Obituary – Wan Abdul Rahim Kamil Wan Muhammed

Written by Mushtak Parker

A Fond Farewell to IF Pioneer Wan Abdul Rahim Kamil 1949-2024

Kuala Lumpur – The global Islamic finance community mourns the untimely passing of Wan Abdul Rahim Kamil Wan Mohamed Ali at his home in downtown Kuala Lumpur on 5 August 2024. He was 75 years old and was the third of five siblings born in the coastal town of Kuala Terengganu on the east coast of peninsular Malaysia.

Wan Abdul Rahim pioneered the development of the Debt Islamic Capital Market in Malaysia and has innovated the development of several benchmark capital market securities through securitisation of Islamic contracts. He was a consummate and dedicated Islamic finance professional and one of the first cohort of students to be awarded a Post Graduate Degree in Islamic Banking and Economics from the then nascent but pioneering International Institute of Islamic Banking and Economics (IIIBE) in Northern Cyprus, in association with Al Azhar University, Cairo, under the tutelage of the prominent Islamic economics pioneer, Professor Dr Ahmed Al Naggar, and the Director of the IIIBE, Mehmet Barut.

In recent years he served as an Islamic Capital Market (ICM) consultant with the Securities Commission (SC), Malaysia’s Capital Market regulatory authority, where he advised and helped formulate and develop the regulatory as well as market framework for the ICM industry in Malaysia.

At the SC he played a key leadership role in the Secretariat for The Royal Award for Islamic Finance (RAIF), the prestigious bi-annual award which recognises excellence and extraordinary achievement in Islamic finance by individuals launched by the Malaysian Ministry of Finance, Bank Negara Malaysia and the SC – under the Royal Patronage of the Malaysian Agong (The King).

I collaborated regularly with Wan Abdul Rahim Kamil on RAIF in my capacity as a Member of its International Jury, and in his capacity as the Project Director for the Securities Commission Malaysia and Oxford Centre for Islamic Studies (OCIS), an independent centre of Oxford University, UK, on their annual SC-OCIS Roundtable, in which I participated on several occasions. DDCAP Group™ Managing Director Ms Stella Cox CBE, FCSI(Hon), also regularly engaged with him in her role as a Member of the Nominations Committee of RAIF.

He was a genteel human being, generous in spirit with a friendly and softly demeanour, which in many respects was beguiling and endeared him to those with whom he interacted and collaborated. Essentially, he was a consummate Islamic finance patriot.

Wan Abdul Rahim was one of the pioneer staff of Malaysia’s flagship state-owned Islamic financial institution, Bank Islam, working there from 1983, the very year the Islamic Banking and Finance Act was passed by the Dewan Rakyat (Malaysian Parliament). He was appointed to handle Corporate Advisory, Investment Banking and Project Development activities and operations – all very new to a nascent Islamic finance ecosystem.

From 1994 to 2006, he was the Chief Executive Officer of ABRAR Discounts Berhad. During his tenure at Abrar Discounts Berhad he successfully converted and repositioned the then-fledgling Jati Discounts Berhad into a fully-dedicated Islamic Discount House and into an active Capital Market industry player that had innovated several capital market products and treasury mechanisms into the industry.

Throughout his three decades of involvement in Islamic finance, he is rightly credited with several of the Islamic finance innovations introduced in the market such as Ar Rahnu (for Islamic ‘pawnshops’), Murabahah Notes Issuance Facility (MuNIF) commercial papers, Sukuk issued under the contracts of Musharakah, Qardhul Hasan and Bai’ Bithaman Ajil (BAIDS) and the first Islamic Asset-Backed Securities (ABS).

He also served as a Member of Shariah Committee at RHB Bank Berhad since April 2013 and was a frequent speaker and trainer on the Islamic conference, seminar and workshop circuit, including those organised by the World Bank, Bank Negara Malaysia (BNM), Securities Industries Development Corporation (SIDC), Islamic Banking and Finance Institute Malaysia (IBFIM), The London Sukuk Summit, and the Kuala Lumpur Islamic Financial Forum (KLIFF).

He was a much sought after expert on Islamic finance, and actively contributed in his capacity as member of International Islamic Financial Market (IIFM)’s Market and Product Development Committee, The National Economic Action Committee (NEAC)’s Islamic Banking Committee, Securities Commission’s Islamic Capital Market Working Group and Labuan LOFSA’s Task Force on Islamic Finance. Elsewhere, Wan Abdul Rahim was also a consultant for the Egypt Financial Services Board and the United States Agency for International Development (or USAID) in the development of the Sukuk and bond markets.

He was also a regular contributor to Islamic Banker, an internationally distributed monthly market reference publication on Islamic finance founded and edited by Mushtak Parker. One of his defining articles was on an alternative Sharia’a compliant structure for factoring and bill discounting based on the Musharakah contract.

Wan Abdul Rahim held a Professional Membership from the Institute of Statisticians (now merged with Royal Statistical Society) of the United Kingdom. His resilience and extraordinary commitment to the Islamic system of financial intermediation inspired him to continue with his consultancy, mentoring, teaching and advisory work till the day of his passing. Until his passing he served as an Academic Fellow at Kolej Universiti Insaniah, Kedah Darul Aman, in Malaysia, and as a director and principal consultant at the First International Consulting Sdn Bhd, Malaysia, a firm that specialises in Islamic finance consulting, training and advisory.

Given his vast experience straddling almost five decades from the mid-1970’s at Aseambankers (M) Berhad, Bank Islam Malaysia Berhad, Abrar Discounts Berhad and the Securities Commission Malaysia, Wan Abdul Rahim built up a well-deserved reputation as a specialist in Islamic Capital Market and Liquidity Management.

Not surprisingly, he was honoured with several accolades for his contribution to the Islamic finance industry including an award for “Outstanding Leadership in Islamic Finance” by The London Sukuk Summit in 2011 organised by ICG Events and supported by the UK Trade and Industry Ministry, and the “Most Outstanding Individual Contribution to Islamic Finance” by the Kuala Lumpur Islamic Financial Forum (KLIFF) in 2017.

Wan Abdul Rahim Kamil Wan Mohamed Ali

Born: 17 May 1949 Died: 5 August 2014

He is survived by his wife Norlia bt Mohamed, and his four children Muhammad Tamlikha, Abdul Matiin, Ahmad Nadzim, and Abdul Mun’eim.

Rest in Peace Wan Abdul Rahim Kamel!

DDCAP Group™ Renews Strategic Partnership with Cambridge IFA to Foster Continued Growth, Leadership Skills, Capacity Building, Diversity and Gender Empowerment in Islamic Finance Sector

London – DDCAP Group™, the prominent provider of intermediating financial technology and Sharia’a-compliant trading services, renewed its strategic partnership with Cambridge IFA dedicated to the advocacy, support and promoting the development of Islamic finance across borders. The renewal agreement was signed by Stella Cox CBE, FCSI(Hon), Managing Director of DDCAP Group™, and Professor Humayon Dar, Executive Chairman of Cambridge IFA, during the 8th Cambridge Islamic Finance Leadership Programme, which was held at Clare College, Cambridge University between 11-16th August 2024.

In fact, DDCAP Managing Director Ms Stella Cox, with her 30-year plus experience and expertise in the Islamic finance industry, gave a Leadership Talk under the programme sharing her insights and lived experience especially on responsible finance, ethical values, and women empowerment. She also shared her insights on the global trends and developments in Islamic finance, the role of innovation and technology, and the importance of collaboration and partnership – all aimed at aspiring and motivating the next generation of Islamic finance leaders.

Stella observed “it was my privilege to be asked to share my insights and experience at IFLP. Cambridge IFA, in conjunction with Bahrain Institute of Banking and Finance (BIBF), has developed a broad and motivating programme that is befitting of such a diverse and talented group of people attending this year, many of whom are already embracing the challenges of industry leadership and others who are preparing to.”

DDCAP and Cambridge IFA have been cooperating on various initiatives, projects, events, and publications aimed at fostering industry growth. These initiatives include the Cambridge Global Islamic Finance Report (GIFR); ISFIRE, the only print magazine dedicated to Islamic finance published from London; The Cambridge Islamic Finance Leadership Programme (IFLP), Cambridge Islamic Finance Structuring Master Programme, WOMANi Programme, and other development and advocacy initiatives.

The renewed partnership, stressed DDCAP, takes a step further and builds upon the success of previous collaborations where both organisations partnered on several initiatives and projects to foster the development and growth of the Islamic finance industry. For over twenty-five years, DDCAP has been at the forefront of supporting and developing the capacity building programmes to enhance ethical leadership in Islamic finance.

The group strongly emphasises the advancement of leadership skills, spearheading training and development of human capital, and empowering individuals, with a special focus on women to contribute sustainably to the evolution of Islamic finance on a global scale. The unwavering support of DDCAP for these projects is a testament to their commitment to connecting and supporting the global Islamic financial market responsibly and sustainably.

“Since 2019 DDCAP’s strategic partnership with Cambridge IFA has afforded us a single point of connectivity that encompasses much of our endeavour to add value to the Islamic financial sector through our supportive themes of work and outreach. We are proud that we can now look back on more than 5 years of extensive, collaborative work. The projects that we have completed together have, in several instances, been groundbreaking and have delivered outcomes that now afford us a means of analysing and measuring the impact of our joint undertakings. We place great value upon the ability we have developed to do so,” explained Ms Stella Cox.

Through their strategic collaboration, Cambridge IFA and DDCAP will continue to shape and evolve the future of Islamic finance by nurturing a new generation of Islamic finance leaders, empowering women to lead in the field of Islamic business and finance and contributing to cutting-edge financial intelligence that is the tool for market leaders.

The renewal of the agreement, added DDCAP, will allow the two partners to continue their advocacy roles and further elevate the profile and understanding of Islamic finance globally. They will further capitalise on their strengths to promote and implement initiatives that will drive greater awareness, acceptance and adoption of Islamic finance principles and products on a global scale. Not surprisingly, to Cambridge IFA’s Professor Humayon Dar, “this collaboration is pivotal as we aim to empower more professionals through our advanced capacity-building and leadership programmes, strengthening our commitment to women empowerment and gender diversity, and disseminating authentic Islamic financial intelligence, thereby contributing to a resilient and dynamic Islamic financial ecosystem”.

Saudi Fintech Entity Emkan Finance Issues Second Sukuk in 2024 in August Through a Private Placement Following its Benchmark SAR2.3bn (US$604.6mn) Senior Sukuk Mudaraba in February

Riyadh – Emkan Finance, a leading Saudi fintech company specializing in financing and payment solutions, successfully closed its latest Mudaraba Sukuk in August 2024, which was distributed through a private placement.

AlRajhi Financial Company was mandated to act as the financial advisor and sole lead manager in overseeing the issuance process. According to AlRajhi Financial Company, the offering attracted strong demand from qualified individual investors, institutions, companies, and charitable organizations.

This issuance together with the overall number of Sukuk issued in the Saudi market, underscored “the positive outlook for the financial sector’s growth—a key objective of the Financial Sector Development Programme under Saudi Arabia’s Vision 2030.”

In its announcement, AlRajhi Financial Company did not disclose any details of the size of the issuance nor the pricing and yield, albeit local banking sources stress that it could be a benchmark size more than SAR2bn (US$530mn). Prior to this latest transaction, Emkan Finance has issued several Sukuk in the past. In fact, this August offering is the company’s second Sukuk issuance in 2024.

On 15 February 2024, Emkan Finance, raised SAR2,268.39mn (US$604.57mn) through a benchmark Subordinated Senior Sukuk Mudaraba.

The full subscription of the August 2024 Sukuk issuance, says Emkan Finance, highlights investor confidence in the local market and strengthens the company’s financial liquidity. The full subscription in the second issuance of Sukuk in 2024 will enable Emkan Finance to continue offering innovative financing solutions through financial technology, including the launch of new products via the Emkan app, which provides customers with a seamless and fast digital experience anytime, anywhere.

According to Abdullah Al-Habdan, CEO of Emkan Finance, “the high demand for both our first and second Sukuk issuances this year serves as a strong incentive for us to further diversify our funding sources and drive the company’s growth. We appreciate the support of our investors for their trust in Emkan Finance, reaffirming the company’s commitment to delivering the best Sharia’a-compliant financial technology solutions.”

The 5-year SAR2,268.39mn (US$604.57mn) subordinated unsecured Sukuk Mudaraba issued by Emkan Finance on 15 February 2024 and solely distributed by Alrajhi Capital, has a coupon rate of 5.1%

This milestone transaction stressed Emkan Finance CEO’s Abdullah Al-Habdan underscores the optimistic outlook for the financing market’s growth, aligning with the strategic objectives of the Kingdom’s Vision 2030 Financial Sector Development Programme. He commended the enthusiastic investor reception to the Sukuk offering, reflecting the deep trust in the company’s financial instruments.

Emkan Finance is set to expand its product offerings through the Emkan app, introducing competitive, digitally streamlined services that promise to boost financing applications from its clientele. This Sukuk issuance, like the one in February 2024 paves the way for future endeavours aimed at diversifying funding sources, he added.

ITFC Extends Aggregate US$150mn Murabaha Facilities to Türkiye to Finance Post-Earthquake Recovery and to Boost Private Sector Involvement in Sustainable Development of Agri-Food industry

Istanbul – The International Islamic Trade Finance Corporation (ITFC), the trade finance fund of the Islamic Development Bank (IsDB) Group, extended an aggregate US$150mn of financing to Türkiye in August 2024.

The facilities comprise a US$100mn Murabaha facility provided to the Development and Investment Bank of Türkiye (TKYB) to support sustainable development by strengthening the agricultural industry and food sector and to contribute to the recovery efforts in the regions affected by the 6 February 2023 earthquake in Türkiye. The second facility is a US$50mn Murabaha financing for The Industrial Development Bank of Türkiye (TSKB). Both facilities are guaranteed by the Ministry of Treasury and Finance of the Republic of Türkiye.

The US$100mn funding, according to ITFC, aims to enhance the efficiency of supply chains disrupted by climate change and earthquakes and to meet the working capital needs of businesses operating in the agricultural and food sector across Türkiye for their import and export activities. TKYB prioritises sustainable development in areas such as renewable energy, food security, employment generation, infrastructure, and combating climate change in line with Türkiye’s development goals.

Ibrahim Öztop, CEO of TKYB, commented: “We have been fully supporting our citizens in the region since the first day of the tragic earthquake disaster in our country. This financing from ITFC is another step in our efforts to address the challenges posed by the earthquakes and the ongoing need for food security. We thank ITFC for this financing, which will contribute to our country’s development and growth, and hope our cooperation will further strengthen going forward.”

Eng. Hani Salem Sonbol, CEO of ITFC reciprocated: “We join hands with the Republic of Türkiye and the Development and Investment Bank of Türkiye in a partnership that marks a new era for ITFC’s business in Türkiye. This collaboration strengthens our shared commitment to economic development and allows us to expand our support for economic operators in both the private and the public sector, addressing critical needs in food security and contributing to Türkiye’s recovery and growth.”

The proceeds from the US$50mn facility to TSKB will be used to address the working capital needs of private sector companies in the provinces affected by the earthquakes in Eastern and Southeastern Türkiye in February 2023. According to ITFC, by supporting Turkish businesses’ pre-import and pre-export requirements, especially those impacted by the tragedy, the financing, which is intended to lessen the financial difficulties and effects of the earthquakes, hopes to improve the area economy’s vitality.

TSKB CEO, Murat Bilgiç stated: “Since the first day of the earthquake, TSKB has been fully committed to supporting recovery efforts with all its strength. This financing agreement represents a significant step towards contributing to Türkiye’s post-earthquake economic recovery and supporting the rebuilding of businesses in the affected regions. We are pleased to collaborate with ITFC to deliver the crucial financial support needed by businesses for the economic recovery of the region. This agreement is also the first collaboration between ITFC and our Bank, and it demonstrates our 74-year commitment to creating lasting value and providing financing for our country’s inclusive and multifaceted development.”

Eng. Hani Salem Sonbol noted that the partnership with TSKB underscores ITFC’s commitment to foster the economic resilience and recovery of companies effected by the earthquake. This agreement also marks a significant milestone where we are extending financing to the priority areas of Turkiye in coordination and cooperation with the Ministry of Treasury and Finance. “This strategic shift signifies a new era in ITFC’s interventions in Türkiye, expanding our role from a focus on pure private sector financing to actively contributing to the rebuilding of the economy, after a natural disaster,” he added

Stella observed “it was my privilege to be asked to share my insights and experience at IFLP. Cambridge IFA, in conjunction with Bahrain Institute of Banking and Finance (BIBF), has developed a broad and motivating programme that is befitting of such a diverse and talented group of people attending this year, many of whom are already embracing the challenges of industry leadership and others who are preparing to.”

DDCAP and Cambridge IFA have been cooperating on various initiatives, projects, events, and publications aimed at fostering industry growth. These initiatives include the Cambridge Global Islamic Finance Report (GIFR); ISFIRE, the only print magazine dedicated to Islamic finance published from London; The Cambridge Islamic Finance Leadership Programme (IFLP), Cambridge Islamic Finance Structuring Master Programme, WOMANi Programme, and other development and advocacy initiatives.

The renewed partnership, stressed DDCAP, takes a step further and builds upon the success of previous collaborations where both organisations partnered on several initiatives and projects to foster the development and growth of the Islamic finance industry. For over twenty-five years, DDCAP has been at the forefront of supporting and developing the capacity building programmes to enhance ethical leadership in Islamic finance.

The group strongly emphasises the advancement of leadership skills, spearheading training and development of human capital, and empowering individuals, with a special focus on women to contribute sustainably to the evolution of Islamic finance on a global scale. The unwavering support of DDCAP for these projects is a testament to their commitment to connecting and supporting the global Islamic financial market responsibly and sustainably.

“Since 2019 DDCAP’s strategic partnership with Cambridge IFA has afforded us a single point of connectivity that encompasses much of our endeavour to add value to the Islamic financial sector through our supportive themes of work and outreach. We are proud that we can now look back on more than 5 years of extensive, collaborative work. The projects that we have completed together have, in several instances, been groundbreaking and have delivered outcomes that now afford us a means of analysing and measuring the impact of our joint undertakings. We place great value upon the ability we have developed to do so,” explained Ms Stella Cox.

Through their strategic collaboration, Cambridge IFA and DDCAP will continue to shape and evolve the future of Islamic finance by nurturing a new generation of Islamic finance leaders, empowering women to lead in the field of Islamic business and finance and contributing to cutting-edge financial intelligence that is the tool for market leaders.

The renewal of the agreement, added DDCAP, will allow the two partners to continue their advocacy roles and further elevate the profile and understanding of Islamic finance globally. They will further capitalise on their strengths to promote and implement initiatives that will drive greater awareness, acceptance and adoption of Islamic finance principles and products on a global scale. Not surprisingly, to Cambridge IFA’s Professor Humayon Dar, “this collaboration is pivotal as we aim to empower more professionals through our advanced capacity-building and leadership programmes, strengthening our commitment to women empowerment and gender diversity, and disseminating authentic Islamic financial intelligence, thereby contributing to a resilient and dynamic Islamic financial ecosystem”.

Dubai-based Luxury Realty Developer DAMAC Successfully Issues Additional US$125mn Sukuk in the International Market in June 2024 to Consolidate with its US$475m Sukuk Issuance of October 2023

Dubai – DAMAC Real Estate Development Limited, one of the leading developers of high-end properties in the Middle East, successfully issued 3-year US$125mn additional Trust Certificates due 2027 on 27 June 2024.

The transaction, according DAMAC, will be consolidated and form a single series with the 3.5 Year US$475mn Senior Unsecured Reg Trust Certificates due 2027 issued by the company on 12 October 2023 through its special purpose vehicle, Alpha Star Holding VIII Limited, a DIFC incorporated special purpose vehicle wholly-owned by the Obligor, DAMAC.

The Sukuk is priced at the same profit rate of the October 2023 offering, 8.375% per annum, bringing the total outstanding amount to US$600mn. According to DAMAC, the transaction received strong support from the global investor community and saw significant demand, reflecting DAMAC’s robust credit fundamentals and the confidence regional investors have in the company following its recent reorganisation and the positive credit ratings actions it received in 2022/2023.

DAMAC is rated Ba2, with a stable outlook by Moody’s Investor Services and BB- with a positive outlook by S&P Ratings. Abu Dhabi Commercial Bank PJSC, Dubai Islamic Bank PJSC, Emirates NBD Bank PJSC, Mashreqbank PSC (acting through its Islamic banking division) and Standard Chartered Bank acted as global coordinators and joint lead managers for this transaction.

Saudi Banks Extend an Aggregate SR231.59mn (US$88.38mn) of Murabaha Financing for Ladun and Taiba Investment Companies

Jeddah – Saudi corporates continued to access the local banking sector in July 2024 for Murabaha financing to fund projects and for general working capital and balance sheet purposes. Two regular users of Islamic credit facilities, Ladun Investment Co. and Taiba Investments Co. raised an aggregate SR231.599mn (US$88.38mn) in two separate transactions in July 2024.

In the first transaction, Ladun Investment Co. renewed a SAR181.599mn (US$48.40mn) Murabaha facility extended by Riyad Bank on 22 July 2024. The drawdown of the facility has multiple tenors ranging from one to five years. In a filing to Tadawul (the Saudi Exchange), Ladun Investment Co stressed that the proceeds from the financing will be used to finance working capital and projects, and for the acquisition of land.

The financing is guaranteed through a pledge of acquired lands, assignment of projects’ proceeds, and promissory notes.

In the second transaction, Taiba Investments Company obtained a SAR150mn (US$39.98mn) Murabaha financing facility on 27 July 2024 from Bank Albilad, the proceeds of which will be used to finance the project that will be established in accordance with the partnership agreement signed with Smart Zone Real Estate Company (wholly owned by Saudi Telecom Company (STC) to develop and operate a hotel within the STC Square multi use complex project.

The facility has a tenor of 10 years with a grace period of 3 years and is guaranteed through a promissory note to the value of the financing facility.

Türkiye Treasury Continues Domestic Sovereign Lease Certificates Issuance Momentum Raising TRY12,000mn (US$353.9mn) in July 2024 as Total to Date in 2024 Reaches TRY49,248.9mn (US$1.5bn)

Ankara – Türkiye’s sovereign Sukuk issuance continued its momentum in July 2024 with two auctions as the Türkiye Treasury further consolidated its regular issuance of Sukuk Al-Ijarah in the domestic and Gold-linked markets on the back of improving macro-economic fundamentals.

Encouragingly, more recent public debt issuance including domestic fixed rate and CP Indexed lease certificates (Sukuk Al Ijarah), FX-linked lease certificates and Gold-linked lease certificates has settled down into a regular pattern as part of the country’s public debt fund raising strategy in addition to the Treasury’s regular forays into the US Dollar and Eurobond markets. The FX-linked certificates are primarily issued in the US Dollar and the Euro Fixed Rent Rate Lease Certificates (Sukuk Al-Ijarah) market.

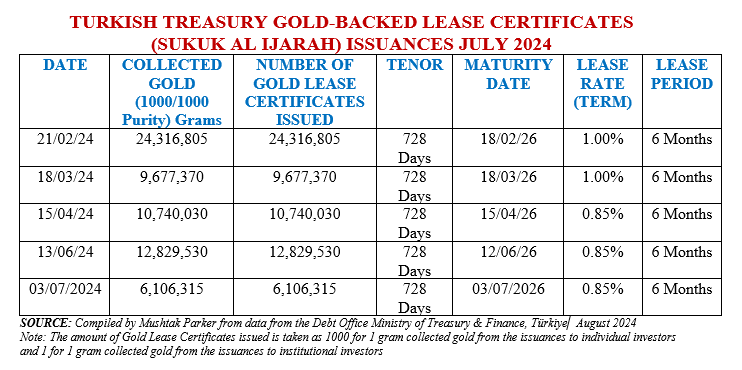

On 3 July 2024, the Treasury issued Gold-backed Lease Certificates (Sukuk Ijarah) with a tenor of 728 days maturing on 3 July 2026 priced at a Lease Rate of 0.85% payable over the 6 Month lease period. The amount of gold collected, according to the Treasury, amounted to 6,106,315 grams of gold (1000/1000 purity) from institutional investors for issuance of an aggregate 6,106,315 gold lease certificates (at a nominal value).

The amount of Gold Lease Certificates issued, according to the Treasury, is taken as 1,000 for 1 gram collected gold from the issuances to individual investors and 1 for 1 gram collected gold from the issuances to institutional investors.

This transaction was followed by a similar one on 13 June 2024 when the Treasury issued Gold-backed Lease Certificates (Sukuk Ijarah) with a tenor of 728 days maturing on 15 April 2026 priced at a Lease Rate of 0.85% payable over the 6 Month lease period. The amount of gold collected, according to the Treasury, amounted to 12,829,530 grams of gold (1000/1000 purity) from institutional investors for issuance of an aggregate 12,829,530 gold lease certificates (at a nominal value).

The direct sale auction of its latest Gold-backed Lease Certificates (Sukuk Ijarah) offering was conducted by the Central Bank of Türkiye via AS (Auction System under Central Bank Payment Systems).

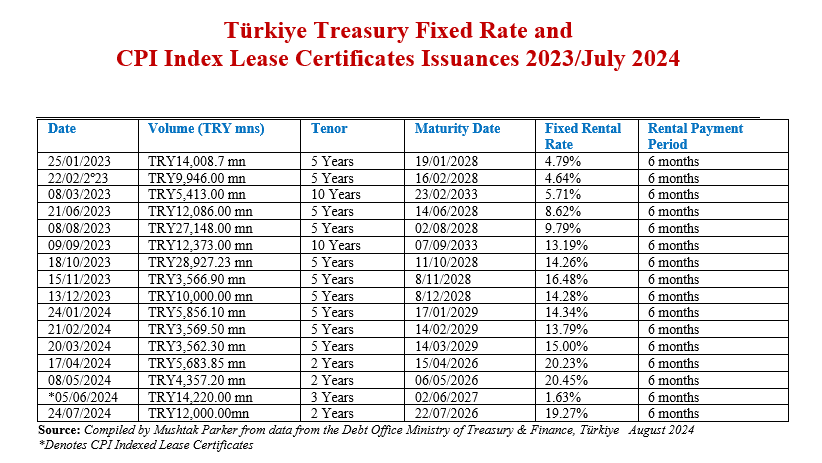

In the Fixed Rate Lease Certificate market, the Türkiye Treasury raised TRY12,000.00mn (US$353.91mn) in an auction on 24 July 2024 through the issuance 2-year Fixed Rate Lease Certificates (Sukuk al Ijarah) maturing on 22 July 2026 priced at a fixed profit rate of 19.27% over a 6-month rental period. The total bids for this issuance matched the allocated amount.

The Türkiye Treasury in fact raised TRY120,994.22 mn (US$4,174.22 mn) from the domestic market through the issuance of Fixed Rate Lease Certificate (Sukuk al Ijarah) in nine auctions in FY2023. The Türkiye Treasury in the first seven months of 2024 have issued consecutive monthly Sukuk Al Ijarah aggregating TRY49,248.95mn (US$1,452.46mn), suggesting that Sukuk Al Ijarah are now a fixed feature of the Treasury’s public debt fund raising strategy.

The Turkish Treasury is a proactive issuer of lease certificates as part of a wider universe of government fund-raising instruments which include bonds and Sukuk – leasing certificates and bonds, FX denominated issuances and gold-backed certificates/bonds. The usual mantra of the Turkish Treasury when announcing these auctions are “in order to increase the domestic savings, broaden the investor base and diversify the borrowing instruments, TRY denominated fixed rent rate lease certificates will be issue to the banks through direct sale method.”

All the lease certificates were issued by Hazine Mustesarligi Varlik Kiralama A.S., a special purpose vehicle owned by and on behalf of the Ministry of Treasury & Finance, the obligor. The Ministry of Treasury & Finance also issues these gold-backed lease certificates “to diversify borrowing instruments, broaden the investor base and bring the idle gold into the economy.”

According to Turkish Treasury “citizens are provided with a safe investment tool for gold savings. With the gold bond and gold-denominated lease certificate issuance through five banks, our citizens will win themselves and contribute to the economy.” Investors will be paid TL-denominated returns on a semi-annual basis indexed to the gold price. On maturity, according to the Treasury, investors may request the principal payment as 1 kilogram of gold bar (produced by refineries) or Republic Gold Quarter Coins printed by the Turkish State Mint.

GCC Poultry Giant Tanmiyah Food Raises SAR320mn (US$85.28mn) Through Two Murabaha Facilities from Regional Banks to Finance Working Capital of its Two Subsidiaries ADC and DVHS

Riyadh – Tanmiyah Food Co, the largest poultry company and food processor in the Gulf Cooperation Council (GCC) region, signed two Murabaha financing agreements with local banks totalling SAR320mn (US$85.28mn) on 5 August 2024.

The facilities were in favour of Tanmiyah’s Saudi subsidiaries, Agricultural Development Company (ADC) and Desert Hills Veterinary Services (DHVS). In a disclosure to Tadawul (the Saudi Stock Exchange), Tanmiyah disclosed that the facilities comprise a SAR200mn (US$53.30mn) Murabaha financing for DHVS and a SAR120mn (US$31.98mn) Murabaha facility for ADC

The SAR200mn facility for DHVS was provided by Alinma Bank, and the SAR120mn to ADC by National Bank of Kuwait. Bother financings have a tenor of 1 year. According to Tanmiyah, the proceeds from both facilities will be used to meet the two companies’ working capital requirements and to support their sustainable growth and development. The facilities are guaranteed by promissory notes and a corporate guarantee from Tanmiyah Food Co.

The company stressed that its operations are in alignment with the Saudi Vision 2030, and that the Saudi government policies are supportive of Tanmiyah’s growth and national objective of achieving greater poultry self-sufficiency and food security well-positioned to capitalize on large-scale initiatives, that are conducive to growth.

Tanmiyah in June announced that the Group’s revenues increased 24% in 1H24 to SAR1,221.2mn (US$325.43mn) compared to 1H23, in line with the continued growth across all product and service lines. The main driver for revenue growth was fresh poultry sales, which increased 18% to SAR971.4mn (US$258.87mn).

The Company’s net profit attributable to shareholders increased 39% to SAR45.0mn, compared to SAR32.4mn in 1H23, benefitting from enhanced operational performance during the period.

Albaraka Türk Launches Maiden US$1bn International Medium-Term Notes (MTN) Sukuk Programme as it Targets More Issuances Including Sustainable Sukuk and a Broader Investor Base

Istanbul – Albaraka Türk Katılım Bankası A.Ş, part of the Al Baraka Group headquartered in Bahrain and a pioneer of Islamic participation banking in Türkiye, established a Medium-Term Notes (MTN) Sukuk Programme with a nominal value of up to US$1 billion in early August 2024. This follows approval from Albaraka Türk’s general assembly and the Capital Market Authority of Türkiye.

This marks the first international public MTN Sukuk Programme by a participation bank in Türkiye. Hitherto, Albaraka Türk has issued two Sukuk in the international market to institutional investors in 2015 (US$250mn – with a coupon rate of 9.371% p.a.) and in 2018 (US$205mn – with a coupon rate 10% p.a.), and a series of domestic public Sukuk Al Ijara (lease certificates) issuances.

The MTN programme, stressed the Bank, will enable it to issue Sukuk in multiple currencies and tenors, including sustainable Sukuk issuances. The programme, which is also listed on the International Securities Market (ISM), will allow the bank to raise funds in international markets to cover general financing requirements and broaden its investor base and funding sources.

The programme also incorporates flexible product features and offering mechanisms that allow for both public issuances and private placements. This flexibility will increase its appeal to investors with different investment horizons and requirements. Fitch Ratings has assigned Albaraka Türk Katılım Bankası A.Ş.’s US$1 billion Sukuk Issuance Programme a long-term rating of ‘B-’ and a short-term rating of ‘B’.

Meanwhile, Albaraka Türk, the very first Islamic bank to be established in Türkiye in 1984 as a Special Finance House, has pioneered Digital Letters of Guarantees which enables their customers “to make their Public Procurement Tender Guarantee and Public Housing Development Administration Procurement Tender Guarantee applications via corporate internet banking.” The Bank started on the Digital Letter of Guarantee (DLG) initiative in September 2023 although it took months for the product and service to take off in scale.

According to the Bank, the DLG introduced as Jet Letter of Guarantee speeds up the procedures and saves time, thus providing convenience and a seamless user-friendly experience to Albaraka Türk customers saving paper, and in the Letter of Guarantees procedures.

According to Albaraka Türk Deputy General Director, Serhan Akyıldız, “while the world is getting increasingly digitalized daily, we strive to continuously integrate the conveniences of digital environment in our services. In this context, with our new Jet Letter of Guarantee, we bring this process, from application to dispatch to the addressee, to digital environment, offering a user-friendly experience. Initially, we only accept TRY applications for Public Procurement Tender Guarantee and Public Housing Development Administration Procurement Tender Guarantee; however, we plan to extend this project to other documents and service in the upcoming months.”

IILM Successfully Closes its Eighth Auction in 2024 with a US$1.26bn Three Tranche Re/issuance of Short-Term A-1 Rated Sukuk in August Attracting New Investors from Qatar, Oman, Malaysia and Singapore

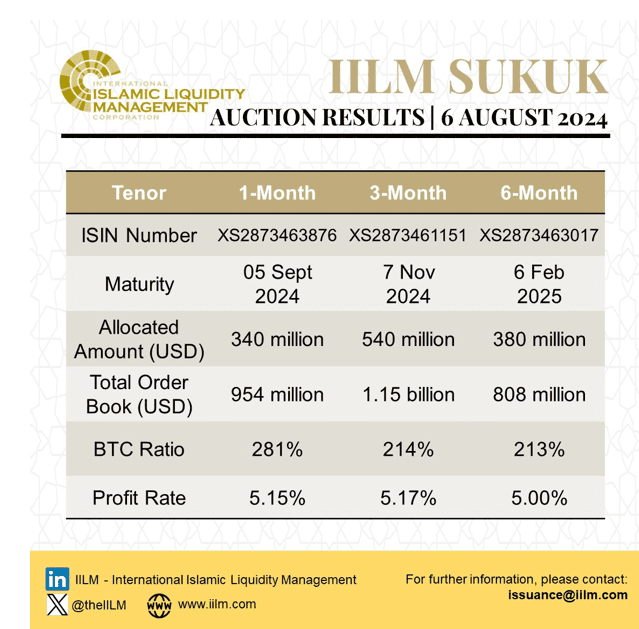

Kuala Lumpur – The International Islamic Liquidity Management Corporation (IILM), the multilateral international industry organisation that develops and issues short-term Sharia’a-compliant liquidity management instruments, successfully reissued its eighth transaction of the year with the reissuance of an aggregate US$1.26bn of 1-3-6 month Sukuk on 6 August 2024.

This follows a similar transaction totalling US$940mn of short-term Ṣukuk across the same three tenors on 9 July 2024. The August auction, according to the IILM, also witnessed the first-time participation of new investors from across the GCC and Asia, namely an Oman-based bank, a Qatari bank, and asset managers from Singapore and Malaysia respectively. The increased participation by investors, said Mr. Mohamad Safri Shahul Hamid, Chief Executive Officer of the IILM, “demonstrates the safe haven status of the IILM Ṣukūk in a highly volatile market environment.”

This latest Ṣukūk reissuance witnessed a competitive tender among Primary Dealers and investors from markets across the GCC, Europe, Asia, as well as Africa. The three series reissued on 6 August 2024 were priced competitively at:

i) 5.15% for the US$340mn Sukuk with a 1-month tenor.

ii) 5.17% for US$540mn Sukuk with a 3-month tenor.

iii) 5.00% for US$380mn Sukuk with a 6-month tenor.

“The combined orderbook in excess of US$2.91bn,” explained Mr. Mohamad Safri Shahul Hamid, CEO of IILM, “represents an average bid-to-cover ratio of 231%, which is also the largest orderbook year-to-date. The profit rates for both the 1-month and 3-month tenors came up tighter than the IILM’s indicative pricing guidance, while the profit rate for the 6-month tenor fell within the pricing guidance range.”

With this latest reissuance, the IILM has achieved year-to-date cumulative issuances totalling US$7.89bn through 24 Sukuk series. The Sukuk offering was completed under the IILM’s US$4bn short-term Sukuk Issuance Programme rated “A-1” (S&P) and “F1” (Fitch Ratings). The IILM is a regular issuer of short-term Sukuk across varying tenors and amounts to cater to the liquidity needs of institutions offering Islamic financial services. The total amount of IILM Sukuk outstanding is now US$3.51 bn. The IILM, added Mr Mohammed Safri, will continue to reissue its short-term liquidity instruments monthly as scheduled in its issuance calendar.

The IILM’s short-term Sukuk is distributed by a diversified network of 11 primary dealers globally, namely Abu Dhabi Islamic Bank, Al Baraka Turk, Boubyan Bank, CIMB Islamic Bank, Dukhan Bank, First Abu Dhabi Bank, Kuwait Finance House, Maybank Islamic, Qatar Islamic Bank, Affin Islamic Bank, and Standard Chartered Bank. The current members of the IILM Board are the central banks of Indonesia, Kuwait, Malaysia, Mauritius, Nigeria, Qatar, Türkiye, the United Arab Emirates, as well as the multilateral Islamic Corporation for the Development of the Private Sector, the private sector funding arm of the Islamic Development Bank Group.

Malaysia’s Mortgage Securitiser Cagamas Berhad Ups Sustainability Sukuk Issuance with RM440mn (US$98.87mn) of Hybrid Sukuk and Bond Issuances in July 2024 Including a Debut Social Repo Issuance

Kuala Lumpur – Cagamas Berhad, the National Mortgage Corporation of Malaysia, one of the most prolific issuers of mortgage finance-related Sukuk, successfully completed a number of hybrid conventional/Islamic transactions on 30 July 2024 comprising its first RM50mn (US$11.23mn) 3-month Social Repurchase Agreement (Social Repo) with a local financial institution, the issuance of a RM100mn (US$ 22.47mn) 2-year ASEAN Sustainability Bond, and RM290mn (US$65.16mn) of 3-month and 6-month Islamic Commercial Papers (ICPs) with ASEAN Social SRI Sukuk status, underscoring its stated commitment to sustainable financing and supporting industry-led sustainability initiatives.

The Social Repo, according to Cagamas, is a bespoke arrangement for the Company whereby proceeds raised from the transaction will be used to purchase Small Medium Enterprises (SME) loans which qualifies as eligible assets under the Cagamas Sustainability Bond/ Sukuk Framework.

“The transaction,” explained Kameel Abdul Halim, President/Chief Executive Officer of Cagamas, “represents another step forward in the Company’s efforts to anchor industry-led sustainability initiatives within the financial sector. A Social Repo provides the financial markets with a viable funding instrument alternative aligned with their sustainability goals. This alternative broadens the Company’s sustainability liquidity sources for the financial sector. These transactions underscore our on-going efforts to foster a sustainable and inclusive financial ecosystem. The Social Repo for SMEs which is a first of its kind for Cagamas, and the ASEAN Social SRI Sukuk for affordable housing are critical steps in our journey to drive meaningful social change through innovative financial solutions.”

The RM145 million each 3-month and 6-month ASEAN Social SRI Sukuk was the Company’s first short-term Islamic debt securities offering that carries the “social” label, encompassing Cagamas’ commitment to providing socially responsible investment opportunities. Cagamas had previously issued social Sukuk of more than one year under its Islamic Medium Term Note programme. Proceeds from the issuances will be used to fund the purchase of affordable housing financing from the financial system.

“Cagamas remains committed to advancing and leveraging financial instruments to promote sustainable and affordable housing financing. These transactions mark significant milestones in our broader strategy to integrate sustainability into our core business offerings,” added Mr Kameel Abdul Halim.

To date in 2024, the Company has raised RM10bn (US$2.25bn) through the issuance of bonds and Sukuk and other funding sources. The papers will be redeemed at their full nominal value upon maturity, are unsecured obligations of the Company, ranking pari passu with all other existing unsecured obligations of the Company.

Cagamas plays a major role in Sukuk origination and continues to be an innovator in the mortgage finance and securitisation market. The Cagamas papers are listed and traded under the Scripless Securities Trading System of Bursa Malaysia. Cagamas’ corporate bonds and Sukuk continue to be assigned the highest ratings of AAA and P1 by RAM Rating Services Berhad and AAA/AAAIS and MARC-1/MARC-1IS by Malaysian Rating Corporation Berhad, denoting its strong credit quality. Cagamas is also well regarded internationally and has been assigned local and foreign currency long-term issuer ratings of A3 by Moody’s Investors Service Inc. that are in line with Malaysian sovereign ratings.

The Cagamas model is well regarded by the World Bank as the most successful secondary mortgage liquidity facility. Cagamas is the second largest issuer of debt instruments after the Government of Malaysia and the largest issuer of AAA corporate bonds and Sukuk in the market. Since incorporation in 1986, Cagamas has cumulatively issued circa RM431.91 billion (US$90.01 billion) worth of corporate bonds and Sukuk.