World’s Largest Oil Exporter Saudi Aramco Returns to the Global Sukuk Market in October 2024 After a 3-year Absence with a USD3bn Market Issuance Fillip to Re-establish its Sukuk Yield Curve

In many respects Saudi Aramco, the world’s largest oil exporter and one of the world’s leading integrated energy and chemicals companies, is a trend setter not only in its core sector constituency of crude oil, natural gas and chemicals, but also in the international Sukuk market.

In June 2021 for instance, Aramco issued the world’s largest single US dollar corporate Sukuk – a three-tranche USD6bn transaction which marked the oil giant’s maiden offering and its entry into the global Sukuk market under a newly-established unlimited Trust Certificate Issuance Programme. In those halcyon days, Aramco could muster tight profit rates as evidenced in the pricing for the transaction – 0.946% per annum for the 3-Year USD1bn tranche, 1.602% for the 5-year USD2bn tranche, and 2.694% for the 10-year USD3bn tranche. The fact that the issuance was oversubscribed an incredible 20 times with the orderbook exceeding a staggering USD120bn speaks volumes and arguably paved the way for other major corporates and sovereign wealth funds in the GCC to enter the Sukuk market.

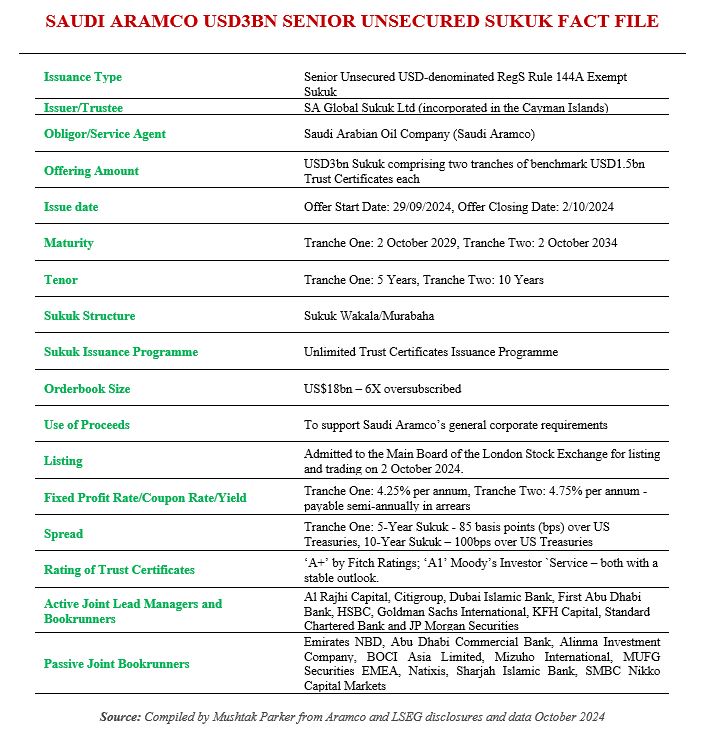

Fast forward to 2024. After an absence of just over 3 years, Aramco returned to the international Sukuk market in October 2024 with a two-tranche two-tenor aggregate USD3bn benchmark Sukuk Wakala/Murabaha senior unsecured RegS Rule 144A issuance under its unlimited Trust Certificate Issuance Programme.

The offering comprised i) An USD1.5bn 5-year tranche maturing in 2029, carrying a profit rate of 4.25% per annum and a spread of 85 basis points (bps) over US Treasuries, and ii) a USD1.5bn 10-year tranche maturing in 2034, carrying a profit rate of 4.75% per annum. and a spread of 100 bps over US Treasuries. The proceeds will be used for general corporate funding requirements and the transaction will also mark the “re-establishment of Aramco’s Sukuk yield curve.”

This transaction follows Aramco’s USD6bn foray into the conventional bond market in July 2024 when it raised USD6bn under its unlimited Global Medium Term Note Issuance Programme. Aramco is effectively the premier revenue generator for the Kingdom’s economy as it seeks to invest in new industries, a massive project programme centred around Neom City, and its stated policy of weaning the economy away from its dependence on crude oil as per the ambitious Saudi Vision 2030 Plan.

The USD6bn bond transaction of USD2bn each in comparison was priced at a coupon rate of 5.250% for the 10-Year bonds, 5.750% for the 30-Year bonds and 5.875% for the 40-Year bonds.

Aramco is the Saudi state-owned oil company, in which the Saudi government holds an 81.5% stake and its sovereign wealth fund, Public Investment Fund, another 16%.

Aramco started to market the transaction which was distributed through syndication on 24 September 2024. It mandated Al Rajhi Capital, Citigroup, Dubai Islamic Bank, First Abu Dhabi Bank, Goldman Sachs International, HSBC, JP Morgan Securities, KFH Capital and Standard Chartered Bank to act as joint active bookrunners, and to arrange a series of investor calls with accounts in London, EU, the GCC, Mena Region, Asia and Offshore US accounts, for a two-tranche two-tenor issuance totalling USD3bn pursuant to SA Global Sukuk Limited’s unlimited Trust Certificate Issuance Programme. The trust certificates (Sukuk) will constitute USD denominated, direct, unsubordinated, unsecured and limited recourse obligations of SA Global Sukuk Limited.

In addition, Abu Dhabi Commercial Bank, Albilad Capital, Alinma Investment, BOC International, Emirates NBD Capital, Mizuho, MUFG, Natixis, Sharjah Islamic Bank and SMBC Nikko acted as joint passive bookrunners to the transaction.

In a disclosure to Tadawul (Saudi Stock Exchange), Aramco said that the offering was aimed at institutional investors (qualified investors in the jurisdictions in which the offering will be made in accordance with the rules and regulations of such jurisdictions). The transaction was marketed at initial price thoughts of around US Treasuries plus 120bp for a five-year tranche and US Treasuries plus 135bp for a 10-year tranche.

The offering, said the oil company, received robust demand from a variety of investors and was six times oversubscribed, with the order book exceeding USD18bn. This allowed Aramco to tighten the pricing with the yield settling at 85bps for the 5-Year tranche and 100bps for the 10-year issuance. The fact that the issuance was priced a day after its launch on 25 September 2024 reflected market confidence in the transaction. Both tranches, emphasised Aramco, were priced with a negative new issue premium, reflecting the oil company’s strong credit profile. The successful issuance builds on Aramco’s efforts to diversify and broaden its investor base, further enhance liquidity, and re-establish its Sukuk yield curve.

According to Ziad T. Al-Murshed, Aramco Executive Vice President and CFO, “building on the strong investor reception from our July 2024 bond issuance, this Sukuk offering represented an opportunity to engage with a broader investor base. The impressive demand, as demonstrated by the oversubscribed Sukuk order book, reflects Aramco’s unique credit proposition, underpinned by its competitive advantage and a proven track record of financial resilience through cycles.”

In August 2024, Aramco announced robust Interim financial results. Net income for the FH 2024 was SAR211.28bn (USD56.34bn), compared to SAR232.35bn (USD61.96bn) for the same period in 2023. The decrease was primarily a result of lower crude oil volumes sold, weakening refining margins, and lower finance and other income. Total revenue for FH 2024 was SAR827.75bn (USD220.73bn), compared to SAR820.02bn (USD218.67bn). Aramco also announced an USD64.7bn cash flow from its operating activities, and a projected “industry-leading total dividends of USD124.2bn in 2024.”

“We have delivered market-leading performance once again, with strong earnings and cash flows in the first half of the year. Leveraging these strong earnings, we continued to deliver a base dividend that is sustainable and progressive, and a performance-linked dividend that shares the upside with our shareholders.

“We have also continued to create and deliver both value and growth, as demonstrated by the positive investor response to the Government’s secondary public offering of Aramco shares and our recent USD6.0 billion bond issuance (and by extension the USD3bn Sukuk issuance). Our drive to create value is supported by our distinctive long-term competitive advantages, our exceptional financial resilience through cycles, and our strong balance sheet. These are exciting times for Aramco as we continue to seek new opportunities to enhance our portfolio and our capabilities to enable a secure and more sustainable energy future.”

Note to Newsletter readers from DDCAP Group™: In addition to the above details, we were pleased that the Group was also involved in the new issuance by Saudi Aramco, for which the Murabaha tranches were facilitated by DD&Co Limited and utilisation of its multiple award-winning platform ETHOS AFP™.