Robust Demand for Saudi Arabia’s A-Rated US$5bn Sovereign Sukuk Underlines Kingdom’s Pre-eminence as a Public Debt Sukuk Issuer

The National Debt Management Centre (NDMC) of the Saudi Ministry of Finance successfully completed its latest foray into the international Sukuk market with a US$5 billion fixed rate Sukuk Murabaha/Mudaraba offering on 29 May 2024 – a year after its last US dollar-denominated Sukuk issuance of US$6 billion in May 2023.

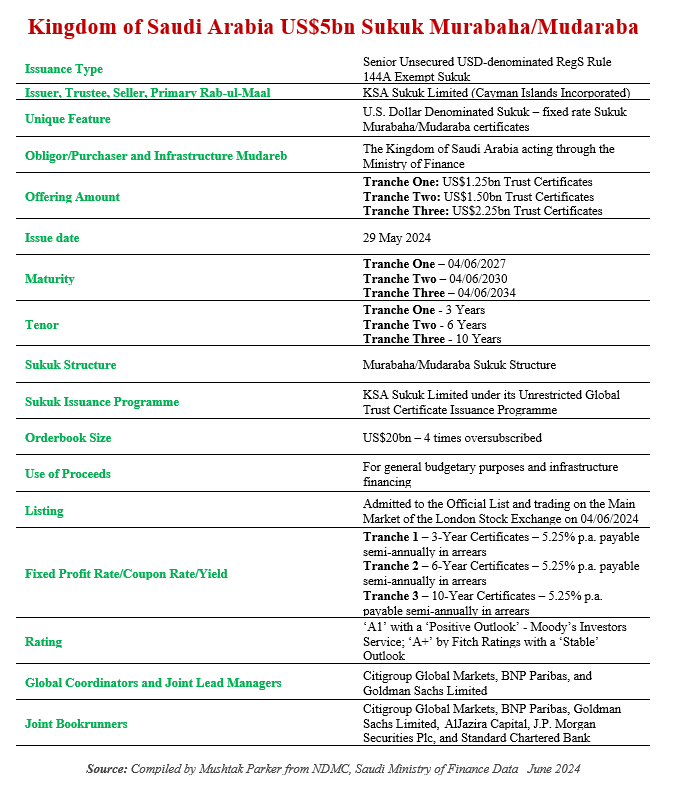

The Sukuk certificates were issued by Cayman Islands incorporated KSA Sukuk Limited, which also acted as Trustee, Seller and the Primary Rab-ul-Maal, on behalf of the Obligor, the Kingdom of Saudi Arabia acting through the Ministry of Finance.

The transaction was issued under the Kingdom’s Unrestricted Global Trust Certificate Issuance Programme and comprised three tranches with different tenors – a 3-year US$1.25 billion tranche maturing in June 2027, a 6-year US$1.5 billion tranche maturing in June 2030, and a 10-year US$2.25 billion tranche maturing in June 2034 – all priced at a coupon rate of 5.25% per annum payable semi-annually in arrears.

According to NDMC, the transaction attracted robust demand from local, regional, and international investors and was oversubscribed four times with the orderbook reaching more than US$20 billion.

“The bid-to-cover ratio reflects the strong demand of the Kingdom’s issuances, confirming the international investors’ confidence in the strength of the Kingdom’s economy and its investment opportunities future. That was shown in this issuance that oversubscribed with demand from a wide array of international investors and was allocated to a global mix of asset managers and financial institutions,” said the NDMC.

This latest transaction, added the NDMC, represents Saudi Arabia’s first triple tranche sovereign Sukuk issuance that is a part of the Centre’s strategy to diversify the Kingdom’s funding sources and expand the investor base to meet the country’s financing needs from the international debt capital markets efficiently and effectively, to ensure the Kingdom’s continuous presence in debt markets and manage the debt repayments for the coming years while taking into account market movements and the government debt portfolio risk management.

The NDMC had mandated Citigroup Global Markets, BNP Paribas, and Goldman Sachs Limited in early May 2024 to act as global coordinators for the issuance and to arrange a series of investor roadshows and calls with investors in the UF, Europe, the MENAT region, Asia and with Offshore US accounts.

They were joined by AlJazira Capital, J.P. Morgan Securities Plc, and Standard Chartered Bank as lead managers and bookrunners to the transaction.

According to the Base Prospectus supplemented in May 2024, the proceeds from each issuance of Trust Certificates “will be used by the Trustee to enter Murabaha Transactions with the Kingdom and the Primary Mudaraba with the Onshore Investment Vehicle. The Kingdom will sell the commodities purchased pursuant to the Murabaha Transactions to a Third Party broker and will use the proceeds from the sale for its general domestic budgetary purposes. The Kingdom will utilise the proportion of the proceeds provided as the Infrastructure Investment Amount to finance infrastructure projects in the Kingdom.” The Sukuk certificates were admitted to the Official List and trading on the Main Market of the London Stock Exchange on 4 June 2024.

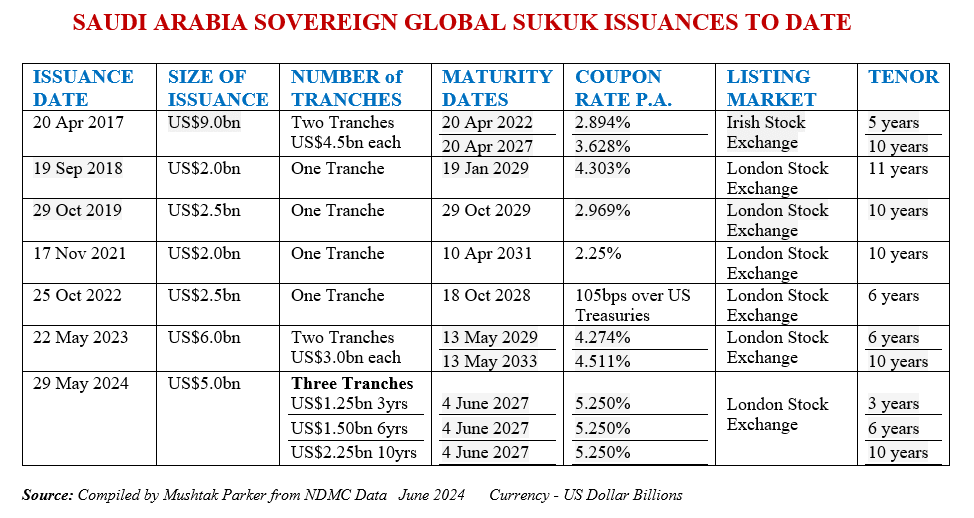

This is the Ministry of Finance’s seventh offering in the international market – all US dollar issuances – since the inaugural US$9 billion issuance in April 2017.

The aggregate amount raised by the Ministry of Finance in the international market through seven Sukuk issuances has reached US$29 billion. These were annual issuances between 2017 and 2024 except in 2020 at the onset of the Covid-19 pandemic

This latest transaction is part of NDMC’s strategy to diversify the Kingdom’s funding sources and expand the investor base, in accordance with the approved Annual Borrowing Plan, considering additional funding activities subject to market conditions and through available funding channels locally or internationally.

According to the NDMC, the Kingdom’s Sukuk issuance strategy centres around the Saudi Government SAR Sukuk Programme and foreign currency Sukuk issuances, as well as conventional bond offerings in the international market. This year’s plan will continue to be “through diversified funding sources which include domestic and international Sukuk and bond issuances as well as new financing channels, including Government Alternative Financing, [and] Supply Chain Financing, in addition to unifying the domestic Sukuk issuance programmes.”

Saudi sovereign Sukuk issuance is driven by the robust market demand for such Sukuk certificates in a global market starved of highly rated papers. The NDMC’s role is to secure Saudi Arabia’s debt financing needs with the most competitive financing costs. Saudi Arabia is ahead in tapping the domestic sovereign Sukuk market because it also has an established issuance infrastructure complete with a government policy framework under its ‘Fiscal Balance Programme and Financial Sector Development Programme’, whose objectives are to add to a diversified public debt fund raising strategy and to the development of the Saudi Sukuk and Islamic Capital Market.

The proceeds from Saudi sovereign issuances are primarily used to fund budget shortfalls; pre-funding for refinancing and Sukuk redemptions; developing a secondary market for trading on Tadawul (the Saudi Stock Exchange); promoting the development of a thriving Islamic debt capital market and for various policy reasons.