Malaysia-based IHH Healthcare Yet Another Debutante in the Sukuk Market with an Aggregate 3-Tranche Benchmark RM4bn ICP/IMTN Sukuk Wakalah Bi Al-Istithmar Offering

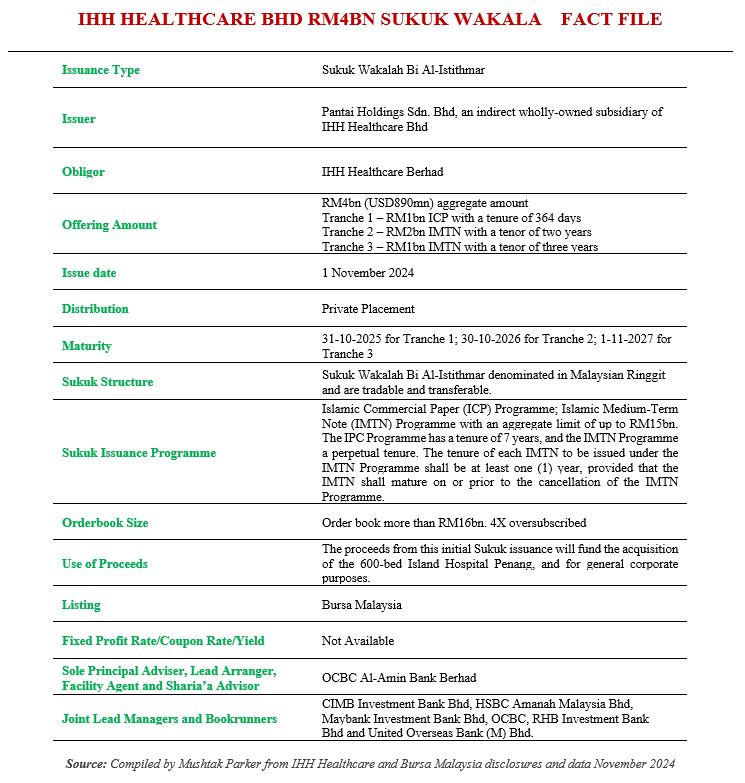

Kuala Lumpur-based IHH Healthcare Berhad, an international private healthcare group focused on upmarket health services, and Asia’s largest private healthcare group, is yet another debutante in the Sukuk market with an inaugural three tranche aggregate RM4 billion (USD890mn) Sukuk Wakalah Bi Al-Istithmar issuance on 1 November 2024.

The certificates were issued by Pantai Holdings Sdn. Bhd, an indirect wholly owned subsidiary of the Obligor IHH Healthcare Bhd, under its Commercial Paper (ICP) Programme and Islamic Medium-Term Note (IMTN) Programme with an aggregate limit of up to RM15bn established in September 2024. The ICP Programme has a tenure of 7 years, and the IMTN Programme a perpetual tenure. The tenure of each IMTN to be issued under the IMTN Programme shall be at least one (1) year, provided that the IMTN shall mature on or prior to the cancellation of the IMTN Programme.

For this transaction, the issuance comprised a Tranche 1 of RM1bn (USD220mn) Islamic Commercial Paper (ICP) with a tenure of 364 days maturing on 31 October 2025, a Tranche 2 of RM2bn (USD450mn) IMTN with a tenor of two years maturing on 30 October 2026, and a Tranche 3 of RM1bn (USD220mn) IMTN with a tenor of three years maturing on 1 November 2027. All the certificates are denominated in Malaysian ringgit and are tradable, transferable and listed on Bursa Malaysia.

“This strategic initiative not only diversifies our funding sources but also strengthens our growth initiatives in Malaysia. This programme is designed to enable the issuance of both sustainability and sustainability-linked Sukuk, aligning with our sustainability goals. Proceeds from the issuance will fund our recent 600-bed capacity Island Hospital Penang acquisition, an asset with strong operations in Penang,” said the company in a social media post.

IHH Healthcare Group CFO Dilip Kadambi explained that “the acquisition of Island Hospital in Penang allows IHH Healthcare to build on its leadership position in Penang while also providing a platform for future growth with capacity expansion and greenfield opportunities in addition to being financially attractive and ROE accretive. This transaction was financed through the Group’s first ever issuance of RM4bn unrated Sukuk through the Sukuk Programmes at optimal pricing and is one of the largest Sukuk issued year to date in Malaysia.” The private placement for the issuance of both the ICP and the IMTN were completed on 1 November 2024.

The issuance, according to IHH Healthcare Group, was well supported by local and foreign banks, and structured through multiple tenors and tranches which allowed the Group to maximise its cash flows and liquidity deployment from a debt servicing perspective. However, the company did not reveal the final pricing of the transaction.

IHH, which is largely owned by Malaysia’s sovereign wealth fund Khazanah Nasional Bhd, operates in 10 countries, with Malaysia, Singapore, Türkiye, India and China as key markets. With the addition of Island Hospital, IHH now owns 18 hospitals in Malaysia, including three in Penang, besides Gleneagles Hospital and Pantai Hospital.

The proceeds from the issuance of the Sukuk Wakalah under the Sukuk Programmes, according to the company, while initially been part used for the hospital acquisition in Penang, but also for the following Sharia’a-compliant purposes of the Issuer and/or its subsidiaries, associates and/or joint venture companies:

- To finance/reimburse or part finance/reimburse investments, acquisition, capital expenditure, working capital requirements and/or the repayment of existing conventional intercompany borrowings and both existing and future Sharia’a-compliant intercompany borrowings.

- For general corporate purposes (which shall include, without limitation, the payment of fees, costs and expenses in connection with the establishment of the Sukuk Programmes and the issuance of the Sukuk Wakalah.

- To refinance both existing conventional debt obligations and Sharia’a-compliant financing and/or future Sharia’a-compliant financing (whether in whole or in part).

“For the avoidance of doubt and in any case, all utilisation of the proceeds raised under the Sukuk Programmes shall always be for Sharia’a-compliant purposes only,” added Mr Kadambi.

ICC Healthcare had appointed OCBC Al-Amin Bank Berhad as the sole principal adviser, the lead arranger, the lead manager, the facility agent, the Sharia’a adviser and the sustainability structuring adviser for the Sukuk Programmes and the transaction. The Bank was joined by CIMB Investment Bank, HSBC Amanah Malaysia, Maybank Investment Bank, RHB Investment Bank, and United Overseas Bank (M) in the transaction.

Notably, the Sukuk issuance has received tremendous support, achieving a subscription rate exceeding four times the issuance size with the order book exceeding RM16bn.