Emirates Islamic Returns to International Sukuk Market in May 2024 with Maiden 5-Year US$750mn Sustainability Sukuk as Momentum of Such Offerings Gathers Pace

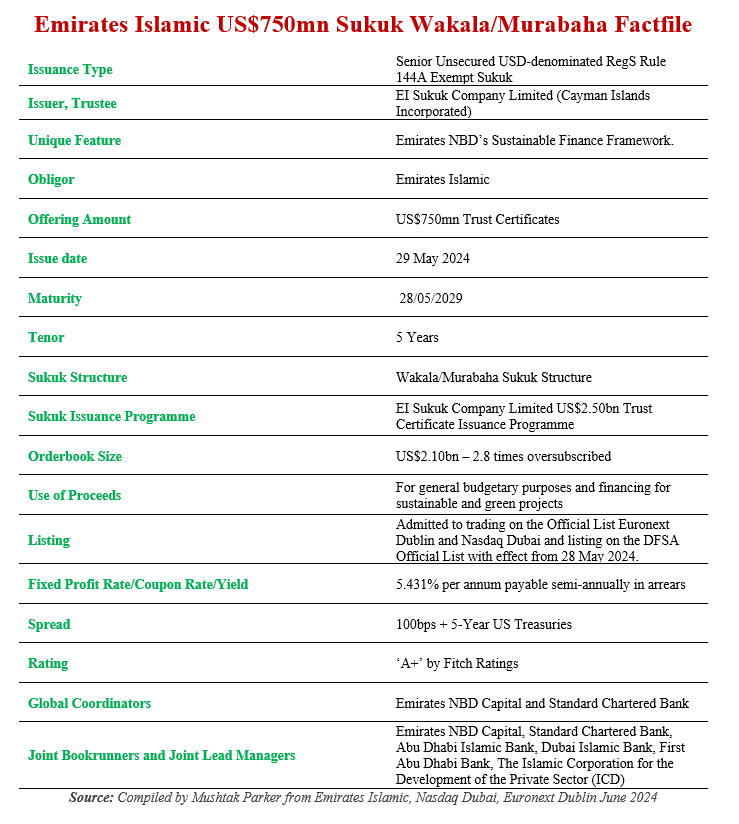

Emirates Islamic, one of the leading Islamic financial institutions in the UAE and the Islamic banking subsidiary of the Emirates NBD Group, successfully priced its latest Sukuk offering on 21 May 2024 – a 5-Year benchmark maiden US$750mn RegS Senior Unsecured Sustainability Sukuk.

Sustainability Sukuk issuances, together with Green, ESG and SRI Sukuk, are gaining momentum in the Islamic capital and debt markets as governments start pushing green economy and finance agendas in line with their Net Zero ambitions under the 2015 Paris Climate Agreement and in pursuit of the UN SDG targets. These have been driven by issuers such as Malaysia and Indonesia at the sovereign level, Islamic Development Bank (IsDB), Dubai Islamic Bank, AlRajhi Bank, SEC, and a host of corporates and other issuers. The Emirates Islamic issuance is also in line with the UAE Government and Emirates NBD’s Sustainable Finance Framework.

In April 2024, the International Capital Market Association (ICMA), the IsDB and the London Stock Exchange Group (LSEG) issued a landmark “Guidance on Green, Social and Sustainability Sukuk,” and according to Emirates Islamic this offering is the first Sustainability Sukuk issued out of the UAE under the above Guidelines. The Emirates NBD Group participated as a member of the Working Group that contributed to the development of the ICMA/IsDB/LSEG Green, Social and Sustainability Sukuk Guidance Framework.

The Sukuk certificates, in alignment with the Programme, are rated ‘A+ by Fitch Ratings, were issued on 28 May 2024 by EI Sukuk Company Limited, incorporated in the Cayman Islands, as Trustee on behalf of the Obligor and Service Agent, Emirates Islamic Bank, under the Company’s US$2.50bn Certificate Issuance Programme. The 5-Year certificates have a maturity date of 28 May 2029. The Sukuk has a Wakala/Murabaha structure, with the asset pool comprising 82.67% of tangible and 17.33% of intangible assets.

Emirates Islamic mandated Emirates NBD Capital and Standard Chartered Bank on 20 May 2024 to act as Joint Global Coordinators of the transaction, and along with Abu Dhabi Islamic Bank, Dubai Islamic Bank, First Abu Dhabi Bank and The Islamic Corporation for the Development of the Private Sector (ICD), the private sector funding arm of the IsDB Group, as Joint Lead Managers and Bookrunners to the transaction. Emirates NBD Capital acted as sole Sustainability Structuring Agent. Emirates Islamic Bank set the initial price guidance for the 5-Year Sukuk transaction at 130 basis points (bps) over US Treasuries. Due to the robust demand from investors across different regions, with 44% of orders coming from outside of MENA region, the order book exceeded US$2.10bn resulting in an oversubscription of 2.8 times. This allowed the Bank to tighten the expected profit rate to 5.431% per annum payable semi-annually in arrears on each Periodic Distribution Date and at a spread of 100bps over 5-Year US Treasuries.

Farid Al Mulla, Chief Executive Officer of Emirates Islamic, emphasised that the Bank “is committed to reducing its environmental impact, in line with the UAE Net Zero by 2050. As one of the leading Shariah compliant banks in the UAE, Emirates Islamic remains committed to addressing climate change by offering customers sustainable Islamic solutions that prioritise the environment and support a low-carbon economy.

“We remain committed to promoting sustainable Islamic finance and supporting and guiding our clients in making sustainable financial decisions, reinforcing our dedication to building a more sustainable future. The bank has always embraced sustainability as a core strategic pillar. The announcement also contributes to the Emirates NBD Group-wide sustainability efforts as a signatory of the UAE Banking Federation pledge to mobilise AED1 trillion in sustainable finance by 2030.”

The proceeds from the issue, according to the base prospectus, will be used to purchase Commodities and on-sell such Commodities to the Obligor for the Deferred Sale Price pursuant to a Murabaha Contract; to purchase from the Obligor the Initial Wakala Assets; and by the Obligor for its general corporate purposes including for its general financing and refinancing requirements for its Islamic finance business. In respect of each issue of Certificates identified as ESG Certificates, Emirates Islamic intends to allocate an amount at least equal to the amounts received by the Obligor in accordance with Emirates NBD’s sustainable finance framework for credit facilities and projects.

The Sukuk certificates were admitted to trading on the Regulated Market of Euronext Dublin and Nasdaq Dubai and, listing on the Official List of Euronext Dublin and the DFSA Official List with effect from 28 May 2024.

At the bell ringing ceremony at Nasdaq Dubai, Hesham Abdulla Al Qassim, Chairman, Emirates Islamic and Vice Chairman and Managing Director of Emirates NBD, commented: “The listing of our first Sustainability Sukuk on Nasdaq Dubai represents our dedication to be the pioneering Shariah-compliant bank for customers, people, and communities, as well as our continuing commitment to fostering sustainability. Emirates Islamic is committed to reducing its environmental impact, in line with the UAE Net Zero by 2050.” With this latest admission, the total value of Sukuk listings by Emirates Islamic on the exchange reached US$2.02bn through four listings.

Nasdaq Dubai is a leading Sukuk listing bourse, with an outstanding value of US$93bn in Sukuk issuances. Following this latest Emirates Islamic offering, some 44% of the listings on the bourse by value are from UAE issuers, while 56% are from overseas issuers. The exchange, according to Hamed Ali, CEO of Nasdaq Dubai and DFM, continues to solidify its status “as the premier platform regionally and globally for both fixed income and ESG-related listings. It holds an outstanding total value of US$129bn in listed fixed income and US$29bn in ESG listings, of which sustainability issuances account for US$9.5bn.”