IsDB Starts its 2024 Issuance Calendar with a US$2bn SOFR Linked Public Sustainable Sukuk Wakala in May 2024 to Fund ESG Projects in Member States in Climate Action, Poverty Alleviation, Food Security and Resilience Building

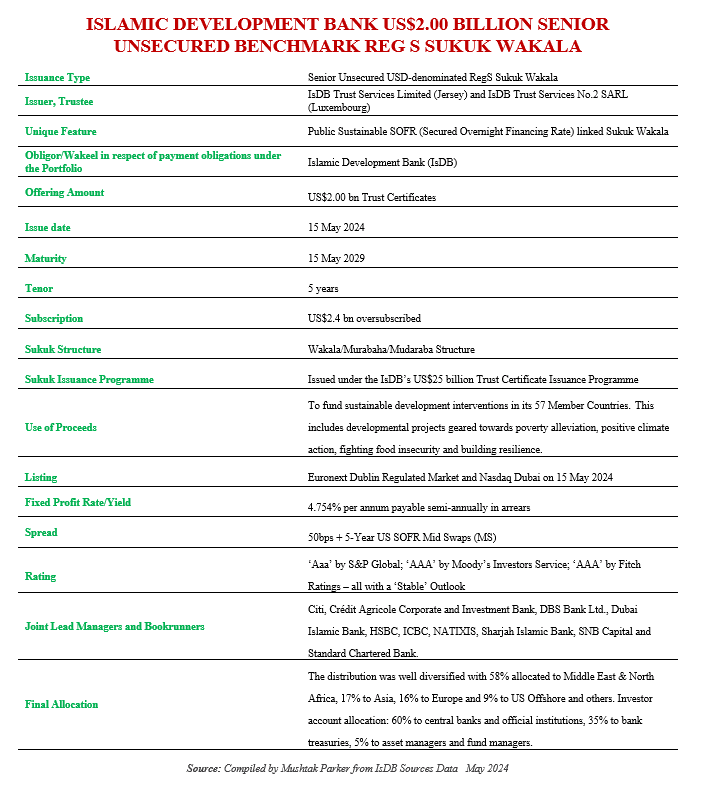

The Islamic Development Bank (IsDB), the multilateral development bank (MDB) of the 57-member OIC (Organisation of Islamic Cooperation) countries, successfully priced its first public Sukuk issuance of 2024 – a US$2.00 billion offering on 15 May with a tenor of five years.

The structure is based on a Public Sustainable SOFR (Secured Overnight Financing Rate) linked Sukuk Wakala with Murabaha and Mudaraba components.

The Senior Unsecured US Dollar-denominated RegS Sukuk Wakala was issued by IsDB Trust Services Limited (Jersey) and IsDB Trust Services No.2 SARL (Luxembourg), who acted as Trustees to the Obligor/Wakeel, the IsDB, in respect of payment obligations under the Portfolio of the relevant Series of Trust Certificates) provided by the IsDB.

The transaction was completed under the IsDB’s US$25 billion Trust Certificate Issuance Programme, which was first established in September 2023 and upgraded in May 2024 as a supplement.

The IsDB remains the most proactive and prolific issuer of AAA-rated Sukuk in the international market. The Bank is rated Aaa/AAA/AAA by S&P, Moody’s Investors Service and Fitch Ratings – all with Stable Outlook.

The IsDB had mandated Citi, Crédit Agricole Corporate and Investment Bank, DBS Bank Ltd., Dubai Islamic Bank, HSBC, ICBC, NATIXIS, Sharjah Islamic Bank, SNB Capital and Standard Chartered Bank in early May 2024 to act as Joint Lead Managers and Joint Bookrunners for the issuance and to arrange a series of investor calls and visits in the UK, Europe, the Middle East, Asia and with Offshore US Accounts.

According to the IsDB, the proceeds of the issuance will be utilized for sustainable development interventions in the IsDB’s Member States.

At its 49th Annual Meetings at end April 2024 in Riyadh, Saudi Arabia, the Board of Governors renewed the MDB’s comprehensive mandate of delivering sustainable socio-economic development in its Member States and in Muslim communities worldwide.

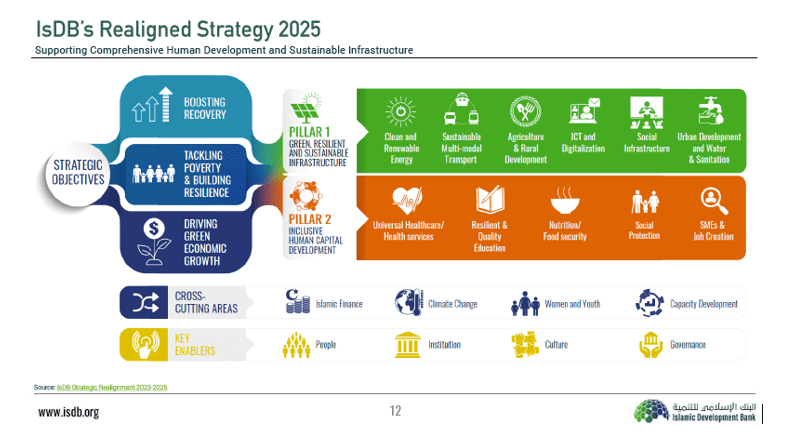

As such, the proceeds will be used towards developmental projects geared to poverty alleviation, positive climate action, fighting food insecurity and building resilience. The interventions are guided by the fit-for-purpose Realigned Strategy of the Bank with a stronger focus on green, resilient, and sustainable infrastructure as well as inclusive human development.

The IsDB Sukuk issuances are driven by its Strategic Realigment Strategy 2023-2025, first approved at the Group’s 46th Annual Meetings in Tashkent in Uzbekistan. The Realigned Strategy hinges on three overarching objectives: boosting recovery; tackling poverty and building resilience; and driving green economic growth agenda.

These objectives will be achieved by focusing the Bank’s interventions on two key pillars over the next three years (2023-2025): (1) developing green, resilient, and sustainable infrastructure; and (2) supporting inclusive human capital development through projects and capacity development initiatives.

The 5-year Sukuk certificates, which mature on 15 May 2029, were oversubscribed to the tune of US$2.4 billion with several first-time investors in IsDB risk and debt papers, especially from central banks and official government institutions.

This latest Sukuk transaction was announced to the markets on Tuesday, 7 May, with Initial Price Thoughts (IPTs) set at 5Y US SOFR Mid Swap (MS) plus 55 basis points (bps). On the back of an over-subscribed orderbook, the Bank revised the guidance to 5Y US SOFR Mid Swap (MS) plus 53 bps, and further tightened it by 3 bps on Wednesday, 8 May, to finally land at a spread of 5Y US SOFR MS plus 50 bps, translating into a pricing at part with an overall profit rate of 4.754%, payable on a semi-annual basis in arrears.

In terms of the final allocation, the distribution, says the IsDB, was well diversified with 58% allocated to investors in the Middle East & North Africa (MENA) region, 17% to Asia, 16% to Europe and 9% to US Offshore Accounts and others.

“Overall, the deal witnessed strong participation from real money accounts and official institutions as well as several first-time investors, a testament of IsDB’s credit strength, as 60% was allocated to central banks and official institutions, 35% to bank treasuries, 5% to asset managers and fund managers,” explained the MDB.

On completion of the pricing, Dr. Zamir Iqbal, the Vice President (Finance) and CFO of IsDB, commented: “This year, we are celebrating 50 years of the Bank’s service to its 57 Member Countries, and we are proud to have executed, yet again, a benchmark issuance with strong investor response for our first public issuance of the year. We will continue to build on this momentum with our growing balance sheet. We are very grateful to IsDB’s Member Countries and all the investors, including new ones, for their trust in IsDB and its mission of sustainable development around the world.”

IsDB Head of Treasury, Mohammed Sharaf, similarly commended the successful benchmark transaction “brought to the market in a challenging environment. This would not have been possible without the positive response from investors and the efforts of the joint lead managers on the trade. We look forward to returning to the markets later in the year to achieve our annual funding programme.”

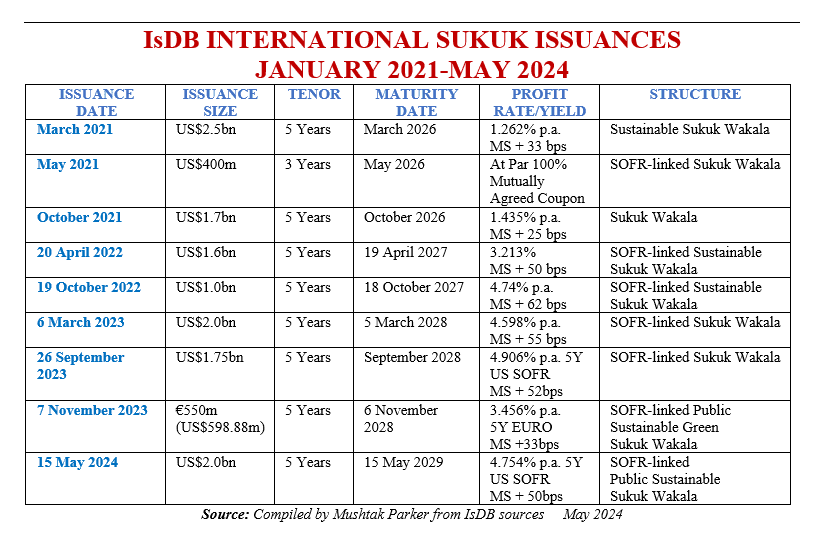

Prior to the May 2024 transaction, the IsDB last accessed the market on 7 November 2023 with a benchmark 5-Year €550m (US$598.88m) SOFR-linked Public Sustainable Green Sukuk Wakala priced at a profit rate of 3.456% p.a. and a spread of 5Y Euro MS +33bps and maturing on 6 November 2028.

The Bank was the first Islamic financial institution to issue a SOFR-linked Sukuk. The Trust Certificates have been admitted for listing on the Regular Market of Euronext Dublin and NASDAQ Dubai on 15 May 2024.

The IsDB Strategic Realigment Strategy will rely on the Bank’s resource mobilisation activities. The IsDB remains the most proactive and prolific issuer of AAA-rated Sukuk in the international market.

In its rating rationale for the May 2024 issuance, Fitch Ratings stressed that the key drivers for its Long-Term Issuer Default Rating (IDR) at ‘AAA’ with a Stable Outlook and Short-Term IDR at ‘F1+’ include:

1) The IsDB’s Standalone Credit Profile (SCP), with solvency and liquidity both assessed at ‘aaa’.

ii) In 2020, IsDB approved a capital increase amounting to ID5.5 billion, which is 100% paid-in capital and will be paid over 14 years. This capital increase supports solvency, says Fitch. The IsDB’s unit of accounting is the Islamic Dinar (ID). 1 Islamic Dinar = 1 Special Drawing Right of the IMF. 1ID = US$1.341670.

iii) IsDB’s ‘aaa’ solvency assessment is underpinned by its ‘excellent’ capitalisation with a Fitch usable capital to risk-weighted assets (FRA) ratio of 43.5% at end-2023 and an equity-to-adjusted-assets ratio of 37.1%.

iv) The IsDB’s Unchanged Credit Risk Profile. The bank’s ‘moderate’ non-performing loans ratio was 4.6% at end-2023, unchanged from end-2022.

v) IsDB’s ‘aaa’ liquidity assessment reflects its ‘excellent’ liquidity buffers.

As a frequent issuer the IsDB has issued more than US$44 billion since 2005. Dr Muhammed Al Jasser, IsDB Chairman, has been highly encouraged by the investor response to the bank’s Green Sukuk and Sustainability Sukuk transactions.

For the period January 2021 to May 2024, the IsDB has raised some US$13,248.88 million through nine Sukuk transactions in the international market – largely sustainable and Green Sukuk offerings. (see table above).

The IsDB continues to tap the international markets more often than in previous years, partly driven by the on-going impact of the Covid-19 pandemic; the increasing demands from member countries for help towards their post-pandemic economic recovery effort; the on-going demands due to the supply chain disruptions relating to food and energy supplies as a result of the Ukraine conflict which has seen food and fuel prices spiral and many OIC Member States like elsewhere faced with a cost-of-living crisis; and the socio-economic impacts of climate change, food insecurity and the global economic shocks of high inflation, increasing sovereign indebtedness and unemployment.

The Bank is keen to widen its investor base including in East Asia. During his visit to the Far East in January 2024, where he also spoke at the Asian Financial Forum in Hong Kong, Dr Al Jasser discussed ways of expanding IsDB treasury relations with peer counterparts in the region including the Asian infrastructure Bank and the New Development Bank, and the potential cooperation in supporting diversification and investor’s reach to IsDB Sukuk offerings.

Dr Al Jasser stressed that the IsDB‘s 2024 funding programme “is our largest ever, as we are targeting to raise US$6 billion through benchmark-size Sukuk issuances, mainly in the dollar and euro markets. Since 1976 to date, the IsDB Group has approved more than US$180 billion in development finance to a wide array of sectors to help improve socio-economic development in its 57 member countries and beyond.”