Saudi NDMC Closes 2023 on a High Note with a Two-tranche SAR10.6bn (US$2.81bn) Sukuk as it Consolidates Domestic Sovereign Sukuk Issuance for 2024 with a Full Calendar of Monthly Auctions and an Annual Borrowing Plan in which SAR Sukuk Comprises 35% of Funding Needs

The National Debt Management Centre (NDMC) of the Saudi Ministry of Finance (MoF) reiterated its proactive support for sovereign Sukuk issuance in 2024 by publishing in January a full consecutive monthly calendar of issuances for the year ahead and its Annual Borrowing Plan (ABP) Report for 2024.

The projected distribution of fund-raising channels for 2024 under the ABP comprises:

i) Up to 35% of the total funding plan through the domestic SAR-denominated debt market through monthly Sukuk auctions.

ii) Up to 40% of the total funding plan in the international debt markets through the issuance of conventional bonds and Sukuk – usually US dollar-denominated.

iii) Up to 50% of the total funding plan through Government Alternative Funding (GAF) channels.

The Saudi sovereign Sukuk issuance programme, together with the Malaysian Government Sharia’a Securities (MGSS) one, are the mainstay of the global Sukuk market in terms of commitment, volumes and frequency. The Indonesian government with its Sharia’a securities auctions and the Central Bank of Bahrain acting on behalf of the Ministry of Finance are also regular issuers of domestic and the perennial international Sukuk but not in terms of volumes.

The same applies to the Turkish Treasury with its Sukuk Al Ijarah issuances – primarily fixed rate Turkish Lira leasing Sukuk with the occasional forays into the US dollar and Euro Sukuk market.

The rest of the sovereign Sukuk market, although gaining limited traction in the last two years, remains at best fragmented and at worst non-existent, largely due to various barriers to entry especially in terms of lack of market education regarding Sukuk as an efficient public fund-raising instrument; the dearth of structuring and technical expertise; exaggerated perceptions of country credit risk metrics especially by the international rating agencies leading to increased cost of finance; and often the absence and lack of requisite enabling legislation, Sukuk issuance guidance frameworks, and listing and secondary trading architecture at the local or regional bourses.

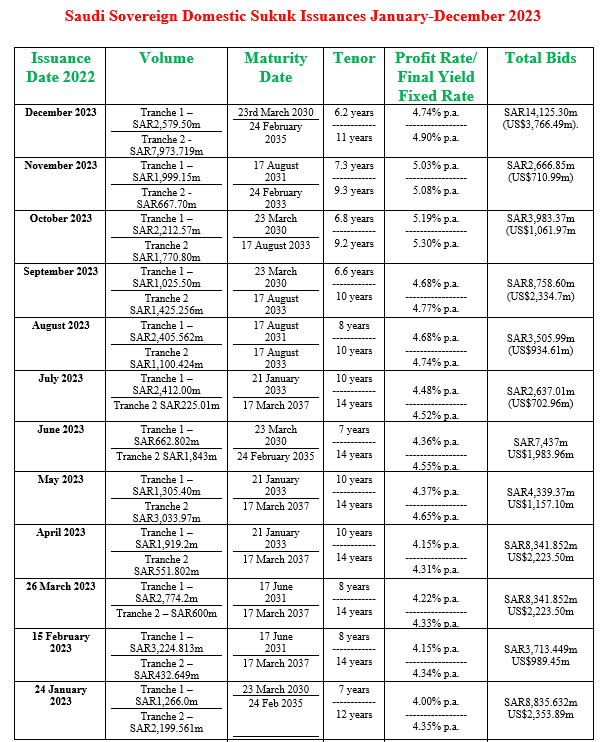

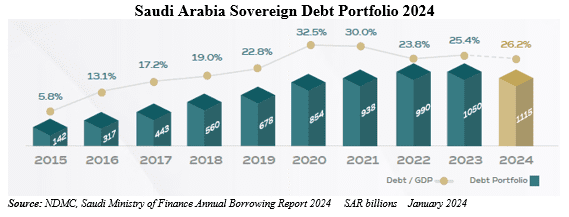

The NDMC initiative comes on the back of the successful closure of its twelfth consecutive monthly domestic sovereign Sukuk issuance on 19th December 2023 raising a total SAR10,553. 219 million (US$2,814.00 million) thus closing the year on a high note. This follows the Sukuk issuance on 23rd November 2023 raising a total SAR2,666.85 million (US$710.99 million), through a two-tranche auction conducted by the Saudi Central Bank (SAMA).

The NDMC Sukuk are all issued under the unlimited Saudi Arabian Government SAR-denominated Sukuk Programme, which focuses on fixed-rate instruments “to hedge against risks of potential interest rate fluctuations.”

The two tranches auctioned on 19th December 2023 which raised an aggregate SAR10,553. 219 million (US$2,814.00 million) comprised:

- A first tranche of SAR2,579.50 million (US$687.82 million) with a 6.2-year tenor maturing on 23rd March 2030 and priced at a yield of 4.74 % per annum and a price of SAR89.0121. Bids received totalled SAR5,184.05 million (US$1,382.32 million).

- A second tranche of SAR7,973.719 million (US$2,126.18 million) with a 11-year tenor maturing on 24th February 2035 and priced at a yield of 4.90% per annum and a price of SAR83.7947. Bids received reached SAR8,941.25 million (US$2,384.17 million).

Total 2023 Sukuk Issuance

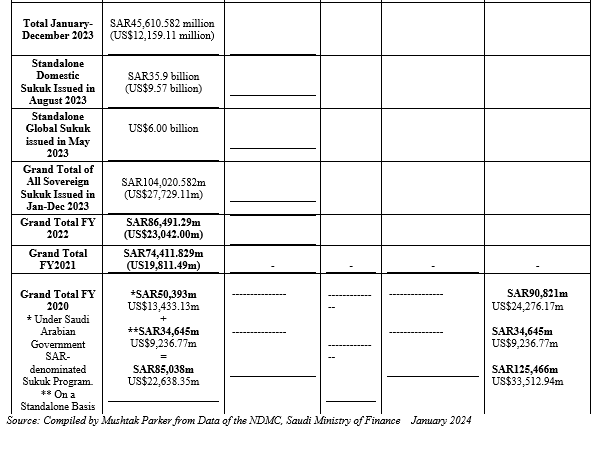

This brings the total amount raised by the NDMC in 2023 through 12 consecutive monthly domestic Sukuk transactions to SAR45,610.582 million (US$12,159.11 million) in the January-December period, compared to SAR86,491.29 million (US$23,042.00 million) and SAR65,741.315 million (US$17,491.51 million) for the same periods in 2022 and 2021 respectively.

In a statement, the NDMC stressed that “this issuance confirms the NDMC’s statement on the mid of February 2022, that it will continue, in accordance with the approved Annual Borrowing Plan, to consider additional funding activities subject to market conditions and through available funding channels locally or internationally. This is to ensure the Kingdom’s continuous presence in debt markets and manage the debt repayments for the coming years while taking into account market movements and the government debt portfolio risk management.”

This latest transaction also follows the one-off Saudi sovereign Sukuk issuance in the international Sukuk market in mid-May 2023 through a dual tranche Sukuk totalling US$6 billion in response to “receiving investors’ requests for the issuance of international trust certificates (Sukuk).”

In addition to the above issuance activity, the NDMC also issued a standalone Sukuk tranche under the Local Saudi Sukuk Issuance Program in Saudi Riyal with a total value around SAR35.9 billion (US$9.57 billion) in August 2023. This means that the total funds raised by the NDMC through domestic Sukuk issuances reached SAR81.51 billion (rounded to SAR82 billion in the ABP 2024 report).

If we add the international Sukuk issuances in 2023 it comes to a staggering SAR104,020.582 million (US$27,729.11 million) through domestic Saudi riyal denominated Sukuk in the January to December period and the standalone US$6 billion (SAR22.51 billion) issuance in the international market in May through the Government Alternative Funding (GAF) channel to finance capital expenditures and infrastructure projects.

Priorities for 2024

The Kingdom is by far the single most proactive sovereign domestic Sukuk issuer in the world. The NDMC’s 2024 Calendar of Local Sukuk Issuances, released in January, double downs this issuance momentum and confirms the intention of issuing domestic sovereign Sukuk consecutively for each month of the year from January to December – the only sovereign issuer to commit to such a calendar in advance.

This commitment is partly driven by the robust market demand for Saudi Arabian sovereign domestic Sukuk certificates from both local and international investors. For the December 2023 transaction with an aggregate allocation of SAR10,553. 219 million (US$2,814.00 million), for instance, the total bids received by the NDMC reached SAR14,125.30 million (US$3,766.49 million).

The NDMC’s role is to secure Saudi Arabia’s debt financing needs with the most competitive financing costs. Saudi Arabia is ahead in tapping the domestic sovereign Sukuk market because it also has an established issuance infrastructure complete with a government policy framework under its ‘Fiscal Balance Programme and Financial Sector Development Programme’, whose objectives are to add to a diversified public debt fund raising strategy and to the development of the Saudi Sukuk and Islamic Capital Market.

“This initiative is a continuation of the NDMC’s efforts to strengthen the domestic market and to keep up with market developments which have been reflected positively on the growing trading volume in the secondary market. Further, this initiative enables the NDMC to exercise its role in managing the government debt obligations and its future maturities. This will also align the NDMC’s efforts with other initiatives to enhance the public finance in the medium and long term,” stressed the NDMC.

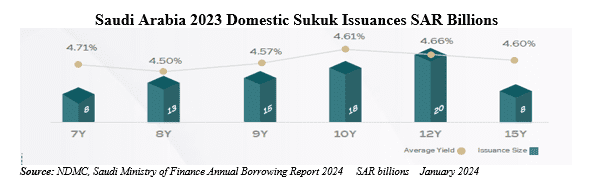

Public Debt Dynamics

As outlined in the 2024 National Budget statement, the budget deficit is projected to reach SAR79 billion (US$21.07 billion), resulting in total funding needs for 2024 of approximately SAR86 billion (US$22.93 billion) after securing approximately SAR14 billion (US$3.73 billion) of the 2024 total financing needs in 2023 through pre-funding activities encompassing both debt maturities and deficit financing requirements. By the end of 2024, the total debt portfolio is anticipated to reach SAR 1,115 billion (US$297.31 billion).

In the ABP 2024 report, the NDMC stresses that “capitalizing on the successful execution of liability management transaction in 2023, which reduced 2024 debt maturities by SAR19 billion (US$5.07 billion), the total remaining debt maturities for 2024 are estimated at SAR21 billion (US$5.60 billion). During 2023, prefunding activities were executed and approximately SAR14 billion (US$3.73 billion) of 2024 total financing needs were secured by 2023 year-end.”

As such, the MoF intends to continue borrowing to finance the estimated 2024 budget deficit and refinance debt maturities due in FY 2024. Additionally, the NDMC “will remain vigilant in identifying and pursuing favourable market opportunities to implement additional financing activities to refinance debt maturities in the coming years. The Government remains committed to leveraging market opportunities to execute alternative government financing activities that promote economic growth, such as financing capital projects and infrastructure developments.”

The NDMC says it is committed to ensuring the Kingdom’s sustainable access to various debt markets to issue sovereign debt instruments at fair prices while maintaining prudent risk levels. To achieve this objective, it will continue to diversify financing channels throughout 2024. This diversification will include expanding financing through export credit agencies (ECA’s), financing infrastructure projects, and exploring tapping into new markets in new currencies. These initiatives aim to expand the investor base and enhance the Kingdom’s access to global capital markets.

The NDMC continues to work on attracting new capital, and more international financial institutions in addition to selected local banks to take part in the Primary Dealers Program, to capitalize on the debt instruments arranged by the NDMC. Already, BNP Paribas, Citigroup, Goldman Sachs, J.P. Morgan, and Standard Chartered Bank have signed up as new primary dealers in the government’s local debt instruments. They join five local institutions, namely Saudi National Bank, Saudi British Bank (SABB), Al Jazira Bank, Alinma Bank, and Al Rajhi Bank, already in the NDMC’s Primary Dealers Programme.