NDMC Finishes its Sovereign Domestic Sukuk Issuance Programme with a Flourish with Auctions in November and December 2024 through two 5-Tranche Offerings Raising a Total SAR15,01.6mn (USD3,996.41mn) as the Volume of Domestic Issuances under the Programme Reaches a Staggering SAR71,680.33mn (US$19,095.71mn) in 2024 due to Strong Investor Demand

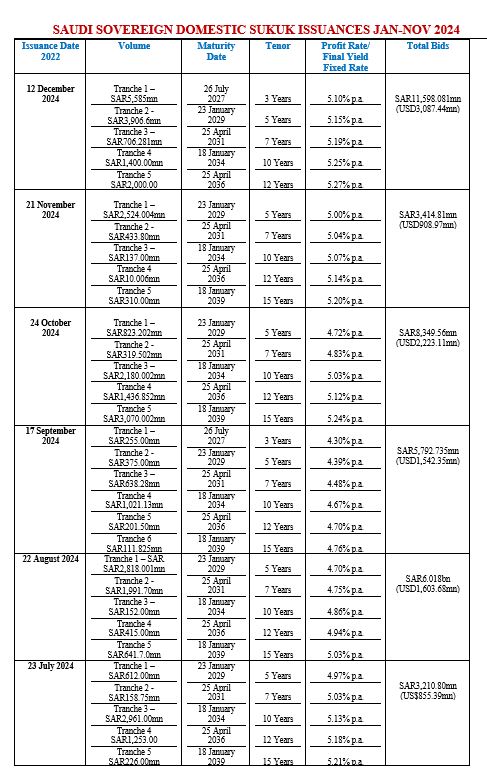

The National Debt Management Centre of the Saudi Ministry of Finance (MoF) continued its proactive sovereign Sukuk issuance momentum in the Saudi riyal-denominated domestic market finishing the year 2024 with a flourish of activities resulting in an auction on 21 November 2024 raising SAR3,414.81mn (USD908.97mn) and an auction on 24 December 2024 amounting to SAR11,598.081mn (USD3,087.44mn) – its 11th and 12th consecutive monthly auctions of the year under its published issuance calendar.

The issuance comes against a backdrop of several developments involving the NDMC and the Kingdom’s public debt strategy. On 30th October 2024 for instance the NDMC completed arranging a syndicated loan for the Ministry of Finance with several local and international banks, amounting to about SAR23.3bn (US6.2bn). This follows the Ministry of Finance’s announcement on July 31, 2024, regarding its intention to take several measures to support the Binladin Group with the aim of stabilizing its financial structure through several arrangements to settle bank dues, in coordination between the Ministry and the Group. This comes as a continuation of government support to the construction sector, which will boost the completion of vital projects and create attractive investment opportunities in the sector in alignment with Saudi Vision 2030.

It also comes at a time when Moody’s Investors Services upgraded the Kingdom of Saudi Arabia’s sovereign local and foreign currency issuer ratings to ‘Aa3’ from ‘A1’ with a “Stable” outlook on 22 November 2024.

A week later Moody’s similarly upgraded the long-term issuer ratings to Aa3 from A1 of six state-owned entities domiciled in Saudi Arabia and changed their outlook of all entities to stable from positive. They included the Public Investment Fund (PIF), the Kingdom’s sovereign wealth fund; the Saudi Arabian Oil Company (Aramco), the largest oil producer and exporter in the world; Saudi Basic Industries Corporation (SABIC), the petrochemical giant; Saudi Electricity Company (SEC); the recently established Saudi Power Procurement Company (SPPC); and Saudi Telecom Company (STC) – all of which are active in the Islamic finance and Sukuk market.

The rating upgrade according to Moody’s is a result of the Kingdom’s ongoing progress in economic diversification and the robust growth of its non-oil sector. Over time, these advancements are expected to reduce Saudi Arabia’s exposure to oil market developments and long-term carbon transition on its economy and public finances.

The agency also commended the Kingdom’s financial planning within the fiscal space, emphasizing its commitment to prioritizing expenditure and enhancing spending efficiency. As such, Moody’s noted that this planning and commitment strategy underpin its projection of a relatively stable fiscal deficit, which could range between 2%-3% of GDP. Moody’s projects that the non-oil private sector GDP of Saudi Arabia will expand by 4-5% in the coming years.

In addition, the IMF in its October 2024 World Economic Outlook growth projections point to an encouraging GDP growth trajectory for the Kingdom rising from an estimated 1.5% in 2024 to 4.6% in 2025. In fact, relations between Riyadh and the Fund have assumed much greater importance during the tenure of Mohammed Aljadaan, Saudi Minister of Finance as the current Chair of the IMF’s International Monetary and Financial Committee (IMFC). Saudi Arabia and the IMF have agreed to hold a high-level Annual Conference on Emerging Markets in Al-Ula.

IMF Managing Director, Kristalina Georgieva, and Mr Aljadaan, in a joint statement in Washington on 14 November 2024 confirmed that the Fund and the Kingdom “have agreed to organize jointly in Al-Ula, Saudi Arabia, a high-level annual conference on challenges and opportunities facing emerging market economies. The first edition of this series will be held on February 16-17, 2025. The Al-Ula Conference for Emerging Market Economies will convene a select group of emerging markets’ ministers of finance, central bank governors, and policymakers, as well as public and private sector leaders, international institutions, and academia. It will offer a unique platform to exchange views on domestic, regional and global economic developments and discuss policies and reforms to spur inclusive prosperity and build resilience supported by strong international cooperation.”

It is against such a positive economic background, the NDMC raised an aggregate SAR3,414.81mn (USD908.97mn) in a five-tranche transaction on 21 November 2024, and an aggregate SAR11.598bn in a five-tranche transaction on 12 December 2024.

The November 2024 issuance comprised:

i) A 5-Year Tranche of SAR2,524.004mn (USD671.85mn) priced at a yield on 5.00% p.a. maturing on 23 January 2029.

ii) A 7-Year Tranche of SAR433.80mn (USD115.47mn) priced at a yield of 5.04% p.a. maturing on 25 April 2031.

iii) A 10-Year Tranche of 137.00mn (USD36.47mn) priced at a yield of 5.07% p.a. maturing on 18 January 2034.

iv) A 12-Year Tranche of 10.006mn (USD2.66mn) priced at a yield of 5.14% p.a. maturing on 25 April 2036.

v) A 15-Year Tranche of SAR310.00mn (USD82.52mn) priced at a yield of 5.20% p.a. maturing on 18 January 2039.

Total bids for the 5-tranche transaction in November equalled the allocated amount. This compared with the previous auction on 24 October 2024 when the NDMC raised SAR7,829.56mn (USD2,084.66mn) in a five-tranche transaction comprising.

The November transaction had an expanded list of tenors ranging from 3 years to 15 years with robust demand for the certificates from local and foreign investors. The NDMC is keen to extend the tenors of the Sukuk up to 30 years to help build a yield curve for various maturities.

The December 2024 issuance similarly comprised:

i) A 3-Year Tranche of SAR5,585mn (USD1,486.74mn) priced at a yield on 5.1% p.a. maturing on 26 July 2027.

ii) A 5-Year Tranche of SAR3,906.6mn (USD1,039.95mn) priced at a yield of 5.15% p.a. maturing on 23 January 2029.

iii) A 7-Year Tranche of SAR706.281mn (USD188.01mn) priced at a yield of 5.19% p.a. maturing on 25 April 2031.

iv) A 10-Year Tranche of SAR1,400.00mn (USD372.68mn) priced at a yield of 5.25% p.a. maturing on 18 January 2034.

v) A 12-Year Tranche of SAR2,000.00 (USD532.41) priced at a yield of 5.27% p.a. maturing on 25 April 2036.

Total bids for the 5-tranche transaction on 24 December amounted to SAR11,598.081mn (USD3,087.44mn) equal to the allocated amount.

The NDMC started 2024 where it had left off in 2023 with a robust issuance of Riyal-denominated Sukuk in the domestic market with eleven consecutive monthly multi-tranche transactions in the first eleven months to date, which were all fully subscribed by selected local and foreign institutional investors, suggesting a robust sustained trajectory of the issuance and demand for Saudi local currency government securities.

This follows the extension in June 2024 by the Saudi Ministry of Finance and the NDMC of the local primary dealer network for the issuances, to include Albilad Investment Company, Al Jazira Capital Company, Al Rajhi Capital Company, Derayah Financial Company, and Saudi Fransi Capital appointing them as distribution primary dealers in the government’s local debt instruments.

The institutions join the other five local institutions, namely, the Saudi National Bank, the Saudi Awwal Bank (SAB), AlJazira Bank, Alinma Bank, and AlRajhi Bank, as well as the five new international institutions, namely, BNP Paribas, Citigroup, Goldman Sachs, J.P. Morgan, and Standard Chartered Bank. The aim is to widen the distribution network for the Sukuk and the reach of the international investor base for local currency Saudi issuances.

The NDMC Sukuk are all issued under the unlimited Saudi Arabian Government SAR-denominated Sukuk Programme, which focuses on fixed-rate instruments “to hedge against risks of potential interest rate fluctuations.”

These issuances confirmed the NDMC will continue, in accordance with the approved Annual Borrowing Plan, to consider additional funding activities subject to market conditions and through available funding channels locally or internationally. This is to ensure the Kingdom’s continuous presence in debt markets and manage the debt repayments for the coming years while considering market movements and the government debt portfolio risk management.

Total Volume in First Nine Months 2024 Exceed SAR48bn

In 2023, the total volume of funds raised by the Saudi Ministry of Finance through all sovereign Sukuk issuances reached a staggering SAR104.02bn (US$27.73bn), of which SAR81.51bn came through domestic Sukuk issuances.

In the twelve months of 2024, the NDMC has raised an aggregate SAR71,680.331mn (US$19,095.71mn) through twelve consecutive local currency auctions – well exceeding its local currency issuance volume only of SAR45,610.582mn (USD12,159.11mn) in 2023 under the NDMC’s SAR Sukuk Issuance Programme in 2023.

However, the 2024 figure is slightly lower than the SAR86,491.29m (US$23,042.00m) raised in 2022, during the height of the Covid-19 pandemic when the government had to raise funds to finance Covid-rescue packages for both citizens and the business sectors. The NDMC also issued raised an additional SAR35.9bn (US$9.57bn) through a standalone local currency Sukuk in 2023, bringing the total SAR-denominated Sukuk to SAR81.51bn.

The trajectory for Saudi Sovereign Sukuk issuance is promising and exciting given the need to finance the volatility of the 2024 and 2025 budget deficits and the huge infrastructure funding requirements especially associated with the giga NEOM projects and issuance under its newly launched Green Financing Framework (GFF) unveiled by the Saudi Ministry of Finance earlier this year. Sovereign Sukuk origination in tandem with corporate, bank and quasi-sovereign (PIF, Aramco, IsDB) issuers in fact, is set to increase given also the geopolitical and geo-environmental demands to finance mitigation, adaptation and transition projects towards achieving the UN SDG targets and the Paris Net Zero commitments by 2030 to 2050.

The Kingdom is by far the single most proactive sovereign domestic Sukuk issuer in the world. The NDMC’s 2024 Calendar of Local Sukuk Issuances, released in January, double downs this issuance momentum and confirms the intention of issuing domestic sovereign Sukuk consecutively for each month of the year from January to December – the only sovereign issuer to commit to such a calendar in advance.

This commitment is partly driven by the robust market demand for Saudi Arabian sovereign domestic Sukuk certificates from both local and international investors.

The NDMC’s role is to secure Saudi Arabia’s debt financing needs with the most competitive financing costs. Saudi Arabia is ahead in tapping the domestic sovereign Sukuk market because it also has an established issuance infrastructure complete with a government policy framework under its ‘Fiscal Balance Programme and Financial Sector Development Programme, whose objectives are to add to a diversified public debt fund raising strategy and to the development of the Saudi Sukuk and Islamic Capital Market.

The MoF intends to continue borrowing to finance the estimated 2024 budget deficit and refinance debt maturities due in FY 2024. Additionally, the NDMC “will remain vigilant in identifying and pursuing favourable market opportunities to implement additional financing activities to refinance debt maturities in the coming years. The Government remains committed to leveraging market opportunities to execute alternative government financing activities that promote economic growth, such as financing capital projects and infrastructure developments.”

The NDMC says it is committed to ensuring the Kingdom’s sustainable access to various debt markets to issue sovereign debt instruments at fair prices while maintaining prudent risk levels. To achieve this objective, it will continue to diversify financing channels throughout 2024. This diversification will include expanding financing through export credit agencies (ECAs), financing infrastructure projects, and exploring tapping into new markets in new currencies. These initiatives aim to expand the investor base and enhance the Kingdom’s access to global capital markets.

The prospects for the Saudi Sukuk and bond market remain buoyant. In early September the Saudi Ministry of Investment announced updated investment rules will make it easier for foreign investors to invest in the Kingdom to attract more international investment by streamlining the process and creating a more investor-friendly environment. The ministry highlighted that the updated regulations which come into effect in January 2025 will eliminate the need for many licenses and prior approvals, as well as significantly reduce paperwork and bureaucratic hurdles.

The updated investment system, approved by the Saudi Council of Ministers, is a key pillar of the national investment strategy and aligns with Saudi Vision 2030, emphasizing the pivotal role of investment in achieving comprehensive development goals and diversifying the national economy’s resources.

Rising Demand for SAH Savings Sukuk

In tandem with the Saudi Arabian Government SAR-denominated Sukuk Programme, the NDMC also oversees the Saudi Arabian Government Guaranteed SAH Retail Savings Sukuk launched by the Saudi MoF in February 2024.

The issuance under the programme seems to be gaining traction especially among younger and retail investors. According to the NDMC, the latest round of issuance of SAH Savings Sukuk closed on 4 November 2024 offering a 4.89% profit rate, compared with the October SAH Sukuk which were priced at a fixed profit rate of 5.92%. The subscription window was done through digital channels of the participant financial institutions – the primary dealers and distributors.

The SAH Savings Sukuk product, which was launched by the Ministry of Finance and managed by the NDMC, is an initiative under the umbrella of the Financial Sector Development Programme’s initiatives (one of the Saudi Vision 2030 programs) aimed to increase the savings ratios among individuals by motivating them to allocate a portion of their income to savings on a periodic basis, in addition to increasing the supply of savings products, raising the awareness around financial literacy and the importance of savings and its benefits for future plans.

SAH Sukuk are reserved for Saudi citizens only, who are over the age of 18 years, provided the subscriber has an account with either SNB Capital, AlJazira Capital, Alinma Investment, SAB Invest or Al Rajhi Capital, the primary dealers and distribution channels. SAH Sukuk is the first subsidized savings product intended for individuals that is compatible with Shariah principles in the form of Sukuk. It comes under the aegis of the Saudi Ministry of Finance’s Local Trust Certificates Issuance Programme denominated in Saudi riyals.

The purpose of issuance of SAH Sukuk is to enhance the financial planning of the younger generation for the future and increasing individuals’ savings rates by motivating them to periodically deduct a portion of their income and allocate it to savings, in addition to increasing the supply of savings products.

Its key marketing drivers include Sharia’a compliance products which enjoy growing popularity and traction among Saudi youth, featuring a short-term tenor of 1-year, annual returns, easy subscription, no fees for subscribers, and no restrictions on redemption. The minimum subscription rate of SAH Sukuk is SAR1,000, which is equivalent to the nominal value, while the maximum subscription limit is SAR200,000 for the total number of issues per individual during the programme period. The SAH Sukuk has the potential to become an exemplary retail Sukuk savings product – in terms of Issuer of Last Resort (the Saudi Government), Guarantor, Volume, Competitive Pricing, and Investors, albeit transparency and data by the NDMC could be improved.