Saudi NDMC Domestic Sovereign Sukuk Issuance Momentum Continues with Closure of Three-tranche SAR4.44bn (US$1.2bn) Sukuk in March 2024, as Aggregate for First Quarter 2024 Reaches SAR21.14bn (US$5.64bn) Through Three Auctions

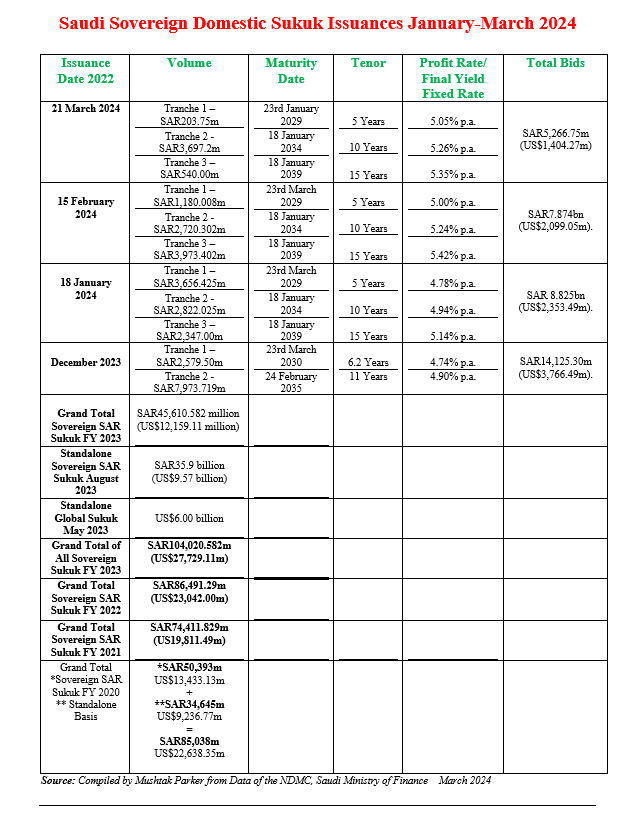

The National Debt Management Centre (NDMC) of the Saudi Ministry of Finance (MoF) successfully closed its third consecutive monthly domestic sovereign Sukuk issuance as per its annual issuance calendar on 21 March 2024 raising an aggregate SAR4,440.95 million (US$1,184.09 million) in the process through a three-tranche auction conducted by the Saudi Central Bank (SAMA). The total amount of bids received was SAR5,266.75 million (US$1,404.27 million).

The NDMC started 2024 where it had left off in 2023 with a robust issuance of Riyal-denominated Sukuk in the domestic market in two transactions in January and February this year. The NDMC raised an aggregate SAR16,699.162 million (US$4,452.54 million) in two three tranche auctions – one on 16 January 2024 and the other on 13 February 2024, which were both fully subscribed by selected local and foreign institutional investors, suggesting a robust sustained trajectory of the issuance and demand for Saudi government securities. It is consistent with the issuance trend of 2023.

The NDMC kicked off the year 2024 with its first auction on 16 January 2024 – a two-tranche offering of SAR3,465.561 million (US$923.25 million) completed on 24 January 2023. This was followed by a three-tranche issuance on 13 February 2024 which raised an aggregate SAR7.874 billion (US$2,099.05 million).

The auction on 21 March 2024 which raised an aggregate SAR4,440.95 million (US$1,184.09 million) comprised three tranches as follows:

- A first tranche of SAR203.75 million (US$54.33 million) with a 5-year tenor maturing on 18 January 2029 and priced at a yield of 5.05 % per annum and a price of SAR95.11192. Bids received totalled SAR203.75 million (US$54.33 million).

- A second tranche of SAR3,697.20 million (US$985.78 million) with a 10-year tenor maturing on 18 January 2034 and priced at a yield of 5.26% per annum and a price of SAR97.56185. Bids received reached SAR3,697.20 million (US$985.78 million).

- A third tranche of SAR540.00 million (US$143.98 million) with a 15-year tenor maturing on 18 January 2039 and priced at a yield of 5.35% per annum and a price of SAR97.86153. Bids received reached SAR1,364.80 million (US$363.90 million).

The NDMC Sukuk are all issued under the unlimited Saudi Arabian Government SAR-denominated Sukuk Programme, which focuses on fixed-rate instruments “to hedge against risks of potential interest rate fluctuations.”

In a statement, the NDMC stressed that “this issuance confirms the NDMC’s statement in February 2022, that it will continue, in accordance with the approved Annual Borrowing Plan, to consider additional funding activities subject to market conditions and through available funding channels locally or internationally. This is to ensure the Kingdom’s continuous presence in debt markets and manage the debt repayments for the coming years while taking into account market movements and the government debt portfolio risk management.”

Total Volume in 2024 Projected to Exceed 2023 Figure

In 2023, the total volume of funds raised by the Saudi Ministry of Finance through all sovereign Sukuk issuances reached a staggering SAR104,020.582 million (US$27,729.11 million), of which SAR81.51 billion came through domestic Sukuk issuances. Thus far in First Quarter 2024, the NDMC has already raised an aggregate SAR21,140.112 million (US$5,635.75 million) through three auctions – well on its way to potentially exceed its issuance volume in 2023, given the need to finance the 2024 budget deficit (albeit modest) and the huge infrastructure funding requirements especially associated with the mega NEOM projects.

The Kingdom is by far the single most proactive sovereign domestic Sukuk issuer in the world. The NDMC’s 2024 Calendar of Local Sukuk Issuances, released in January, double downs this issuance momentum and confirms the intention of issuing domestic sovereign Sukuk consecutively for each month of the year from January to December – the only sovereign issuer to commit to such a calendar in advance. This commitment is partly driven by the robust market demand for Saudi Arabian sovereign domestic Sukuk certificates from both local and international investors.

The NDMC’s role is to secure Saudi Arabia’s debt financing needs with the most competitive financing costs. Saudi Arabia is ahead in tapping the domestic sovereign Sukuk market because it also has an established issuance infrastructure complete with a government policy framework under its ‘Fiscal Balance Programme and Financial Sector Development Programme’, whose objectives are to add to a diversified public debt fund raising strategy and to the development of the Saudi Sukuk and Islamic Capital Market.

“This initiative is a continuation of the NDMC’s efforts to strengthen the domestic market and to keep up with market developments which have been reflected positively on the growing trading volume in the secondary market. Further, this initiative enables the NDMC to exercise its role in managing the government debt obligations and its future maturities. This will also align the NDMC’s efforts with other initiatives to enhance the public finance in the medium and long term,” stressed the NDMC.

The MoF intends to continue borrowing to finance the estimated 2024 budget deficit and refinance debt maturities due in FY 2024. Additionally, the NDMC “will remain vigilant in identifying and pursuing favourable market opportunities to implement additional financing activities to refinance debt maturities in the coming years. The Government remains committed to leveraging market opportunities to execute alternative government financing activities that promote economic growth, such as financing capital projects and infrastructure developments.”

The NDMC says it is committed to ensuring the Kingdom’s sustainable access to various debt markets to issue sovereign debt instruments at fair prices while maintaining prudent risk levels. To achieve this objective, it will continue to diversify financing channels throughout 2024. This diversification will include expanding financing through export credit agencies (ECA’s), financing infrastructure projects, and exploring tapping into new markets in new currencies. These initiatives aim to expand the investor base and enhance the Kingdom’s access to global capital markets.

The NDMC continues to work on attracting new capital, and more international financial institutions in addition to selected local banks to take part in the Primary Dealers Program, to capitalize on the debt instruments arranged by the NDMC. Already, BNP Paribas, Citigroup, Goldman Sachs, J.P. Morgan, and Standard Chartered Bank have signed up as new primary dealers in the government’s local debt instruments. They join five local institutions, namely Saudi National Bank, Saudi British Bank (SABB), Al Jazira Bank, Alinma Bank, and Al Rajhi Bank, already in the NDMC’s Primary Dealers Programme.

Rising Demand for SAH Savings Sukuk

In tandem with the Saudi Arabian Government SAR-denominated Sukuk Programme, the NDMC also oversees the recently introduced Saudi Arabian Government Guaranteed SAH Retail Savings Sukuk launched by the Saudi Ministry of Finance in February 2024.

The issuance under the programme seems to be gaining traction especially among younger and retail investors. According to the NDMC, the second round of issuance of SAH Savings Sukuk closed on 5 March 2024 with a total volume of savings subscriptions reaching SAR959 million (US$255.71 million), attracting the participation of 37,000 savers – up by 2,000 on the inaugural SAH Sukuk in February 2024.

The latest Sukuk mature on 5 March 2025 and are priced at a fixed profit rate of 5.63%. The third SAH Sukuk savings round is scheduled to be held on 21 April 2024, according to the published issuance calendar for Government Sukuk. The subscription window will be done through digital channels of the participant financial institutions – the primary dealers and distributors.

The SAH Savings Sukuk product, which was launched by the Ministry of Finance and managed by the NDMC, is an initiative under the umbrella of the Financial Sector Development Programme’s initiatives (one of the Saudi Vision 2030 programs) aimed to increase the savings ratios among individuals by motivating them to allocate a portion of their income to savings on a periodic basis, in addition to increasing the supply of savings products, raising the awareness around financial literacy and the importance of savings and its benefits for future plans.

According to the NDMC, the first savings round of the SAH Sukuk closed on 6 February 2024 with a total volume of savings subscriptions reaching SAR861 million (US$229.58 million). The subscriptions were fully allocated on 13 February 2024 to some 35,000 applicants. The Sukuk mature on 5 February 2025 and are priced at a fixed profit rate of 5.64%.

SAH Sukuk are reserved for Saudi citizens only, who are over the age of 18 years, provided the subscriber has an account with either SNB Capital, AlJazira Capital, Alinma Investment, SAB Invest or Al Rajhi Capital, the primary dealers and distribution channels.

SAH Sukuk is the first subsidized savings product intended for individuals that is compatible with Sharia’a principles in the form of Sukuk. It comes under the aegis of the Saudi Ministry of Finance’s Local Trust Certificates Issuance Programme denominated in Saudi riyals. The purpose of issuance of SAH Sukuk is to enhance the financial planning of the younger generation for the future and increasing individuals’ savings rates by motivating them to periodically deduct a portion of their income and allocate it to savings, in addition to increasing the supply of savings products.

Its key marketing drivers include Sharia’a compliance products which enjoy growing popularity and traction among Saudi youth, featuring a short-term tenor of 1-year, annual returns, easy subscription, no fees for subscribers, and no restrictions on redemption. The minimum subscription rate of SAH Sukuk is SAR1,000, which is equivalent to the nominal value, while the maximum subscription limit is SAR200,000 for the total number of issues per individual during the programme period.

The SAH Sukuk has the potential to become an exemplary retail Sukuk savings product – in terms of Issuer of Last Resort (the Saudi Government), Guarantor, Volume, Competitive Pricing, and Investors: