MENA Investors Dominate Subscription to Sovereign Indonesia’s Latest 3-Tranche US$2.35bn Global/Green Sukuk Wakalah Offering

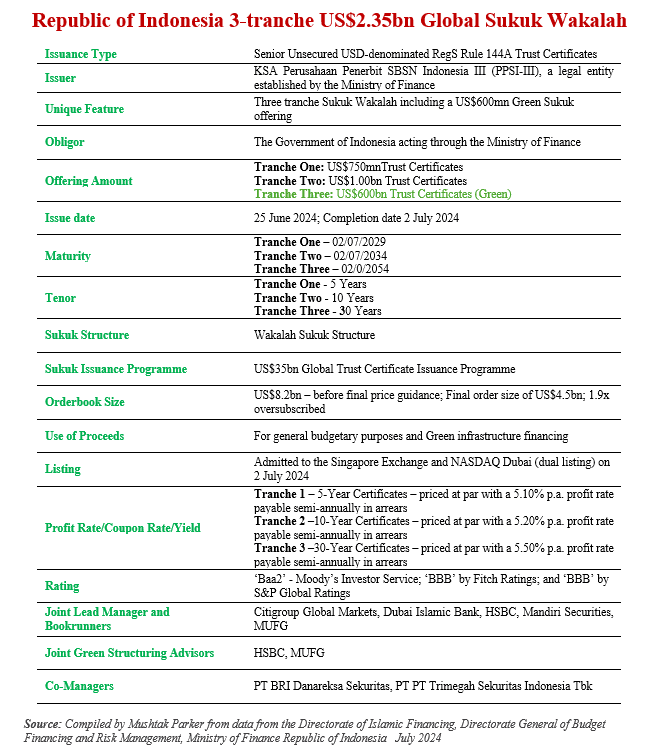

The Government of Indonesia, a proactive issuer of Green Sukuk offerings, returned to the international market in early July 2024 with a three-tranche aggregate US$2.35bn Sukuk issuance.

According to the Directorate of Islamic Financing at the Directorate General of Budget Financing and Risk Management, Indonesian Ministry of Finance, the issuance comprised a US$750mn 5-year tranche maturing on 2 July 2029, a US$1.0bn 10-year year tranche maturing on 2 July 2034, and a 30-year US$600mn (Green) Reg S/144A tranche due on 2 July 2054.

“As evidence of the Republic’s dedication and long-term commitment to green and sustainable financing, and as part of its effort in combating climate change, the 30-year tranche was a Green issuance series, backed by the Republic’s significant pool of green assets,” said the Ministry of Finance.

The Wakalah Sukuk transaction was issued through Perusahaan Penerbit SBSN Indonesia III (PPSI-III), a legal entity established by the Ministry of Finance on behalf of the Obligor, the Republic of Indonesia, solely for the purpose of issuing Sharia’a compliant securities in foreign currencies in the international markets.

The Indonesian Ministry of Finance mandated Citigroup Global Markets, Dubai Islamic Bank, HSBC, Mandiri Securities, and MUFG Chartered to act as Joint Lead Managers and Joint Bookrunners to the transaction, and to arrange a series of investors meetings and calls in several international markets in the UK, Europe, the Middle East, Asia and with Offshore US Accounts. HSBC and MUFG also acted as Joint Green Structuring Advisors. The local PT Danareksa Sekuritas and PT PT Trimegah Sekuritas Indonesia Tbk acted as Co-Managers for the transaction.

This latest Sukuk Wakalah issuance is pursuant to the updated US$35 billion Trust Certificate Issuance Programme updated by Indonesia in 2023 through PPSI-III. This is the fourteenth US dollar-denominated Sukuk issuance by Indonesia to date. The Wakalah Sukuk certificates were subsequently priced at par and with a profit rate of 5.1% per annum payable semi-annually in arrears for the 5-year tranche, 5.2% per annum payable semi-annually in arrears for the 10-year tranche, and 5.5% per annum payable semi-annually in arrears for the 30-year tranche.

The transaction attracted robust demand, with the order book attracting US$8.2bn before the final price guidance, before settling to a final aggregate order size of US$4.5bn – an oversubscription of more than 1.9x of the issuance. Amidst challenging market conditions, the transaction attracted interest from a diverse investor base and geography “showcasing strong investment appetite for Indonesia given the Republic’s strong following and economic fundamentals.”

According to the Directorate General, the 5-year tranche was distributed 15% to Asia ex Indonesia and Malaysia investors, 50% to Middle East and Malaysia, 10% to Indonesia, 16% to U.S and 9% to Europe. By investor type, the tranche was allocated 32% to asset managers/fund managers, 41% to financial institutions/banks, 23% to central banks, 3% to insurance/pension funds and 1% to private banks.

The 10-year tranche was distributed 11% to Asia ex Indonesia and Malaysia investors, 58% to Middle East and Malaysia, 11% to Indonesia, 8% to U.S and 12% to Europe. By investor type, the tranche was allocated 27% to asset managers/fund managers, 62% to financial institutions/banks, 1% to insurance/pension funds, 9% to central banks and 1% to private banks.

The 30-year tranche was distributed 34% to Asia ex Indonesia and Malaysia investors, 9% to Middle East and Malaysia, 1% to Indonesia, 27% to U.S and 29% to Europe. By investor type, the tranche was allocated 53% to asset managers/fund managers, 6% to financial institutions/banks, 33% to insurance/pension funds, 6% to central banks and 2% to private banks.

The proceeds from the Green Sukuk according to the Directorate General “will be used to finance or refinance expenditure directly related to general National Budgetary needs and those of the Green Sukuk to finance ‘eligible Green Projects’ as defined in Indonesia’s Green Bond & Green Sukuk Framework.” The transaction is aligned with the Republic’s strategy to finance the 2024 state budget, as well as its commitment to develop and improve the liquidity of the Sukuk market in the region and to consolidate Indonesia’s green finance agenda.

The Sukuk are structured based on the Sharia’a principle of Wakalah and has obtained Sharia’a opinion from DSN MUI as well as from the Sharia’a Advisory Board of Citi Islamic Investment Bank, the Internal Sharia’a Supervisory Committee (ISSC) of Dubai Islamic Bank, the HSBC Global Sharia’a Supervisory Committee, the Sharia’a Advisor of PT Mandiri Sekuritas and the Sharia’a Committee of MUFG Bank (Malaysia) Berhad.

The underlying Sukuk Wakala assets, confirmed the Directorate General in a statement, comprise a pool of state-owned assets including land and buildings (accounting for 51 per cent of the asset pool) and project assets that are under construction or to be constructed (accounting for the remaining 49 per cent of the asset pool).

The Wakalah Sukuk certificates are listed on the Singapore Stock Exchange and NASDAQ Dubai (dual listing). Each tranche has been assigned a rating of ‘Baa2’ by Moody’s Investor Service, ‘BBB’ by S&P Global Ratings and by Fitch Ratings.

Indonesia is the world’s most proactive issuer of Green Sukuk totalling US$5.6bn through six issuances between 2018-2024. In addition to this latest US$600mn Green Sukuk in July 2024, it issued a US$1.5bn 10-year year (Green) Reg S/144A Trust Certificate tranche due in June 2032 as part of an US$3.25bn Sukuk offering in 2022.

This was preceded by a 30-year US$750mn Green Sukuk as part of a US$3bn transaction in 2021; a 5-year US$750mn Green Sukuk Wakalah in June 2020 as part of a US$2.5bn three-tranche transaction; a 5.5 year US$750mn Green Sukuk Wakala in February 2019 as part of an US$2bn transaction; and a 5-year US$1.25bn Reg S/144A Green Sukuk Wakalah in February 2018, which was part of a two-tranche US$3bn transaction. The Government also launched a retail Green Sukuk at the end of 2019.

Nasdaq Dubai welcomed the three-tranche Sukuk issue. The listing of these Sukuk, said the Bourse, “solidifies the Republic of Indonesia’s position as one of the leading Sukuk issuers on Nasdaq Dubai, with a total of 20 listings amounting to US$24.1bn. These new listings reinforce Dubai’s stature as the world’s leading centre for Sukuk listings, with a total value of US$96.39 billion, while further strengthening the close ties between Dubai and Indonesia.”

The total value of debt listed on Nasdaq Dubai amounts to US$134.1bn, with Sukuk totalling US$93.89bn. Nasdaq Dubai continues to also lead on the ESG related listings with green issuances totalling US$19.7 billion of the US$29.75bn ESG related issuances.