BSF Completes Second Sukuk Offering in 2024 with SAR3bn (USD800mn) Additional Tier 1 Issuance in September 2024 Through a Private Placement

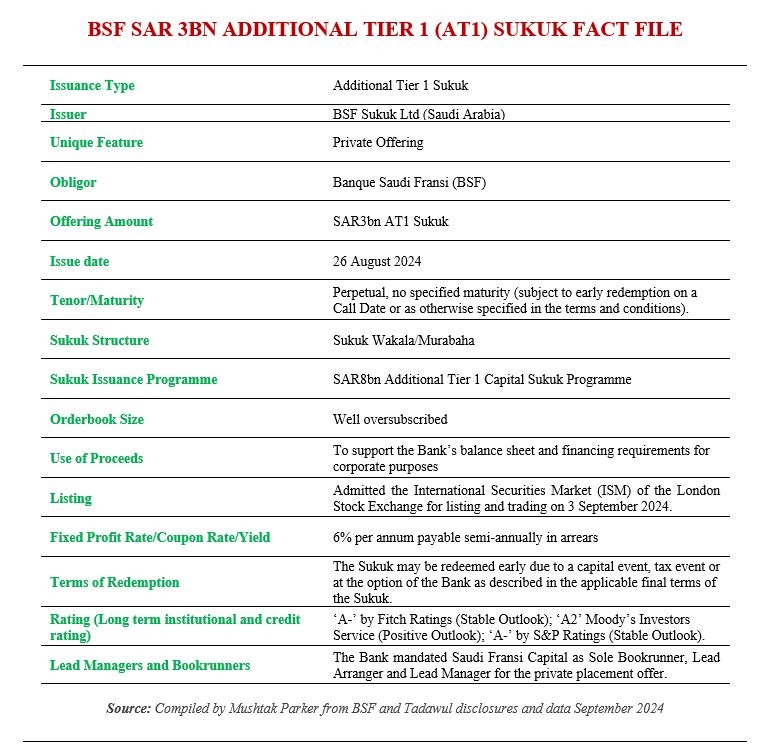

Banque Saudi Fransi (BSF), one of the largest providers of corporate banking services in Saudi Arabia, returned to the Sukuk market on 28 August 2024 when it closed its latest offering – a SAR3bn (USD800mn) Additional Tier 1 Sukuk through a private placement. BSF is a regular issuer of Sukuk usually alternating between tapping the international USD and domestic Saudi riyal markets.

According to a BSF disclosure to Tadawul (the Saudi Exchange), the Wakalah/Murabaha Sukuk is a Perpetual issuance with no specified maturity (subject to early redemption on a Call Date or as otherwise specified in the terms and conditions). The Bank mandated Saudi Fransi Capital as Sole Bookrunner, Lead Arranger and Lead Manager for the private placement offer to Institutional and Qualified investors in accordance with the Rules on the offer of Securities and Continuing Obligations issued by the Capital Market Authority (CMA).

The Bank announced its intention to issue by way of private placement in the Kingdom of Saudi Arabia a SAR denominated Additional Tier 1 Sukuk under its SAR8bn (USD2.3bn) Additional Tier 1 Capital Sukuk Programme following approval by its Board of Directors on 22 January 2024 of establishing the Programme with a view to the issuance of any Series of Sukuk from time to time.

The marketing of the Sukuk offering started on 12 August and closed on 26 August 2024. According to the Bank demand for the trust certificates was robust.

BSF has been assigned a long-term credit rating of ‘A2‘ by Moody’s Investors Service (with a Positive Outlook); an ‘A-’long-term credit rating by S&P Ratings Services (with a Stable Outlook); and an ‘A-’long-term credit rating by Fitch Ratings (with a Stable Outlook).

In August 2024, BSF announced interim net profits of SAR2,279mn (USD607.27 mn) for First Half 2024 – up 6% on the SAR2,150mn (USD572.9mn) in the same period in 2023; total income of SAR2,030mn (USD542.92mn) down 6.4% on the SAR2,168mn (USD577.69mn) in the same period in 2023; total assets of SAR288,826mn (USD76,961.77mn) compared with the SAR245,718mn (USD65,475mn) in the same period in 2023; and financing and investments of SAR55,506mn (USD14,790.36mn) – up 12.9% on the SAR49,178mn (USD13,104.17mn) for the same period.

This is BSF’s second Sukuk issuance in 2024. On 22 January the Bank successfully closed a 5-year USD700mn senior unsecured RegS Sukuk, issued by BSF Sukuk Company Limited (Cayman Islands Incorporated) under its USD4bn Trust Certificates Issuance Programme, which was priced a profit rate of 5% per annum payable semi-annually in arrears. The Certificates are listed on the International Securities Market of the London Stock Exchange.