ADIB Benchmark Inaugural US$500m Public Green Sukuk Oversubscribed 5.2 Times as Global Investor Appetite in Islamic Sustainability Commercial Papers Increase

ADIB’s Sustainable Development Framework determines eligibility of projects for the bank to finance or refinance, including the issuance of Green, Social and Sustainability Sukuks. The Bank received a Second Party Opinion from ISS Corporate Solutions (ISS) for the framework, which ensured alignment of the framework with the ICMA Green Bond Principles, Social Bond Principles, Sustainability Bond Guidelines, as well as the Loan Market Association Green Loan Principles and Social Loan Principles.

In addition, ADIB has also issued its ESG strategy, “which is seamlessly integrated into ADIB’s sustainability framework, encompassing key pillars such as maximizing positive impact, becoming a lifelong partner of customers, fostering a strong economic footprint, maintaining a people-centric organizational culture, upholding governance excellence, and remaining a steadfast lifelong partner for communities.”

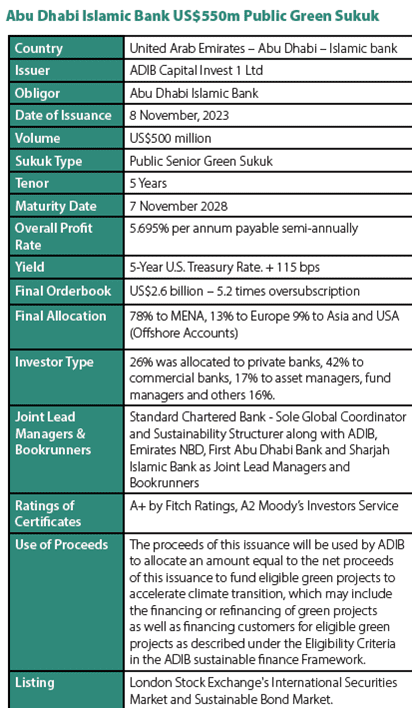

ADIB, which is rated A2 by Moody’s and A+ by Fitch, in each case with a Stable Outlook, priced the Five-year Senior Sukuk certificates, rated A+ by Fitch Ratings at a profit rate of 5.695% per annum payable semi-annually, which translates into a spread of 5-year US Treasury Rate plus 115 basis points (bps).

The issuance, says ADIB, was met with exceptional demand, attracting interest from over 100 global and regional investors with the final orderbook closing at US$2.6 billion, representing an oversubscription rate of 5.2 times. This allowed the final price guidance on 7th November to be tightened meaningfully by 30 bps to 115 bps over the 5-year U.S. Treasury Rate, from initial price thoughts of 145bps.

ADIB intends to allocate an amount equal to the net proceeds of this issuance to fund eligible green projects to accelerate climate transition, which may include the financing or refinancing of green projects as well as financing customers for eligible green projects as described under the Eligibility Criteria in the ADIB Sustainable Finance Framework.

Not surprisingly, Nasser Al Awadhi, ADIB Group Chief Executive Officer, was thrilled that the Bank was “the first financial institution in the world to issue the first US dollar-denominated Green Sukuk, which builds on ADIB’s efforts to address climate change and to advance sustainable solutions that protect the environment and help facilitate a transition to a low-carbon economy. This is an important step in our sustainability journey and will further expand the bank’s role in catalysing capital to address the pressing environmental and social issues facing society today.”

He was particularly buoyed by the “exceptional interest received from a broad range of domestic, regional and international investors. Demand for this issuance exceeded the issue size by 5.2 times, highlighting the tremendous demand and confidence from global investors in ADIB’s asset quality. We are also pleased to see this strong international demand continue as the pricing was tightened significantly. The overall success of this Sukuk can be attributed to ADIB’s clear ESG framework and our strong track record of both growing market share and delivering sustainable returns.”

The issuance was driven by broad demand across three regions, with final allocations of 78% to MENA investor accounts, 13% to Europe, 9% to Asia and Offshore USA. By investor type, private banks accounted for 26% of the allocation, asset and fund managers 17%, commercial banks 42% and others 16%. The new Sukuk is listed and traded on London Stock Exchange’s International Securities Market and Sustainable Bond Market.

During COP28 in Dubai, Mohamed Ali Al Shorafa, Chairman of the Board of The Securities and Commodities Authority (SCA), stressed that “issuing green bonds and Sukuk is one of the transformational projects in supporting the efforts to make the UAE the new global economic hub for the next ten years.”

The aggregate value of green and sustainability-linked bonds and Sukuk registered with the SCA, he disclosed, reached AED15.45 billion (US$4.21 billion) during the first 11 months of 2023. In June the SCA issued a directive exempting companies wishing to list their Green or sustainability-linked bonds or Sukuk in the local market from registration fees for 2023, a move which according to Al Shorafa, “marked a significant start in the growing demand for the issuance of these Sukuk and bonds.”

Issuing Green bonds and Sukuk, further explained Dr Maryam Al Suwaidi, SCA’s CEO in an interview, “is one of the transformational projects for which performance agreements were signed by federal government entities in 2022. These performance agreements represent forward-looking quality projects that will enhance the country’s competitiveness, and the transformational projects will greatly impact all sectors over short periods and ensure the implementation of the new government action model of the UAE government.”