New Entrant Qatar’s Dukhan Bank Joins Major GCC Islamic Banks in the International Financial Market with Debut USD800mn Sukuk Wakala/Murabaha Issuance to Boost Balance Sheet Activities

The entry of the newish Qatari Islamic banking giant, Dukhan Bank which resulted from the merger between the International Bank of Qatar (IBQ) and Barwa Bank, into the international financial market with a maiden benchmark Senior Unsecured 144A/Reg S USD800mn Sukuk Wakala/Murabaha, further reinforces the remarkable current buoyancy of the global Sukuk market.

Industry bodies, pundits and the major rating agencies may speculate and project about the trends in the global Sukuk market in 20024 and beyond, and whether primary issuances this year may or may not overtake last-year’s bumper year. The reality on the ground is what matters. October 2024 has proven to be an extraordinary month for Sukuk origination with some ten offerings led by Saudi Aramco, the Islamic Development Bank and Dubai Islamic Bank – three heavy weight and regular issuers.

Dukhan Bank’s entry is the icing on the cake, on the back of regular Qatari issuers such as Qatar Islamic Bank and Qatar International Islamic Bank, both of which raised funds in the global Sukuk market in September and October.

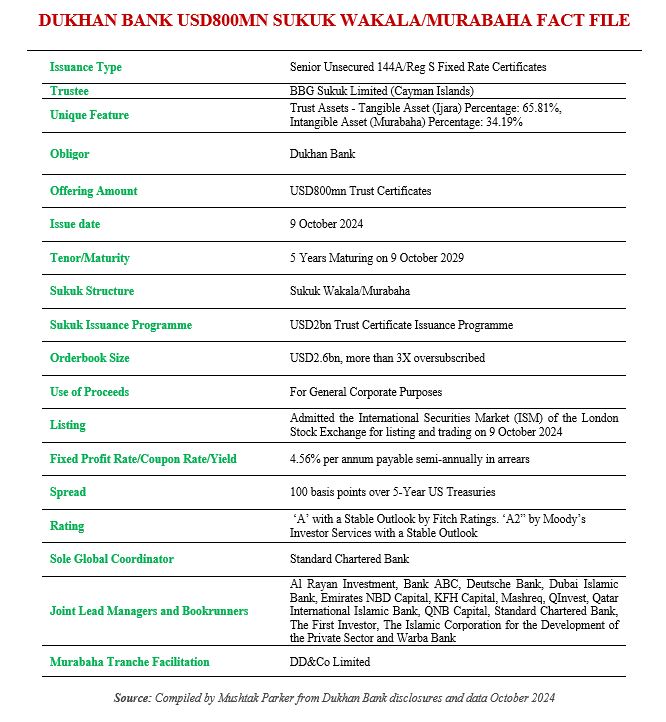

The Bank, rated A2 by Moody’s (stable outlook) and A by Fitch (stable outlook), successfully closed an USD800mn 5-year Senior Unsecured 144A/Reg S Fixed Rate Sukuk maturing on 9 October 2029. The transaction was done through BBG Sukuk Limited, incorporated in the Cayman Islands, the Trustee on behalf of the Obligor, Dukhan Bank on 9 October 2024 under BBG Sukuk Limited’s USD2bn Trust Certificate Issuance Programme

Dukhan Bank mandated Standard Chartered Bank on 30th September 2024 to act as Sole Global Coordinator, and together with Al Rayan Investment, Bank ABC, Deutsche Bank, Dubai Islamic Bank, Emirates NBD Capital, KFH Capital, Mashreq, QInvest, Qatar International Islamic Bank, QNB Capital, Standard Chartered Bank, The First Investor, The Islamic Corporation for the Development of the Private Sector, the private sector funding arm of the Islamic Development Bank, to act as Joint Lead Managers and Bookrunners to the transaction and to arrange a a series of global investor meetings and presentations led by Dukhan Bank’s senior management team to accounts in the UK, EU, the Middle East and Asia.

The transaction according to the Bank, was met with outstanding demand from global and regional investors. Order books were covered more than 3.5 times and peaked at USD2.6bn, enabling the bank to issue USD800mn trust certificates – the largest issue size achieved by a Qatari Islamic bank since 2020.

The initial price thoughts were set at 130 basis points (bps) over 5-Year US Treasuries. The robust demand and oversubscription allowed a 30bps price tightening with the final price guidance settling at a spread of 100bps over 5-year US Treasuries and translating into a profit rate of 4.56% per annum payable semi-annually in arrears.

The offering is based on a Wakala/Murabaha structure, with the Trust Assets comprising 65.81% Tangible Assets and 34.19% Intangible Assets. The Shariah analysis, according to the final terms of the offering, is as follows: an ownership interest in the Wakala Assets comprised within the relevant Wakala Portfolio should pass to the Trustee under the Master Purchase Agreement, as supplemented by the relevant Supplemental Purchase Agreement (together, the “Purchase Agreement”).

The Trustee will declare a trust in respect of the Wakala Assets and the other Trust Assets in favour of the Certificateholders of the relevant Series pursuant to the Master Trust Deed, as supplemented by the relevant Supplemental Trust Deed. Accordingly, from a Shari’a perspective, Certificate holders should, through the ownership interest obtained by the Trustee pursuant to the terms of the Purchase Agreement, have an undivided ownership interest in the relevant Wakala Assets.

The success of the transaction, said Dukhan Bank, is reflective of the strength of the Qatari economy and Dukhan Bank’s strong credit fundamentals. The issuance reaffirms Dukhan Bank’s position as a leading financial institution in Qatar. It is also a significant milestone for the bank as it continues to broaden its funding base and enhance its presence in international markets.

Sheikh Mohammed bin Hamad bin Jassim Al Thani, Chairman and Managing Director of Dukhan Bank, commented at the successful closing of the transaction: “We are delighted with the exceptional success of this debut senior Sukuk issuance. This success is a testament to Qatar’s credit robustness and aligns seamlessly with the ambitious goals outlined in Qatar’s National Vision 2030.”

Similarly, Ahmed Hashem, Acting Group Chief Executive Officer of Dukhan Bank, was thrilled “with the overwhelming response to this Sukuk issuance. This reflects the global confidence in both Qatar’s economic stability and Dukhan Bank’s strong financial foundation. It also highlights the bank’s standing within the international financial community. We extend our deepest appreciation to the Joint Lead Managers, whose expertise and dedication were instrumental in guiding this transaction.”

The Sukuk certificates were admitted to the International Securities Market (ISM) of the London Stock Exchange for listing and trading on 9 October 2024.