NEWS in BRIEF

IsDB Board Approves Substantial USD3bn of Comprehensive New Financing for 17 Member Countries Covering 20 Projects with a Focus on Francophone Markets and Euro-denominated Funding

Jeddah – In one of its single largest new funding allocations for Member Countries, the Board of Executive Directors of the Islamic Development Bank (IsDB) approved more than US$3bn in financing for 20 socio-economic development projects across 17 member countries. The approvals came during the 357th IsDB Board Meeting at the Bank’s HQ in Jeddah on 14th October 2024, which was chaired by IsDB President, Dr Muhammad Al Jasser.

The projects focus on advancing socio-economic development as well as promoting resilience and sustainability in key sectors such as transport, energy, agriculture, water resources, food security, health, and social development.

Reiterating IsDB’s continued commitment to spearheading resilience and sustainable economic growth, Dr Al Jasser noted the importance of the approved projects and the major role they would play in creating significant positive impacts on infrastructure, fostering regional economic integration and improving resource management in line with national development priorities of the Bank’s member countries.

The three stand out features of the new financing are: i) USD1,153.5mn to Kazakhstan for climate-resilient water resources development to enhance agricultural productivity and food security; ii) the direction of financing to nine African Member Countries; iii) eight of the transactions are denominated in Euros, indicating an increased uptake for IsDB funding from Francophone Member Countries especially in West Africa.

The comprehensive and substantial funding approvals comprise:

* USD1,153.5mn to Kazakhstan for a climate resilient water resources development project to enhance agricultural productivity and ensure food and water security.

* USD200.3mn to Jordan to strengthen the country’s food security by enhancing the strategic reserve of two commodities.

* USD45.11mn to Kyrgyzstan to enhance the livelihoods of smallholder farmers and improve food security through agriculture mechanization as well as USD58.25mn additional financing aiming at fostering social and economic development in Issyk-Kul region through reliable and efficient energy supply

* €65.10mn (USD70.96mn) for Senegal to accelerate the industrial transformation of agriculture production.

* €55.23mn (USD60.30mn) for The Togolese Republic to enhance the quality of life for most vulnerable populations by fostering income-generating activities to boost agricultural productivity.

* USD96.73mn for Azerbaijan for water resources management to boost agricultural productivity and ensure food security.

* USD64.65mn for The Maldives towards contributing to economic development by expending the fishing industry capacity.

* USD118.40mn for Pakistan aimed at alleviating poverty among vulnerable communities while simultaneously improving their overall food security, nutritional status, and resilience to climate change.

* USD19.80mn for Mozambique to strengthen the healthcare system through enhancing access to essential healthcare services and strengthening the capacity of health science training institutions.

* €441.82 million (USD472.92mn) for Morocco towards the El Menzel pumped storage hydropower plant project which will contribute to meeting peak period demand with clean, renewable and cost-effective power supply thanks to clean energy storage.

* €260mn million (USD278.2 million) for Côte d’Ivoire towards a highway construction project which will enhance regional integration and agricultural production as well as €15.25mn (USD16.50mn) additional financing for another road project intended to also enhance regional integration and agricultural production.

* USD40.00mn for The Gambia to support economic growth of the nation by bolstering its transport sector.

* €70.320mn (USD72.29mn) for Sierra Leone towards socio-economic development by deploying soil stabilization technology to enhance access to social and economic infrastructure, as well as to promote regional integration.

* USD15.00mn for Comoros to enhance the resilience, connectivity, and safety of maritime transport between islands.

* USD138.80mn for Uzbekistan to upgrade an existing road, from a four-lane dual carriageway to a six-lane dual one, to accommodate current and future traffic demands, enhance regional and local connectivity, and improve road safety.

* €163.68mn (USD176.3mn) for Cameroon to improve transport systems by reducing travel time and cost and enhancing road safety and comfort.

* €246.40 million (USD261.18mn) for Türkiye to contribute to safe, accessible and sustainable transport systems through the Eastern Türkiye Middle Corridor Railway Development Project as well as USD100mn additional financing for another project for economic recovery in earthquake-affected regions and to improve productivity and competitiveness across the country.

The IsDB Board in addition approved a USD10mn grant contribution to the Health Impact Platform in partnership with the World Health Organization, thus joining efforts with partners towards improving global health outcomes.

These structuring and transformational projects come at a crucial phase of IsDB’s strategy to ramp up its financing, harness strategic partnerships and promote sustainable development and inclusive growth as a springboard for equity and shared prosperity in its member countries.

Sharjah Real Estate Developer, Arada Returns to International Debt Market with Second Fixed Rate RegS Public Sukuk Issuance in 2024 – a Tap USD150mn Sukuk Linked to its USD400mn Issuance in June

Sharjah – Arada Developments LLC, the largest real estate developer in Sharjah and one of the region’s fastest-growing and most progressive realty companies, successfully closed its second public Sukuk issuance in 2024 – a USD150mn Tap Sukuk which forms part of the 5-year fixed rate USD400mn RegS Sukuk Ijara/Murabaha issued by the company on 11 June 2024.

The asset pool composition, according to the final terms document, comprises 57.9% Ijara assets, and 42.1% Murabaha assets. The proceeds of the Sukuk will be used for the management of existing bilateral funding, general corporate purposes and to support development of Arada’s existing projects.

The Sukuk Certificates for the tap issuance were issued on 1 October 2024 by Arada Sukuk 2 Limited, incorporated in the Cayman Islands, as the Issuer, Trustee and Lessor, on behalf of the Obligor and Lessee, Arada Developments LLC. This is the second issuance under Arada Sukuk 2 Limited’s newly established US$1bn Trust Certificate Issuance Programme, which was arranged by Emirates NBD Capital and Standard Chartered Bank. This brings the total value of the issuance to USD550mn, aimed at supporting the company’s ambitious growth and development plans.

The Sukuk tap was priced at an issue price of USD102.54, a coupon rate of 8% per annum payable semi-annually in arrears on each Periodic Distribution Date, and a yield of 7.35% per annum, narrowing by 15 basis points from the initial pricing guidance, reflecting strong investor demand. The certificates have been assigned a ‘BB-’ rating by Fitch Ratings and a ‘B1’ rating by Moody’s Investors Service, underscoring Arada’s robust credit profile and sound corporate governance.

The certificates were admitted to the International Securities Market (ISM) of the London Stock Exchange for listing and trading, and on the Official List of the DFSA and admitted to trading on Nasdaq Dubai in October 2024. With this latest issuance, Arada’s total value of Sukuk currently outstanding on Nasdaq Dubai as part of a USD1bn programme and standalone adds up to USD1.05bn.

Bahri Signs USD756mn Murabaha Facility Agreement with Alinma Bank to Largely Fund its Acquisition of Nine VLCCs as Part of its Ambitious Fleet Modernisation Programme

Riyadh – The National Shipping Company of Saudi Arabia (Bahri), an affiliated company of the Saudi sovereign wealth fund, Public Investment Fund (PIF) and a global leader in maritime transportation and logistics, signed a USD756mn a Murabaha Financing Agreement with Alinma Bank on 16 October 2024.

In a disclosure to Tadawul (the Saudi Exchange), Bahri said that the proceeds from the 10-year facility will be used to fund approximately 70% of the purchase value for acquisition of nine (9) VLCCs (Very Large Crude Carriers). The financing facility is guaranteed through mortgaging the purchased VLCCs.

As part of the Company’s ambitious fleet modernization plan, Bahri finalized a purchase agreement on 19 August 2024 with the Greece-based Capital Maritime and Trading Corporation to acquire nine VLCCs for an approximate amount of SAR 3.75 billion (USD1bn).

The transaction, said the company, will significantly advance Bahri’s fleet modernization plans, reinforcing its position among leading VLCC owners globally. The main purpose of this acquisition is to enable Bahri streamlining the process of phasing out older vessels in the fleet going forward. Moreover, the transaction is poised to improve Bahri’s overall fleet competitiveness that will lead to enhancing the company’s revenues and profitability, as Bahri will benefit from the higher earnings from these modern eco-scrubber ships, as well as the reduced operating expenses driven by these cost-efficient VLCCs. Bahri’s Oil Transport Business currently operates a fleet of 40 VLCCs.

Under the terms of the facility agreement, Alinma Bank will extend a credit facility worth USD756mn (SAR2.835bn) to partially finance the purchase of nine state-of-the-art VLCCs intended to streamline the process of phasing out older vessels, to further strengthen its position as a global leader in maritime logistics and transportation.

Commenting on the agreement, Basil Abulhamayel, Chief Financial Officer at Bahri, expressed his delight at the signing of the facility and the company’s partnership with with Alinma Bank to finance one of Bahri’s significant fleet modernization drives.

“The enhanced financial capabilities from this collaboration will fuel our efforts to improve our overall fleet competitiveness that will lead to enhancing the company’s revenues and profitability, aligning with our long-term strategic goals. With these strengthened capacities, we are confident in supporting the Kingdom’s vision to become a global leader in maritime and logistics in line with Vision 2030,” he added

ECOWAS Bank for Investment and Development (EBID) Ventures into Islamic Finance with a €20mn Wakala Facility for MANSA Bank in Côte d’Ivoire to Support SMEs in Key Sectors

Lome – It is not usual for a regional development bank in Sub-Saharan Africa (SSA), or for that matter in Asia, to offer Shariah compliant financing facilities to local banks especially using structures such as the Wakala financing.

The Togo-based ECOWAS Bank for Investment and Development (EBID) is one regional development bank that recently signed a €20 million Wakala Framework Agreement (loan agreement) with MANSA BANK to support private enterprises in key sectors, including agriculture, agro-industry, services, renewable energy, education and health in Côte d’Ivoire.

This financing extended to MANSA BANK, said EBID, aims to stimulate sustainable growth, promoting private sector development, and creating jobs in the ECOWAS region. The agreement follows the first Wakala facility of €30 million granted in December 2023, bringing EBID’s total commitments in Côte d’Ivoire to approximately USD710mn, demonstrating the Bank’s continued efforts to providing financial solutions that drive economic progress.

According to the President and Chairman of the Board of Directors of EBID, Dr George Agyekum Donkor, the €20 million line of credit is a confirmation of the Bank’s commitment to fulfilling its mandate of fostering growth, innovation, sustainability, job creation and driving prosperity across the ECOWAS region with the goal of contributing to the overall well-being of the people of the region.

“We are confident that this partnership with MANSA BANK will have a positive impact on the lives of people in Côte d’Ivoire, Dr Donkor emphasize.” The facility is expected to create 230 new permanent jobs and consolidate 10,225 existing ones, thereby contributing to the economic growth and development of Côte d’Ivoire.

Managing Director of MANSA BANK, Mr. El-Hassana Kaba, expressed appreciation to EBID for the strong collaboration and partnership. He was confident that the new facility would enable MANSA BANK to strengthen its Islamic financing scope and create jobs which would have positive impact in the lives of the populations.

Dr Donkkor asked in an interview whether such Islamic finance instruments as Wakala, Murabaha and Sukuk could play an important role in Africa’s sustainable development ecosystem and needs, stressed that many countries in the West African subregion are debt distressed.

“About six Member States have breached the 70% debt-to-GDP threshold, as set in the monetary union convergence criteria. In effect, countries are looking for innovative ways to undertake development projects without adding to the debt stock. The Bank is always on the lookout for innovative financing which puts less stress on our sovereign and private sector clients. We have had exploratory discussions on Sukuk with some of our partners, but these have not been concretised as yet,” he added.

ADIB and Emirates Development Bank Partner to Boost Shariah-compliant SME Financing in the UAE Under a Financial Inclusion Strategy Through a Joint Finance Guarantee Scheme

Abu Dhabi – In a major boost to push Shariah-compliant SME financing under financial inclusion metrics, Emirates Development Bank (EDB) and Abu Dhabi Islamic Bank (ADIB) have teamed up in a Strategic Partnership to Boost SME Financing in the UAE.

The two entities EDB, the key financial engine of economic development and industrial advancement in the UAE, and ADIB, a leading Islamic financial institution, signed a strategic partnership on 1 October 2024 to support small and medium enterprises (SMEs) in the UAE through a joint finance guarantee scheme.

This collaboration, stressed the promoters, aims to enhance financial inclusion for SMEs, providing them with much-needed access to financing. EDB will guarantee up to 50% of the financing extended to SMEs by ADIB with a focus on supporting projects within EDB’s five priority sectors: Manufacturing, Food Security, Advanced Technology, Healthcare and Renewables.

Ahmed Mohamed Al Naqbi, Chief Executive Officer of EDB, commented on the new partnership: “Our collaboration with ADIB is a significant milestone in our ongoing efforts to foster SME growth and financial inclusion. Through our finance guarantee scheme, in partnership with twelve of the largest commercial banks in the UAE, we are enabling businesses to overcome financial barriers and achieve their full potential. This new partnership amplifies the schemes’ reach and effectiveness while providing a model for how banks can drive sustainable and inclusive economic growth through strategic partnerships and a commitment to delivering impact.”

According to Mohamed Abdelbary, Acting Group Chief Executive Officer of ADIB, “our partnership with Emirates Development Bank reflects our ongoing commitment to empowering SMEs, the backbone of the UAE’s economy. This collaboration not only amplifies our ability to offer enhanced Shariah-compliant financial solutions but also strengthens our position as a trusted partner for growth-oriented businesses. With this initiative, we are expanding our support to SMEs through customized financing options and comprehensive banking services that address their unique needs, enabling them to scale, innovate and contribute to the UAE’s long term economic vision.”

EDB’s Credit Guarantee Scheme is an innovative de-risking solution designed to incentivize commercial banks to extend financing to eligible SMEs that might otherwise face challenges in accessing finance due to perceived risks and long-term return on investment (ROI). By partnering with commercial banks, EDB provides partial guarantees up to 50% of the financing extended to SMEs, capped at AED 10mn.

To date, EDB has provided AED1.58bn in financing through the Guarantee Scheme, directly supporting the creation of 4000 jobs. Since the launch of EDB’s strategy in April 2021, the Bank says it has significantly enhanced the financial inclusion of SMEs. “By helping SMEs establish positive credit histories, the scheme empowers them to access future financing, driving growth and sustainability. EDB’s innovative and partnership-driven approach is bolstered by its proprietary Development Impact Scorecard, which measures the financial and developmental potential of each lending, ensuring alignment with national economic and sustainable development goals,” added EDB.

ADIB at the same time stresses that its involvement amplifies the reach of the Guarantee Scheme, supporting EDB’s goal to provide AED30bn in financing support by 2026, aligned with the UAE’s national economic and sustainable development goals.

Türkiye Treasury Continues Domestic Sovereign Lease Certificates Issuance Raising Funds through Fixed Rate and Gold-backed Leasing Certificates in Two Auctions in October 2024

Ankara – Türkiye’s sovereign domestic Sukuk issuance continued its momentum in October 2024 with two auctions as the Türkiye Treasury further consolidated its regular issuance of Sukuk Al-Ijarah in the domestic markets on the back of improving macro-economic fundamentals.

The Treasury’s public debt issuance domain includes domestic fixed rate and CP Indexed lease certificates (Sukuk Al Ijarah), FX-linked lease certificates and Gold-linked lease certificates as part of the country’s public debt fund raising strategy in addition to the Treasury’s regular forays into the US Dollar and Eurobond markets. The FX-linked certificates are primarily issued in the US Dollar and the Euro Fixed Rent Rate Lease Certificates (Sukuk Al-Ijarah) market.

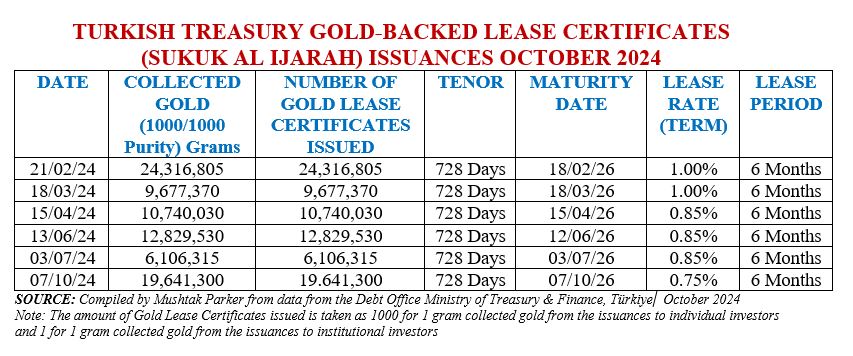

On 7 October 2024, the Treasury issued Gold-backed Lease Certificates (Sukuk Ijarah) with a tenor of 728 days maturing on 12 June 2026 priced at a Lease Rate of 0.85% payable over the 6 Month lease period. The amount of gold collected, according to the Treasury, amounted to 12,829,530 grams of gold (1000/1000 purity) from institutional investors for issuance of an aggregate 12,829,530 gold lease certificates (at a nominal value).

The amount of Gold Lease Certificates issued, according to the Treasury, is taken as 1,000 for 1 gram collected gold from the issuances to individual investors and 1 for 1 gram collected gold from the issuances to institutional investors.

This transaction was followed by a similar one on 15 April 2024 when the Treasury issued Gold-backed Lease Certificates (Sukuk Ijarah) with a tenor of 728 days maturing on 7 October 2026 priced at a Lease Rate of 0.75% payable over the 6 Month lease period. The amount of gold collected, according to the Treasury, amounted to 19,641,300 grams of gold (1000/1000 purity) from institutional investors for issuance of an aggregate 19,641,300 gold lease certificates (at a nominal value).

The direct sale auction of its latest Gold-backed Lease Certificates (Sukuk Ijarah) offering was conducted by the Central Bank of Türkiye via AS (Auction System under Central Bank Payment Systems).

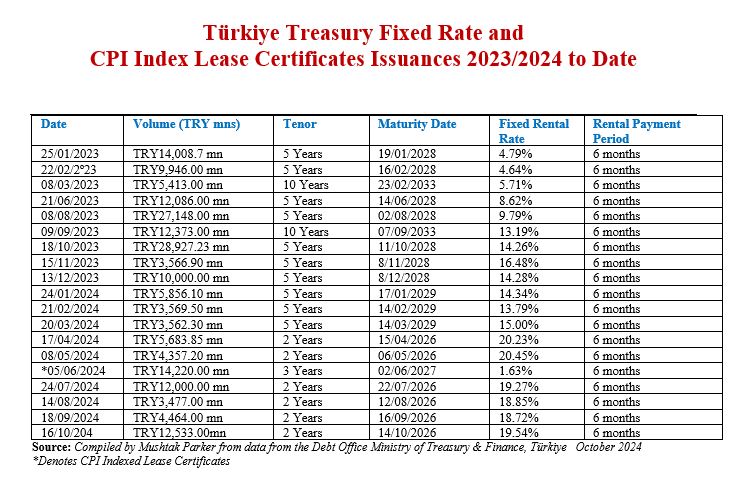

The Fixed Rate Lease Certificate market is the mainstay of the Treasury’s fund-raising in the Sukuk market, with auctions in consecutive months since January 2024.

The Türkiye Treasury raised TRY12,533.00mn (US$365.53mn) in an auction on 16 October 2024 through the issuance 2-year Fixed Rate Lease Certificates (Sukuk al Ijarah) maturing on 14 October 2026 priced at a fixed profit rate of 19.54% over a 6-month rental period. The total bids for this issuance matched the allocated amount.

The Türkiye Treasury in fact raised TRY120,994.22 mn (US$4,174.22 mn) from the domestic market through the issuance of Fixed Rate Lease Certificate (Sukuk al Ijarah) in nine auctions in FY2023. The Türkiye Treasury in the first ten months of 2024 have issued consecutive monthly Sukuk Al Ijarah aggregating TRY69,723.45mn (US$2,041.84mn), suggesting that Sukuk Al Ijarah are now a fixed feature of the Treasury’s public debt fund raising strategy.

The Turkish Treasury is a proactive issuer of lease certificates as part of a wider universe of government fund-raising instruments which include bonds and Sukuk – leasing certificates and bonds, FX denominated issuances and gold-backed certificates/bonds. The usual mantra of the Turkish Treasury when announcing these auctions are “in order to increase the domestic savings, broaden the investor base and diversify the borrowing instruments, TRY denominated fixed rent rate lease certificates will be issue to the banks through direct sale method.”

All the lease certificates were issued by Hazine Mustesarligi Varlik Kiralama A.S., a special purpose vehicle owned by and on behalf of the Ministry of Treasury & Finance, the obligor. The Ministry of Treasury & Finance also issues these gold-backed lease certificates “to diversify borrowing instruments, broaden the investor base and bring the idle gold into the economy.”

According to Turkish Treasury “citizens are provided with a safe investment tool for gold savings. With the gold bond and gold-denominated lease certificate issuance through five banks, our citizens will win themselves and contribute to the economy.” Investors will be paid TL-denominated returns on a semi-annual basis indexed to the gold price. On maturity, according to the Treasury, investors may request the principal payment as 1 kilogram of gold bar (produced by refineries) or Republic Gold Quarter Coins printed by the Turkish State Mint.

International Islamic Trade Finance Corporation (ITFC) Extends USD269mn Murabaha Trade Finance Facility to Government of Pakistan to Help Meet the Country’s Critical Energy Needs

Jeddah –The International Islamic Trade Finance Corporation (ITFC), the trade finance fund of the Islamic Development Bank (IsDB) Group, reaffirmed its commitment to support the Government of Pakistan’s National Development Plans and more specifically, the country’s energy sector with the approval of a USD269 million of Murabaha trade financing facility in October 2024.

The financing, according to ITFC, is strategically intended to help the Government of Pakistan meet the nation’s critical energy needs, which would promote growth, economic stability and impact the lives and livelihoods of citizens and stakeholders.

Commenting on the agreement, Eng. Hani Salem Sonbol, CEO of ITFC stated, “With this USD269mn financing, ITFC reaffirms its commitment to supporting Pakistan’s economic stability and energy security. The success in this syndication reflects our ability to sell the Pakistan success story in the market, one of a sustained improvement in steering the country’ s economy back on the path to recovery. As we continue to collaborate with Pakistan, ITFC is committed to driving sustainable development and enhancing the well-being of its member countries.”

Multilateral Insurer ICIEC Extends USD252mn of Insurance Cover for Syndicated Murabaha Facilities in Support of Egypt’s Energy Sector and Tunisia’s Agricultural Inputs Requirements

Jeddah – The Islamic Corporation for the Insurance of Export Credits and Investment (ICIEC), the multilateral insurer of the Islamic Development Bank (IsDB) Group, provided insurance coverage amounting to USD182mn for a significant transaction aimed at bolstering Egypt’s energy security.

The transaction, a Syndicated Murabaha Facility, was arranged by the International Islamic Trade Finance Corporation (ITFC), the trade fund of the IsDB Group, in support of the Egyptian General Petroleum Corporation (EGPC). The facility is to finance the purchase of crude oil, petroleum products, and liquefied natural gas (LNG), which are essential for sustaining Egypt’s growing energy needs. The total value of the syndicated Murabaha facility is USD200mn in which a consortium of international banks from Kuwait, the UAE, France, and Bahrain participated.

The Syndicated Murabaha Facility is backed by a sovereign guarantee from the Ministry of Finance of Egypt. ICIEC’s policy covers the Non-Honouring of Sovereign Financial Obligations (NHSFO) of the Government of Egypt, providing vital risk mitigation for the participating banks. This ensures that in the event the government is unable to honour its financial obligations under the facility, ICIEC will provide compensation to the insured banks, up to the insured amount. This transaction, says ICIEC, is of critical importance for Egypt as it will facilitate the import of essential energy supplies, such as crude oil and LNG, which are vital for both economic stability and the welfare of the Egyptian population. In addition, it supports Egypt’s

In a second transaction, ICIEC also extended crucial support to a USD 70mn Murabaha Syndicated Facility arranged by the ITFC for the benefit of Groupe Chimique Tunisien in Tunisia. This strategic transaction, with Kuwait International Bank (KIB) participating with USD20mn, is aimed at financing the purchase of fertilizers—a key input for Tunisia’s agricultural sector. ICIEC’s Bank Master Policy (BMP) covers USD50mn of the total facility, providing a high coverage rate of 95% for non-payment risks associated with the Ministry of Economy and Planning of Tunisia, which has issued an irrevocable and unconditional guarantee for the facility.

The syndicated facility will play a vital role in strengthening Tunisia’s fertilizer production capabilities, a sector central to the country’s economic development. Fertilizers are pivotal for increasing agricultural yields, generating foreign currency through agricultural exports, and supporting employment within production and industrialization zones. By boosting agricultural productivity, this facility will help enhance the sector’s competitiveness in the global market.

Both transactions, says ICIEC, align with the UN Sustainable Development Goal (SDG) number 17, which focuses on fostering global partnerships for sustainable development. By facilitating the import of oil and gas, the transaction promotes greater international cooperation and strengthens trade relationships between Egypt and its supplier nations. Such partnerships contribute to the country’s long-term development by ensuring a steady supply of energy resources, critical for economic growth and the well-being of its citizens.

Through this initiative, ICIEC says it continues to demonstrate its commitment to supporting projects that advance the economic development of its member countries while mitigating risks for financial institutions involved in complex cross-border transactions.

Al Rajhi Bank Extends a SAR1.3bn (USD346.54mn) Murabaha

Facility to Private Medical Entity Dr Sulaiman Al Habib Medical Services Group to Fund Three Hospitals and Several Medical Centres

Riyadh – Al Rajhi Bank, the largest Islamic bank in the world in terms of assets under management and one of the largest banks in the MENA region, extended a SAR1.3bn (USD346.54mn) Murabaha credit facility to Dr. Sulaiman Al Habib Medical Services Group Company, one of the largest private medical groups in Gulf Cooperation Council (GCC) region.

The agreement signed on 29th September 2024, has a tenor of 13 years, and is guaranteed by a promissory note pledged by the company to the amount of the facilities. In a disclosure to Tadawul (the Saudi Exchange), Dr. Sulaiman Al Habib Medical Services Group Company confirmed that the proceeds from the facility will be used to finance the following projects of the Group: Sehat AlHamra Hospital, Women’s Health Hospital, Sehat Alkharj Hospital, and the Medical Centers affiliated with AlMarakez Al Awwalyah for Healthcare Company.

IILM Successfully Closes October 2024 Auction of Short-term Sukuk with an Aggregate USD1.14bn on the Back of Positive Market Sentiments Following the US Federal Reserve Rate Cut of 50bps

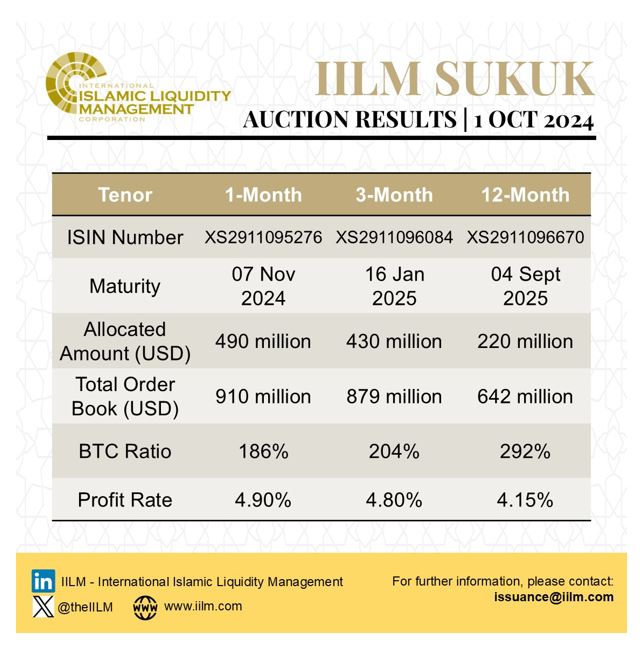

Kuala Lumpur – The International Islamic Liquidity Management Corporation (IILM), the multilateral international industry organisation that develops and issues short-term Shariah-compliant liquidity management instruments, continued its short-term Sukuk issuance momentum with a re-issuance of an aggregate USD1.14bn of papers on 1 October 2024.

The transaction involved three tranches across three different tenors of one, three, and twelve months respectively, which saw strong and well supported demand for the short-term Islamic papers. The October Sukuk reissuance of a total USD1.14bn witnessed a competitive tender among Primary Dealers and investors from markets across the GCC and Asia, with a combined orderbook more than USD2.43bn billion, representing an average bid-to-cover ratio of 213%. The three series reissued on 1 October 2024, says the IILM, were priced competitively at:

i) 4.90% for the USD490mn Sukuk with a 1-month tenor.

ii) 4.80% for USD430mn Sukuk with a 3-month tenor.

iii) 4.15% for USD220mn Sukuk with a 12-month tenor.

The latest Sukuk issuance marks the IILM’s eleventh auction for the year, as well the third time the 12-month tenor was offered in 2024. Prior to this auction, the IILM held an auction on 3 September involving the reissuance of an aggregate USD990mn short-term Sukuk across three different tenors of one, three, and six months.

Mr. Mohamad Safri Shahul Hamid, Chief Executive Officer of the IILM, commented: “As the market continues to adjust to a new environment with the long-awaited US Federal Reserve rate cut of 50-basis points last month, the IILM is extremely pleased with the outcome of the latest auction, which saw a strong and well supported demand for the short-term Islamic papers. This is clearly evidenced by the solid bid-to-cover ratios across all the three tenors. The IILM’s short-term Sukuk continues to be one of the most sought-after Islamic liquidity management solutions for many global institutions with appetite for Shariah-compliant instruments.”

Year-to-date, the IILM has issued a cumulative USD10.51bn across 33 Sukuk series. The issuance forms part of the IILM’s “A-1” (S&P) and “F1” (Fitch Ratings) rated USD6bn short-term Sukuk issuance programme. The total amount of IILM Sukuk outstanding is now USD 4 billion. The IILM regularly issues short-term Sukuk across 1-month, 3-month, 6-month, and 12-month tenors to cater to the liquidity needs of institutions offering Islamic financial services. The IILM will continue to reissue its short-term liquidity instruments monthly as scheduled in its issuance calendar.

In September 2024, the IILM announced a significant expansion of its Sukuk Programme, raising the ceiling from USD4bn to USD6bn. “We are delighted to have successfully completed the upsizing of the IILM Sukuk Programme by 50% from USD4bn to USD6bn,” explained Mr Mohamad Safri. “This increase will allow us to add more high-quality assets and inevitably help strengthen our mandate and role in facilitating effective cross-border liquidity management amongst institutions offering Islamic financial services, in particular.

“The upsizing of the Sukuk programme to USD6bn reflects the growing and sustainable demand for high quality Sukuk issued by the IILM, which has seen oversubscription rates exceeding 220% year-to-date. It also reinforces the IILM’s status as a unique provider of Islamic safe-haven liquidity management instruments, vital for institutions seeking Shariah-compliant High-Quality Liquid Assets (HQLA). The 21 August Sukuk represents a significant milestone for the IILM, as we expand our portfolio to include a new highly rated underlying asset, for the first time since 2020 (rated AA- internationally).”

The IILM’s ongoing commitment to innovation and impact, according to the Corporation, continues to bolster the liquidity management capabilities of Islamic financial institutions. By providing highly rated tools that are increasingly traded in secondary markets, the IILM helps these institutions meet their Liquidity Coverage Ratio (LCR) requirements while offering sustainable returns.

The IILM consistently issues short-term Sukuk across 1-month, 3-month, 6-month, as well as 12-month tenors, tailored to the liquidity needs of Islamic financial institutions. Since its inaugural issuance in 2013, the IILM has successfully issued over USD110.46bn in Sukuk across 263 series. The regular Sukuk auctions, stresses Mr Safri, also reinforce “the IILM’s status as a unique provider of Islamic safe-haven liquidity management instruments, vital for institutions seeking Shariah-compliant High-Quality Liquid Assets (HQLA).

The IILM’s short-term Sukuk is distributed by a diversified network of 11 primary dealers globally, namely Abu Dhabi Islamic Bank, Al Baraka Turk, Boubyan Bank, CIMB Islamic Bank, Dukhan Bank, First Abu Dhabi Bank, Kuwait Finance House, Maybank Islamic, Qatar Islamic Bank, Affin Islamic Bank, and Standard Chartered Bank. The current members of the IILM Board are the central banks of Indonesia, Kuwait, Malaysia, Mauritius, Nigeria, Qatar, Türkiye, the United Arab Emirates, as well as the multilateral Islamic Corporation for the Development of the Private Sector, the private sector funding arm of the Islamic Development Bank Group.

ITFC Signs €300mn (USD356.3mn) 3-Year Financing Facility with the Union of Comoros in Support of Energy, Agriculture and SME Sectors

Jeddah – The International Islamic Trade Finance Corporation (ITFC), the trade fund of the Islamic Development Bank (IsDB) Group, signed a new 3-Year €330mn (USD356.3mn) financing agreement with the Union of Comoros in September 2024, focusing on supporting key sectors such as energy, agriculture, and SME support, and aiming to mobilize trade financing and enhance economic development in Comoros.

The agreement was signed in Jeddah by Eng. Hani Salem Sonbol, CEO of ITFC, and Mr. Ibrahim Mohamed Abdourazak, the Minister of Finance, Budget, and Banking Sector, of Comoros. The new 3-year Framework Agreement builds on the success of the previous €330 agreement, which achieved 83% of its target. Since 2008, ITFC has approved over USD712mn in financing for Comoros.

Eng. Hani Salem Sonbol, CEO of ITFC commented: “We are proud to strengthen our partnership with the Union of Comoros through this new framework agreement, which reflects our shared commitment to fostering sustainable economic development. By focusing on key sectors such as energy, agriculture, and SME development, we aim to support the country in achieving its long-term goals under the Emerging Comoros Plan. Our efforts, including the newly signed Food Security Facility, demonstrate our dedication to addressing critical needs such as food security while empowering key industries to drive growth.”

ITFC recently signed a €20mn Food Security Facility with Comoros, with two local banks, BDC and AFG Bank, acting as Executing Agencies, to support the continuous supply of essential foodstuffs at affordable prices to address food security challenges in the country.

ITFC’s broader support for Comoros includes capacity-building initiatives, such as the Reverse Linkage Project with Morocco for the sustainable tourism sector, and the equipment of the Central Vanilla Buying and Marketing Center under the Aid for Trade Initiative for the Arab States (AfTIAS 2.0) Programme.