Kuwait’s Warba Bank Successfully Closed its Debut US$500mn Sustainability Sukuk Wakalah/Murabaha in July 2024 – the First Sustainable Sukuk to be Offered Out of Kuwait.

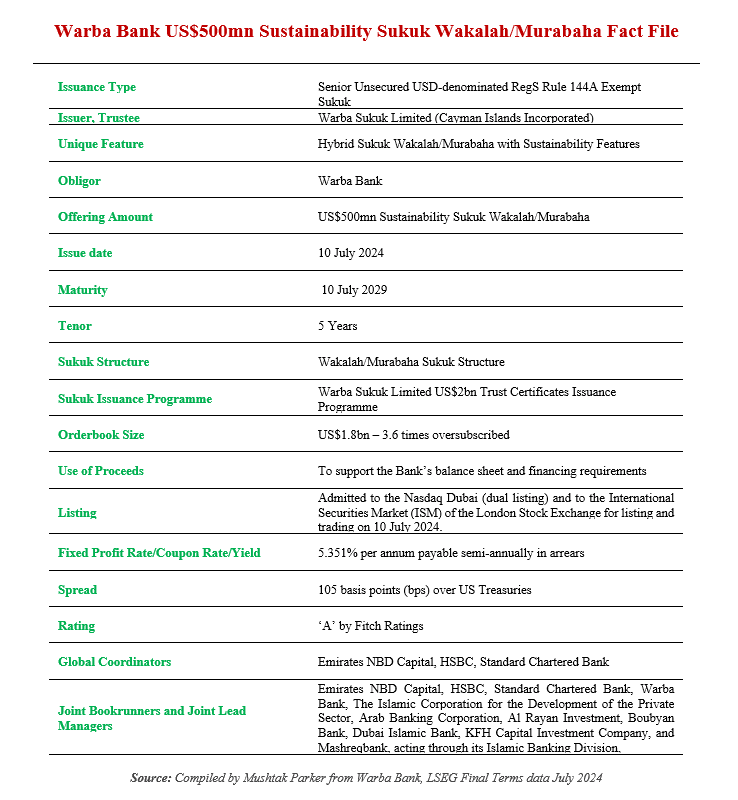

Kuwait’s Warba Bank closed its latest offering in the international capital market with a 5-Year Fixed Rate US$500mn Senior Unsecured RegS Sustainability Sukuk Wakalah/Murabaha on 10 July 2024, maturing on 10 July 2029. According to the Bank, this issuance is the first Sustainable Sukuk to be offered out of Kuwait.

The Sukuk certificates were issued by Warba Sukuk Limited as Trustee, on behalf of the Obligor, Warba Bank. This latest transaction was completed under the Bank’s US$2.0bn Trust Certificate Issuance Programme, which was updated on 24 June 2024 following approval from the Central Bank of Kuwait. This is Warba Bank’s second issuance under the current Programme.

Warba Bank mandated Emirates NBD Capital, HSBC and Standard Chartered Bank to act as joint global coordinators to the transaction, and together with Warba Bank, The Islamic Corporation for the Development of the Private Sector, the private sector funding arm of the Islamic Development Bank (IsDB), Arab Banking Corporation, Al Rayan Investment, Boubyan Bank, Dubai Islamic Bank, KFH Capital Investment Company, and Mashreqbank, acting through its Islamic Banking Division, to act as Lead Managers and Bookrunners to the transaction, and to arrange a series of investor calls and meetings in London, Europe, the Middle East, Asia and with Offshore US Accounts.

The issuance, which was based under a hybrid Wakalah/Murabaha structure, for the 5-Year certificates was launched following final approval from the Central Bank of Kuwait and attracted strong demand from regional and international investors, which Warba Banks says reflected the positive response by investors to the Bank’s financial soundness and performance.

The Bank had set the initial price guidance at around 140 basis points (bps) over US Treasuries. Due to the robust demand with the order book peaking at US$1.8bn – 3.6 times oversubscribed – the indicative price for the 5-Year trust certificates was tightened to a final spread of 105bps basis over U.S. Treasuries.

The transaction was finally priced on 3 July 2024 at a profit rate/yield of 5.351% per annum payable semi-annually in arrears. The trust asset pool, according to the Base Prospectus, comprised 58.71% Wakalah assets and 41.29% Murabaha intangible assets. Warba Bank rated ‘A’ with a Stable Outlook by Fitch Ratings, and ‘Baa2’ with a Positive Outlook by Moody’s Investor Service, according to a disclosure to Boursa Kuwait had the option to issue a US$750mn transaction.

According to the Bank, this latest Sukuk issuance is a major boost to its sustainability practices and framework, and significantly strengthens its financial position. It also reflects the strength of the Bank’s credit position and confirms its commitment to achieving remunerative and sustainable returns for investors.

Mr. Shaheen Hamad Al-Ghanem, CEO of Warba Bank, explained that “issuing these Sukuk represents an important strategic step in strengthening our financial framework. It is in line with our strategic initiatives to enhance financial flexibility and supports our ongoing efforts to improve the liquidity structure and enhance our ability to confront financial challenges. This issuance also reflects the great confidence placed by investors in our ability to fulfil our financial obligations, which enhances the strength of our financial position and confirms our leadership in good governance practices. This is the first sustainable Sukuk to be issued in Kuwait.”

The proceeds from the Sukuk issuance, according to the Bank, will be used to finance or refinance projects that are consistent with Warba Bank’s sustainability framework, which includes initiatives focused on renewable energy, sustainable water management, and community development projects that meet standards supporting environmental, social and institutional governance.

This issuance also supports Basel III liquidity requirements, which enhances the Bank’s liquidity flexibility, makes it stronger and more efficient in meeting the needs of our clients and enhancing our ability to grow sustainably.