SEC Successfully Closes Second Big Ticket Dual Tranche Sukuk in the US Dollar Market in Less Than a Year

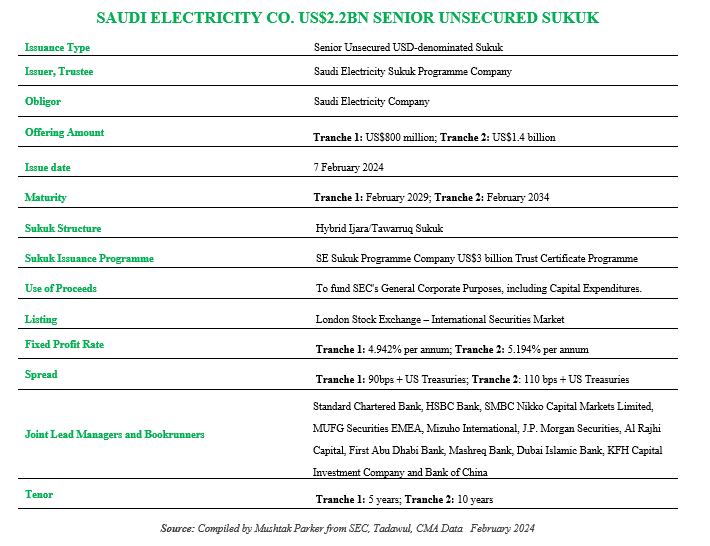

Saudi Electricity Company (SEC), the Kingdom’s power generation utility, returned to the international financial market in February 2024 with another big ticket Sukuk offering – a two tranche two tenor aggregate US$2.2 billion Senior Unsecured Reg S Sukuk under the US Securities Act of 1933, as amended.

The return is less than a year since SEC, a regular issuer of Sukuk and latterly more so of Green and Sustainability transactions, similarly raised US$2 billion with a dual tranche transaction in April 2023 comprising a 10-year US$1.2 billion Green Sukuk tranche, and a 30-year US$800 million Sukuk tranche.

This latest Sukuk offering in February 2024 comprises a 5-year senior unsecured US$800 million tranche and a 10-year US$1.4 billion senior unsecured tranche. Both the 2023 and 2024 Sukuk Transactions were issued under SEC’s Trust Certificates Issuance Programme.

The Sukuk certificates were issued by the Saudi Electricity Sukuk Programme Company, the issuer and trustee, a special purpose vehicle incorporated in the Cayman Islands, on behalf of the Obligor, Saudi Electricity Company, under its US$6 billion Trust Certificate Issuance Programme.

SEC in a disclosure to Tadawul (the Saudi Exchange) on 5th February 2024 announced its intention to issue a Sukuk in the US dollar market, and mandated a consortium of regional and international banks led by Standard Chartered Bank, HSBC Bank, SMBC Nikko Capital Markets Limited, MUFG Securities EMEA, Mizuho International, J.P. Morgan Securities, Al Rajhi Capital, First Abu Dhabi Bank, Mashreq Bank, Dubai Islamic Bank, KFH Capital Investment Company and Bank of China as Joint Lead Managers and bookrunners to the offering, and to arrange a series of investor calls and meetings with accounts in the UK, Europe, the GCC, MENA region, Asia and with Offshore US investor accounts.

Following a virtual roadshow on 5th February 2024 that received an overwhelming participation of international investors in Asia, Europe, and the Middle East, the order book for the issuance closed on 7th February, attracting robust demand and over-subscription rate for both tranches from regional and international investors. SEC set the initial price guidance for its 5-year Sukuk at around 130 basis points (bps) over U.S. Treasuries, and for its 10-year Sukuk at 145 bps over US Treasuries.

Due to the strong demand for the certificates, the price tightened to close at a final spread of 90 bps over US Treasuries for the 5-year tranche and at 110 bps over US Treasuries for the 10-year tranche. This translated to a fixed profit rate of 4.942% per annum for the 5-year certificates, and a fixed profit rate of 5.194% per annum for the 10-year certificates. This compared to the pricing of the US$2 billion April 2023 transaction in which the 10-year US$1.2 billion Green Sukuk tranche was finally priced at a fixed profit rate of 4.632% per annum at a spread of 120 bps over 10 years US Treasuries, while the 30-year US$800 million Sukuk tranche was priced at a fixed profit rate of 5.684% per annum at a spread of 205 bps over 30 years US Treasuries.

The Sukuk, rated ‘A’ with a stable outlook by S&P Global and Fitch Ratings, are based on a Ijarah/ Commodity Murabaha structure. According to the prospectus, the issuer/trustee will utilise the proceeds of the Sukuk as follows: at least 55% to purchase from SEC of assets pursuant to a master purchase agreement; and a maximum of 45% to acquire a portfolio of commodities (Murabaha assets). SEC will pay leases (under the master and supplemental lease agreement) and the profit element (under the Murabaha agreement), which will be calibrated to match the periodic distribution amount payable to investors. Profit instalments under the Murabaha agreement are expected to account for 10% of the periodic distribution amount, with the remaining 90% to be covered with Ijara assets rentals.

The transaction documentation requires tangible assets to remain above 50% of total assets in the portfolio underlying any issuance, throughout the transaction’s lifetime.

In a disclosure to Tadawul, SEC said the proceeds from the US$2.2 billion Sukuk transaction will be used to fund the company’s general corporate requirements, including capital expenditures, and/or, if so specified in the applicable issuance Final Terms, to fund a portfolio of Eligible Projects as set out in SEC’s Green Sukuk Framework.

This Sukuk offering is also aligned with the company’s strategy to diversify its funding sources and expand its investor base in international markets. It also supported the company’s aspirations to finance its projects through innovative and sustainable financing instruments. Application has been made for the SEC Sukuk Certificates to be admitted for listing and trading on the main board of the London Stock Exchange in February 2024.

SEC, prior to the February transaction, fully redeemed two of its Sukuk issuances – the US$800 million international Sukuk issued on 27 September 2018, which was due on 27th January 2024, and the SAR4.5 billion (US$1.2 billion) riyal denominated Sukuk issued on 30th January 2014, which was due on 30th January 2024.

SEC is a frequent user of Islamic finance facilities especially through raising funds through syndicated Murabaha financing and issuance of Sukuk. In February 2023, for instance, the company signed one of the largest riyal-denominated Syndicated Murabaha Facilities – a SAR10 billion (US$2.66 billion) transaction with a consortium of nine local banks.