Saudi Arabia’s Public Investment Fund Entry into International Sukuk Market with Maiden US$3.5bn Offering Set to be a Gamechanger for Primary Sukuk Origination in 2024

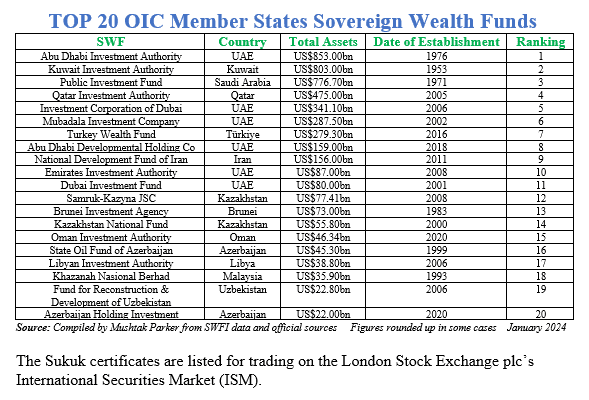

When one of the world’s top six sovereign wealth funds (SWFs) issues a debut Sukuk raising US$3.5 billion in the process attracting investors from across the world, has the mainstreaming of Sukuk as a cost-effective fundraising capital market debt instrument finally arrived in a meaningful way for the SWFs, state-run pension and social security funds and national development finance institutions fraternity?

The fact that the issuance in October 2023 was over 7 times oversubscribed with the order book attracting major international and regional institutional investors and exceeding US$25 billion, suggests that the above market segment and investor universe at best remains nascent and untapped, but represents the opportunities, pathway and potential to propel Sukuk origination as an alternative investment bond way beyond its current levels of primary offerings.

Saudi Arabia’s Public Investment Fund (PIF) potential gamechanger for the Islamic Capital market (ICM) was its maiden two tranche US$3.5 billion Sukuk issued by its wholly-owned Cayman Islands-incorporated special purpose vehicle, SUCI Second Investment Company (SSIC), on behalf of the Obligor, PIF, as part of its medium-term capital raising strategy. SSIC is also the Trustee on behalf of the Sukuk certificate holders.

The Sukuk were issued under SSIC’s Trust Certificate Issuance Programme which was established in October 2023 and arranged by Al Rajhi Capital, Emirates NBD Capital, HSBC and Standard Chartered Bank, with Citigroup and JP Morgan joining as dealers. The transaction had two tranches comprising:

i) A first tranche of US$2.25 billion with a tenor of 5 years and maturing on 16 October 2028.

ii) A second tranche of US$1.25 billion with a tenor of 10 years and maturing on 16 October 2033.

The Sukuk issuance, according to PIF, was more than seven times oversubscribed, with orders exceeding US$25 billion from a diverse range of accounts in Europe, UK, the Middle East, Asia and Offshore US Accounts, reflecting investor confidence in the SWF’s corporate and investment strategy.

The initial price guidance was set at around150 basis points (bps) over US Treasuries for the 5-year certificates, and 170bps over US Treasuries for the 10-year certificates.

Robust Demand

Due to very robust demand for the certificates with the order book exceeding US$25 billion, the pricing saw substantial tightening to a final spread of US Treasuries + 120bp for the 5-year certificates and US Treasuries +140bp for the 10-year certificates, with demand no doubt bolstered by PIF’s credit strength as highlighted by Moody’s Investors Service upgrading its outlook for PIF to “positive” from “stable,” and Fitch Ratings its long-term foreign and local-currency issuer default ratings to A+ from A, with a “stable” outlook. This translates into a profit rate of 6% per annum for the US$2.25 billion 5-year certificates payable semi-annually and maturing in October 2028, and a profit rate of 6.25% per annum for the 10-year US$1.25 billion certificates payable semi-annually and maturing in October 2033.

Being the first foray of the SWF into the international Sukuk market and the preference of Saudi investors in general for investing in domestic and international sovereign Sukuk, it was no surprise that the allocation was dominated by domestic Saudi investors, who were assigned 60% of the 5-year tranche and 68% of the 10-year certificates.

Fahad Al Saif, Head of PIF’s Global Capital Finance Division and formerly the Head of the NDMC at the Ministry of Finance who oversaw the Centre’s domestic sovereign Sukuk issuance programme, stressed that “this inaugural international Sukuk issuance is another milestone for PIF’s medium-term capital raising strategy and a continuation of our efforts to diversify our funding sources. The high level of investor demand validates PIF’s robust credit profile, which we are determined to maintain and enhance. The success of this transaction also reflects PIF’s ongoing commitment to delivering on its mandate and Vision 2030 targets.”

Proceeds from the issuance will be used by PIF for its general corporate and balance sheet purposes. Loans and debt instruments represent one of PIF’s sources of funding. Other sources include retained earnings from investments, capital injections from the government and government assets transferred to PIF such as the proceeds from IPO sales from Aramco, the state oil utility and the largest producer and exporter of oil in the world.

PIF first entered the debt market in October 2022 with a three-tranche inaugural conventional Green Bond raising an aggregate US$3 billion, followed by an aggregate US$2 billion inaugural Century Green Bond by a sovereign wealth fund, as well as a US$17 billion corporate loan in 2022, as part of PIF’s strategy to diversify its funding sources. The coupon rate in comparison for the inaugural US$1.25 billion (SAR4.69 billion) 5-year Green Bond (Tranche 1) in October 2022 was 5% per annum payable semi-annually; and for the US$1.25billion (SAR4.69 billion) 10-year Green Bond (Tranche 2) was 5.250% payable semi-annually; and the US$500 million (SAR1.88 billion)100-year Green Bond (Tranche 3) was 5.375% per annum payable semi-annually.

Breakthrough Year for Sukuk

For the international Sukuk market, 2024 could be the breakthrough year for Sukuk issuance to take a greater leap forward in terms of product, structure and market differentiation, innovation and reach. Progress however will be subject to the commitment of PIF and other market movers to mainstay Sukuk as an established and regular component of their debt raising and investment programmes. This commitment in itself will be subject to OIC member states and their agencies, and industry bodies, boosting their market awareness of the potential and opportunities the ICM can bring to their public debt-raising mix and the necessary enabling legislation and Sukuk issuance frameworks that need to be in place to facilitate this.

The government of Saudi Arabia and its agencies including PIF and the National Debt Management Centre (NDMC) of the Ministry of Finance have confirmed that domestic and international Sukuk issuance are core components of their debt financing mix for 2024 and beyond together with conventional bonds, Government Alternative Funding (GAF) channels such as standalone issuances, and financing facilities and guarantees by foreign export credit agencies (ECAs) such as the €1 billion export finance facility provided to NDMC in December 2023 by a consortium of international banks but guaranteed by the Italian Export Credit Agency (SACE) in support of Italian exports to the Kingdom. In fact, this is the third financing of its kind after the first two provided by financial institutions through two other export credit agencies.

PIF is poised to be the driver of greater involvement of SWFs and cohorts in the Islamic finance space, not only in Sukuk issuances, but also in Syndicated Murabaha and ECA-related transactions especially with the Islamic Development Bank (IsDB) Group’s multilateral insurer, ICIEC.

The involvement of SWFs in the Islamic finance space has been limited and disappointing since the advent of the contemporary Islamic finance movement in 1975. SWFs have lamented the lack of standardisation, especially of Shariah governance and rules relating to Sukuk issuance; the lack of quality asset pools for securitisation, the lack of engagement between stakeholders and market education; the lack of regular AAA-rated certificates issuances with the requisite volumes, and perhaps most importantly the lack of a secondary trading market to unlock liquidity for both sovereign and corporate Sukuk transactions.

It is just over 13 years since Khazanah Nasional Berhad, the Malaysian SWF, issued the first Sukuk by a SWF in 2011 – a RM500m offering (US$107.58 million at today’s exchange rate). Since then, Khazanah has pioneered several Sukuk offerings including structures incorporating equity exchange options and others especially aimed at financing socially-responsible, sustainable and social projects in the education, financial inclusion and other sectors. Very few other SWFs and pension funds have entered the Sukuk market. As such the US$3.5 billion Sukuk issued by PIF is by far the single largest transaction to date by any OIC SWF.

PIF, according to the SWF Institute, is the sixth largest sovereign wealth fund in the world with assets under management (AUM) totalling US$776.7 billion. Thanks to the Kingdom’s aggressive investment development strategy, especially projects related to the futuristic NEOM City, PIF and its subsidiaries and joint ventures have committed an estimated US$2.3 trillion of investment to a cornucopia of projects and initiatives over a whole spectrum of economic and social sectors. These include several in the Islamic finance space such as the Halal Products Development Company (HPDC); The Saudi Real Estate Refinance Company (SRC), the Sharia’a compliant mortgage finance and securitisation company; and other entities such as GIB KSA and The Helicopter Company which are also accessing Islamic finance facilities or issuing Sukuk.

This issue of DDCAP Research News is dominated by various PIF deals and initiatives in the Islamic finance space, and Sukuk issued by the NDMC over the last two months.