IsDB Governors Target Greater Role in Sukuk Market and Deepening Islamic Capital Markets, Increased Concessional Funding, Greater International Partnerships and Intra-OIC Trade in the Next 50 Years

As far as the key enablers for the next 50 years of the Islamic Development Bank (IsDB) are concerned, the stated ambitions of the Riyadh Declaration adopted on 2 May 2024 are spot on.

The Board of Governors of the 57-member states of the multilateral development bank (MDB) of the OIC countries, attending the Golden Jubilee 50th Anniversary celebrations in the Saudi capital of a supranational that has matured arguably into the second most important MDB amongst its peers in terms of capital and funding operations with sustainable and people-centered development as its core ethos, must be marveling at the success of an institution whose organizational gestation is nascent.

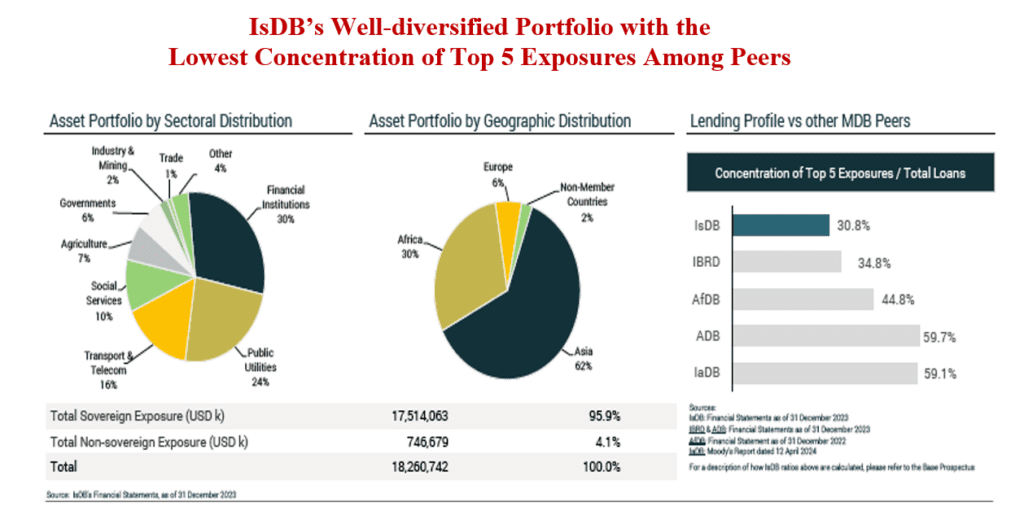

The fact that since inception the IsDB’s total approvals has exceeded US$182 bn, geared to the financing of more than 12,000 development projects, and its current subscribed share capital is US$74.1 bn and total assets just under US$40 bn, is a compelling story of institutional capacity building and performance delivery, given the fact that the institution literally had to start from scratch and was presenting to the world an alternative faith-based development finance model diametrically opposed to the prevailing interest-based financial orthodoxy.

According to IsDB Chairman, Dr Muhammad Al Jasser, over the past five decades, the IsDB has served as a major force for progress, financing critical development projects valued at over US$182 bn.

These projects spanned essential sectors like basic infrastructure and agriculture, alongside strategic areas such as health, education, energy, trade, and Islamic finance, all significantly helping to improve the lives of millions, particularly the most vulnerable populations.

The key enabler ambitions for the next 50 years suggest that despite the massive achievements of the IsDB Group since its establishment in 1975, it remains a work in progress given the demography of and disparities within its membership which ranges from some of the world’s richest nations in terms of GDP per capita to some of the most vulnerable and poorest nations on earth. The differential in membership demography tilts towards the latter.

The key enablers reflect a pragmatism and realism that augurs well for the future:

- Continuing to advance the overall structure and governance framework of the Group to achieve greater clarity and integration of the roles of its entities to reach optimum levels of performance and financial sustainability, guided by recognized international practices.

- Increasing the level of concessional financing through an institutional mechanism that would ensure effective mobilization of resources to respond optimally to the increasing financing needs faced by member countries, including but not limited to the least developed member countries. This would be done by balancing the continued growth of IsDB’s operations with its financial sustainability.

- Increasing the volume of grants through international partnerships and platforms that would ensure effective mobilization of complementary resources from official donors and from the private and third sectors to respond adequately to the growing development needs of the most vulnerable social groups considering the disasters and difficulties experienced by an increasing number of our member countries and Muslim communities.

- Strategically positioning the IsDB Group within the Islamic financial sector by consolidating its leading role in the Sukuk market, expanding, and deepening local and international Islamic capital markets and directing their resources to support development; developing regulatory and legal environments; building capacities; and mobilizing the necessary partnerships.

- Strategically positioning the IsDB Group within the South-South cooperation arena by consolidating its role in promoting regional integration, intra-regional investments, intertrade, and exchange of developmental expertise and experience; developing regulatory and institutional environments; building capacities; and mobilizing the necessary partnerships.

In his address marking the 50th Anniversary, IsDB President Dr Muhammad Al Jasser reiterated: “I would like to assure you that while we cherish our extensive past and inspiring present, we are charting our future with the same intent and optimism. We are currently studying plans to draw up a new strategy for IsDB that contemplates the future, aligns with the ambitious visions of our member countries, and builds on the successes and experiences accumulated by IsDB in serving cooperation and exchange of knowledge and experience among member countries.”

His call at a Special Session on “Charting a Course for Augmenting SDGs Financing”, to reform the global financial system with a more robust structure to deal with the “immense challenges and inequalities that persist” and to increase the success rate of achieving the UN Sustainable Development Goals (SDGs) attracted much support from prominent international peers.

Dr. Al Jasser reiterated that the IsDB Group was already making significant strides to bring about this shift – agreeing on a reform agenda with fellow multilateral MDBs. He added that the Bank has a unique expertise in “prioritizing not just financial returns but the holistic well-being of individuals and our planet.”

“Our goal is to promote Islamic finance as a viable, effective solution for addressing the most pressing development challenges, not only in our Member Countries, but also across the globe. We must collectively work towards a global financial system that fosters a more inclusive, equitable and sustainable future,” he added.

Climate change, the fallout from the COVID-19 pandemic and ongoing conflicts continue to threaten the achievement of SDGs but according to Dr Al Jasser “the task ahead is daunting but it is within our collective power to chart a course towards a more sustainable, inclusive and prosperous future for all.”

At the World Bank Group/IMF Spring Meetings in Washington DC in April, the IsDB was a prime mover to get the Heads of the Top 10 MDBs to commit to concrete and actionable deliverables in five critical areas:

- Scaling up MDB financing capacity to over US$400 bn over the next decade.

- Boosting joint action on climate change.

- Strengthening country-level collaboration and co-financing.

- Catalyzing private-sector mobilization.

- Enhancing development effectiveness and impact.