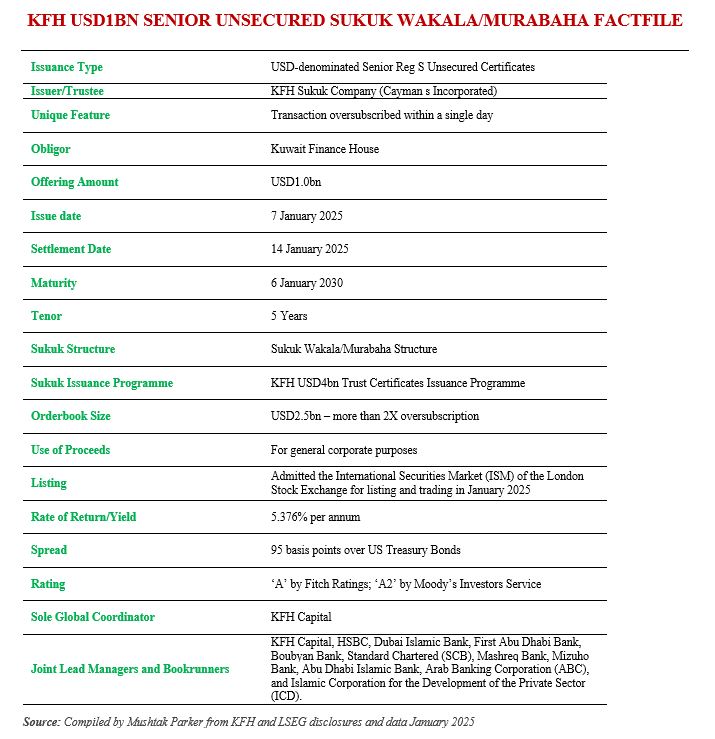

Kuwait Finance House (KFH), the second oldest commercial Islamic bank in the world having been established in 1978, returned to the international market on 7 January 2025, exactly a year after its previous Sukuk issuance in January 2024. This time round, KFH had the first mover advantage in issuing the first USD Sukuk of the year – A USD1bn Senior Unsecured Reg S Sukuk Wakala/Murabaha offering.

The Sukuk, which has a tenor of 5 years and matures on 6 January 2030, is the second issue under the KFH USD4bn Trust Certificates Issuance Programme. KFH is a latecomer to the Sukuk market because of its then conservative Sharia’a Advisory Council which frowned upon accessing the debt capital market. Nevertheless, under new leadership the Bank issued its inaugural Sukuk – a benchmark Reg S USD750mn Sukuk Mudaraba with a Perpetual Non-call 5.5-year maturity –in June 2021.

Since then, Sukuk issuance has become an important part of the Bank’s fund-raising activities and diversification of funding sources. In April 2023, KFH established a USD4bn Trust Certificate Issuance Programme under a special purpose vehicle, the KFH Sukuk Company Limited which is listed on the London Stock Exchange (LSE’s) International Securities Market (ISM), to which Fitch Ratings assigned an ‘A’/’FI’ rating, in line with KFH’s Long- and Short-Term Foreign-Currency Issuer Default Ratings of ‘A’ and ‘F1’.

The Bank mandated KFH Capital on 7 January 2025 to act as sole coordinator of the transaction and, together with HSBC, Dubai Islamic Bank, First Abu Dhabi Bank, Boubyan Bank, Standard Chartered (SCB), Mashreq Bank, Mizuho Bank, Abu Dhabi Islamic Bank, Arab Banking Corporation (ABC), and Islamic Corporation for the Development of the Private Sector (ICD), to act as joint lead managers and bookrunners to the transaction, and to arrange a series of investor calls and meetings in the UK, Europe, Offshore US Accounts, the GCC and Asia.

KFH Acting Group Chief Executive Officer, Abdulwahab Iesa Al Rushood, in a disclosure to Boursa Kuwait said that the Sukuk were priced at 95 basis points (bps) above the US Treasury Bonds, with a yield of 5.376% per annum payable semi-annually in arrears. This is in contrast to the pricing of 105 bps above US Treasuries with a yield of 5.011% per annum for the first transaction under the Programme in January 2024.

The Sukuk issuance attracted orders exceeding US$2.5 billion and was oversubscribed by more than 2 times. The issuance received demand from regional and global investors (the Middle East, Europe and Asia), most of them banks, financial institutions, and investment funds.

Al Rushood emphasised that this latest issuance, which was oversubscribed within a single day, confirms the confidence that regional and global investors have placed in KFH, its capabilities, strategy, and reputation. In addition, it reflects the prestigious position it enjoys among financial institutions and capital markets, as well as its efficient operations and reliable and outstanding performance. “The aim of this issuance is to finance KFH`s operations and diversify its financing sources. Additionally, the new issuance gives KFH the opportunity to increase its financing and investment capabilities, support the infrastructure projects and the local economic sectors, as well as help customers with their expansion plans regionally and globally,” he added.

KFH Capital, KFH’s investment banking arm, has emerged as a leader in Sukuk structuring and arranging, especially for some of the iconic transactions over the last few years.

According to KFH, the company successfully led and arranged approximately USD17.8bn in Sukuk issuances for sovereigns and corporates across various sectors and geographies in 2024. Furthermore, KFH Capital has emerged as a leader in Sukuk issuance, acting as joint lead manager and bookrunner for USD6.5bn worth of issuances for sovereign funds in the region.

The Sukuk certificates of the latest issuance have been admitted for listed on the International Securities Market of the London Stock Exchange in January 2025.

Note to Newsletter readers from DDCAP Group™: In addition to the above details, we were pleased that the Group was involved in the new issuance by KFH, with the Murabaha issuance being facilitated by DD&Co Limited and utilisation of its multiple award-winning platform ETHOS AFP™.