Al Rajhi Bank Raises Aggregate US$2bn in Two Consecutive Sustainable Sukuk Wakala Transactions of US$1bn Each in March and May 2024

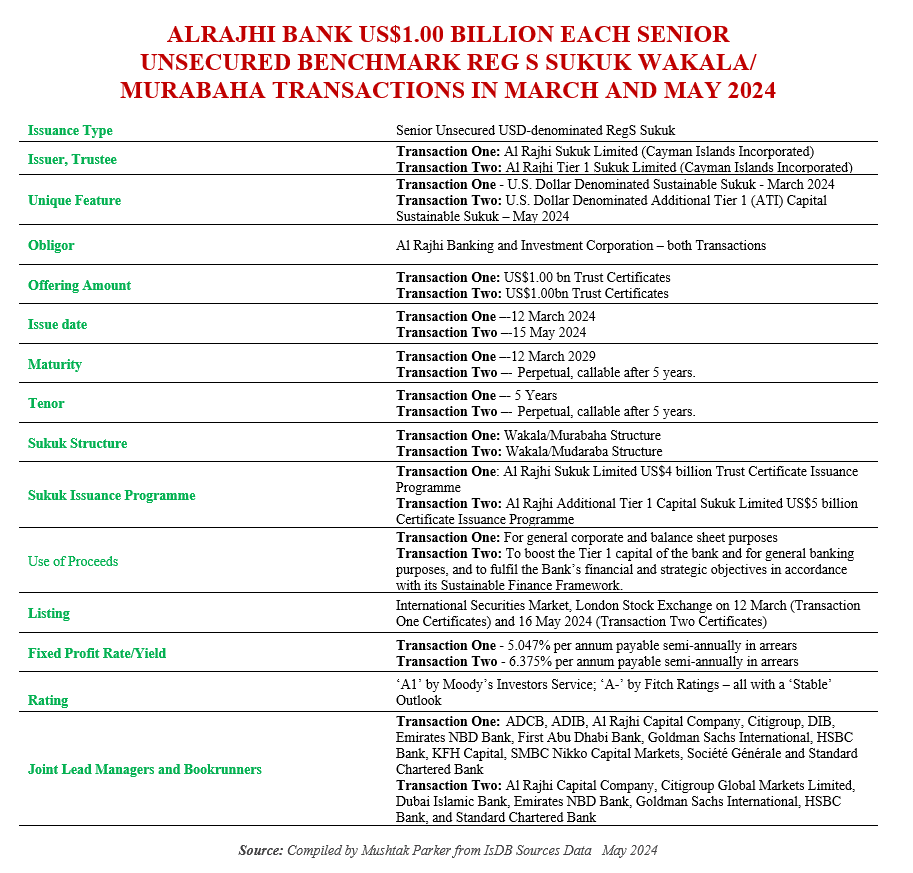

Al Rajhi Bank, the largest Islamic bank in the world and one of the largest in the OIC member countries in terms of assets, went to the international market to raise an aggregate US$2 billion through two issuances of Senior Unsecured RegS Sukuk Wakala/Mudaraba/Murabaha transactions in March and May 2024.

In a disclosure to Tadawul (the Saudi Stock Exchange), Al Rajhi Bank confirmed that the two issuances comprised:

i) A 5-year US$1 billion Sustainable Sukuk Wakala/Murabaha offering on 12 March 2024 which was priced at a profit rate/yield of 5.047% per annum payable semi-annually in arrears.

ii) A second US$1 billion Additional Tier 1 Capital Sustainable Sukuk Wakala/Mudaraba offering on 16 May 2024 which was priced at a profit rate/yield of 6.375% per annum payable semi-annually in arrears. This Sukuk is a perpetual Sukuk, callable after 5 years.

The March transaction was executed under the US$4 billion Trust Certificate Issuance Programme as per the pricing supplement dated 7 March 2024, while the May transaction was closed under the Additional Tier 1 Capital Certificate Issuance Programme supplemented US$5 billion Trust Certificate Issuance Programme.

Both were arranged by Al Rajhi Capital and Standard Chartered Bank, on 7 March and 18 April 2024 respectively.

The March offering certificates were issued by Al Rajhi Sukuk Limited (Cayman Islands Incorporated) while the May offering certificates were issued through Al Rajhi Tier 1 Sukuk Limited (Cayman Islands Incorporated) – both acting as Trustees on behalf of the Obligor, Al Rajhi Banking and Investment Corporation.

For the March 2024 issuance, Al Rajhi Bank had mandated Abu Dhabi Commercial Bank, Abu Dhabi Islamic Bank, Al Rajhi Capital Company, Citigroup Global Markets Limited, Dubai Islamic Bank, Emirates NBD Bank, First Abu Dhabi Bank, Goldman Sachs International, HSBC Bank, KFH Capital Investment Company, SMBC Nikko Capital Markets Limited, Société Générale and Standard Chartered Bank to act as Joint Lead Managers and Bookrunners for a Sustainable Sukuk offering, and to arrange a series of fixed income investor calls with entities in the UK, EU, the MENA region, Asia and with Offshore US Accounts, for a 5-Year Sukuk Wakala/Murabaha issuance.

The percentage of trust assets for the March offering comprised 75% for the Wakala and 25% for the Murabaha facility. The certificates were assigned an ‘A-’ rating by Fitch Ratings, and an ‘A1’ rating by Moody’s Investors Service. The transaction was priced at a profit rate of 5.047% per annum payable semi-annually in arrears. The proceeds from the March offering, said Al Rajhi Bank in a disclosure to Tadawul, will be used to boost the Tier 1 capital of the bank and for general banking purposes.

For the May 2024 issuance, Al Rajhi Bank had mandated Al Rajhi Capital Company, Citigroup Global Markets Limited, Dubai Islamic Bank (DIB), Emirates NBD Bank, Goldman Sachs International, HSBC Bank, and Standard Chartered Bank to act as Joint Lead Managers and Bookrunners for a Tier 1 Capital Sustainable Sukuk Wakala/Mudaraba offering, and to arrange a series of fixed income investor calls with entities in the UK, EU, the MENA region, Asia and with Offshore US Accounts. Standard Chartered Bank also acted as the sole sustainability structurer. The certificates are perpetual and are callable after 5 years and were priced at a profit rate of 6.375% per annum payable semi-annually in arrears.

The proceeds from the Sukuk, said Al Rajhi bank in a disclosure to Tadawul, will be used to boost the Tier 1 capital of the bank and for general banking purposes, and to fulfil the Bank’s financial and strategic objectives in accordance with its Sustainable Finance Framework.

Both the March and May 2024 Sukuk offerings are listed on the International Securities Market of the London Stock Exchange.