Al Rajhi Bank Successfully Closes its Second USD1.5bn AT1 Sustainable Sukuk Wakala/Mudaraba in a Year to Boost its Tier 1 Capital and Financing Under its Sustainable Finance Framework

Al Rajhi Bank, the largest Islamic bank in the OIC member countries and in the world in terms of balance sheet, went to the international market in January 2025 to successfully complete a USD1.5bn Additional Tier 1 Capital Sustainable Sukuk Wakala/Mudaraba. The Bank is a proactive and regular issuer of Sukuk in both the domestic and international as a fund-raising tool and in accessing Murabaha syndicated facilities.

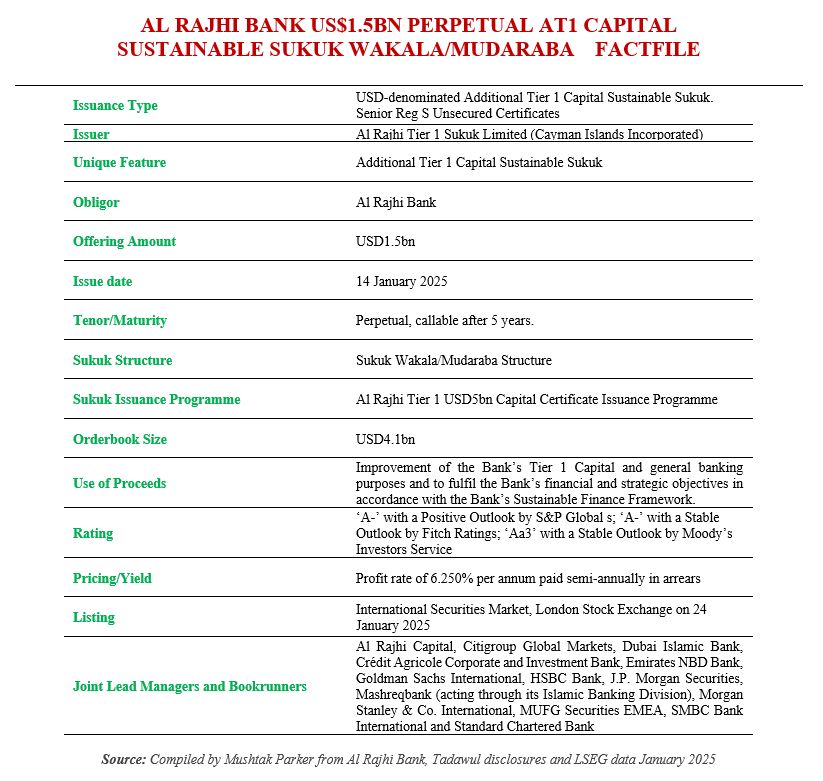

In a disclosure to Tadawul (the Saudi Exchange), Al Rajhi Bank confirmed that the transaction commenced on 14 January 2025 and closed a week later on 21 January, resulting in the issuance of a USD1.5bn Sukuk Wakala/Mudaraba under the bank’s USD5bn Additional Tier 1 CapitalCertificate Issuance Programme. The Senior Reg S Unsecured Certificates were admitted to trading on the International Securities Market of the London Stock Exchange on 24 January 2025.

The certificates were issued by Al Rajhi Tier 1 Sukuk Limited (Cayman Islands Incorporated) on behalf of the Obligor, Al Rajhi Banking and Investment Corporation.

Following approval from its Board of Directors in April 2024 and subsequently from the Capital Markets Authority (CMA), Al Rajhi Bank had mandated Al Rajhi Capital, Citigroup Global Markets, Dubai Islamic Bank, Crédit Agricole Corporate and Investment Bank, Emirates NBD Bank, Goldman Sachs International, HSBC Bank, J.P. Morgan Securities, Mashreqbank (acting through its Islamic Banking Division), Morgan Stanley & Co. International, MUFG Securities EMEA, SMBC Bank International and Standard Chartered Bank to act as Joint Lead Managers and Bookrunners for a Sustainable Sukuk offering, and to arrange a series of fixed income investor calls and meetings with entities in the UK, EU, the MENA region, Asia and with Offshore US Accounts, for a Perpetual Additional Tier 1 Capital Sustainable Sukuk Wakala/Mudaraba offering callable after 5 years.

Al Rajhi Bank had set the initial price thoughts in the 6.750% per annum region for the issue. The robust demand for the certificates, rated ‘A-’ with a Positive Outlook by S&P Global; ‘A-’ with a Stable Outlook by Fitch Ratings; and ‘Aa3’ with a Stable Outlook by Moody’s Investors Service, saw the price guidance tightening to 6.375% before closing at 6.25% per annum, payable semi-annually in arrears. According to Saudi banking sources, the order book exceeded USD4.1bn, just under 2x oversubscribed.

The proceeds from the issuance, added Al Rajhi Bank, will be used towards the improvement of the Bank’s Tier 1 Capital under the Basel III arrangements, for general banking purposes and to fulfil the Bank’s financial and strategic objectives in accordance with its Sustainable Finance Framework, which was introduced in 2022.

Prior to this offering, Al Rajhi Bank issued two Sukuk in March and May 2024 – one a 5-year USD1bn Sustainable Sukuk Wakala offering on 12 March 2024 with a profit rate of 5.047% per annum payable semi-annually in arrears; and a USD1bn Additional Tier 1 Capital Sustainable Sukuk Wakala/Mudaraba offering on 16 May 2024 with a profit rate of 6.375% per annum payable semi-annually in arrears. This Sukuk similarly was a perpetual Sukuk, callable after 5 years.

Al Rajhi’s Bank’s approach to ESG is very much led by its core focus as a provider of Shariah-led Islamic finance, which has social responsibility at its core. For example, the Bank further benefits social welfare through practice of Zakat, which supports individuals who are in need or have partially lost their income, without expectation of repayment or renumeration.

Al Rajhi Bank maintains that it has integrated a range of ESG matters into its decision-making and is committed to improving the way it communicates its management approaches, targets, performance and progress around material ESG issues.

“In line with Saudi Arabia’s Vision 2030 and the King Salman Renewable Energy Initiative, Al Rajhi Bank has been a key participant in financing solar projects under the Kingdom’s Renewable Energy Project Development Office. These projects support the National Renewable Energy Program’s aim of maximising the potential of renewable energy in Saudi Arabia, diversifying local energy sources, providing sustainable economic stability and fulfilling the Kingdom’s commitments to reduce carbon dioxide emissions.”

The Bank also acted as mandated lead arranger to ACWA Power led consortium financing of the Jubail 3A Independent Water Plant (IWP) which is projected to generate 600,000 m3 of potable water per day.