Türkiye Treasury Consolidates Fixed Rate Sukuk Al-Ijarah Issuances Through Three Transactions in July and August 2023 in the Domestic and International Markets Raising an Aggregate US$1.31bn on the Back of Improving Economic Fundamentals

With the return of the respected Mehmet Simsek as Türkiye’s Finance Minister, the economic fundamentals of Türkiye are on a stabilising trajectory. The encouraging development since the May 2023 re-election of President Recep Tayyip Erdogan and the re-appointment of Simsek as finance policy supremo, is the increased activity of the Debt Office of the Turkish Treasury and Finance Ministry in the bond and Sukuk market in July and August 2023.

“Following recent elections,” said Moody’s Investors Service in its latest report on the Turkish banking sector in July 2023, “the government is making tentative steps toward orthodox monetary policy. Since President Recep Tayyip Erdogan’s re-election at the end of May, a new finance minister has been appointed as well as a new central bank governor. The central bank has raised interest rates and loosened penalties imposed on banks for holding foreign-currency liabilities. These measures will aid the recovery of the banking sector’s core margins. the central bank took a further measure to ease pressure on the banks by lowering security maintenance requirements imposed to discourage foreign-currency deposits.”

The move towards orthodox monetary policy after a prolonged period of unorthodox policy, says Moody’s “is positive for Turkish banks because the macroprudential environment constrained their margins.”

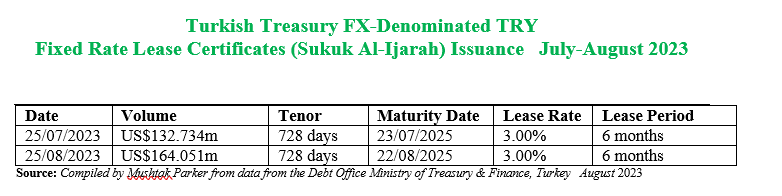

In the public debt space, the encouraging sign is the resort to raise funds from the market through both conventional bonds and Sukuk Al-Ijarah (the preferred structure). In the US Dollar Denominated Fixed Rent Rate Lease Certificate (Sukuk Al-Ijarah) market, the Turkish Treasury raised an aggregate US$296.785 million through two Sukuk Al-Ijarah issuances – one in July and the other in August.

The transaction on 25 July 2023 raised US$132.734 million with a tenor of 728 days priced at a fixed rental rate of 3.00% over 6 months. The transaction on 25 August 2023 raised US$164.051 million also with a tenor of 728 days and priced at a fixed rental rate of 3.00% over 6 months. Demand for the certificates was robust. Both issuances were part of a hybrid fixed rate bond and Sukuk transaction. In the August 2023 issuance the Treasury raised US$2.4 billion compared with the US$164.051 million Sukuk Al-Ijarah. Both issuances mature on 22nd August 2025. The total demand for these issuances, according to the Turkish Treasury exceeded US$2.65 billion.

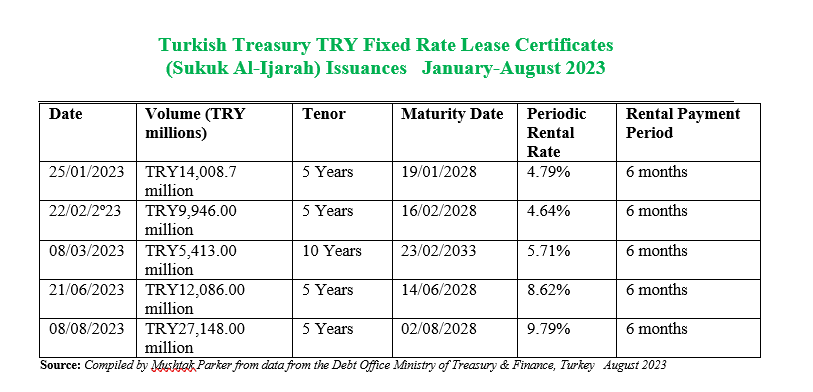

The Turkish Treasury is also consolidating its regular issuance of Sukuk Al-Ijarah in the domestic market. On 8th August 2023 it raised TRY27,148.00 million (US$1,016.39 million) in a 5-Year transaction maturing on 2 August 2028 and priced at a fixed profit rate of 9.79% over a 6-month rental period. This brings the aggregate funds raised so far by the Turkish Treasury in the January-August 2023 period to TRY68,601.7 million (US$2,568.36 million) from the market through the issuance of Fixed Rate Lease Certificate (Sukuk al Ijarah).

In January 2023, the Turkish Treasury raised TRY14,008.7 million (US$740.78 million) through a TRY 5-year Fixed Rate Lease Certificate (Sukuk al Ijarah) issuance. This was followed by a second auction on 22 February 2023 which raised TRY9,946.00 million (US$516.72 million) through a TRY 5-year Fixed Rate Lease Certificates (Sukuk al Ijarah); and a third transaction on 8 March 2023 which similarly raised TRY5,413.00 million (US$281.22 million) through a 10-year Fixed Rate Lease Certificate (Sukuk al Ijarah) issuance. On 21 June 2023, the Treasury raised TRY12,086 million (US$458.76 million) through a 5-year Fixed Rate Lease Certificate (Sukuk al Ijarah) issuance.

The January issuance has a tenor of 5 years maturing on 19 January 2028 and was priced at a fixed rental rate of 4.79% over a 6-month rental payment period. The February issuance too has a tenor of 5 years maturing on 16 February 2028 and was priced at a fixed rental rate of 4.64% over a 6-month rental payment period. The March issuance has a tenor of 10 years maturing on 23 February 2033 and was priced at a fixed rental rate of 5.71% over a 6-month rental payment period. This latest June 2023 issuance has a tenor of 5 years maturing on 14 June 2028 and was priced at a fixed rental rate of 8.62% over a 6-month rental payment period.

According to the Ministry, the lease certificates were issued “in order to increase domestic savings, broaden the investor base and diversify the Treasury’s borrowing instruments.” The latest Lease Certificate transactions were done through a direct sale auction on 25 July, 8 and 25 August respectively. The auctions were conducted by the Central Bank of Turkey via AS (Auction System under Central Bank Payment Systems).

The Turkish Treasury is a proactive issuer of lease certificates as part of a wider universe of government fund-raising instruments which include bonds and Sukuk – leasing certificates and bonds, FX denominated issuances and gold-backed certificates/bonds.

The usual mantra of the Turkish Treasury when announcing these auctions is “in order to increase the domestic savings, broaden the investor base and diversify the borrowing instruments, TRY denominated fixed rent rate lease certificates will be issue to the banks through direct sale method.”

All the lease certificates were issued by Hazine Mustesarligi Varlik Kiralama A.S., a special purpose vehicle wholly owned by the Ministry of Treasury & Finance, the obligor.