Dubai Islamic Bank (DIB), one of the most prolific and regular issuers of Sukuk by a financial institution and the largest Islamic bank in the UAE in terms of assets, continues its momentum in Sustainability Sukuk with its second such offering – a US$1 billion 5.5-year Senior Issue on 13 February 2023. This follows DIB’s inaugural Sustainability Sukuk – a landmark US$750 million 5-year Senior Issue only two months ago on 22 November 2022.

Both Sukuk offerings were issued in line with DIB’s Sustainable Finance Framework which was created to facilitate financing of green and social initiatives and projects.

According to DIB, both transactions achieved several landmarks. The February 2023 issuance marks the largest issuance by a Middle East financial institution in the international capital markets since June 2021 and the largest-ever Sustainable issuance by a Middle East Financial Institution. The November offering was the first-ever Sustainable Sukuk from a UAE Financial Institution and the largest issue size (US$750 million) in the international capital markets from a GCC bank since February 2022.

This February deal, stressed Adnan Chilwan, Group Chief Executive Officer, DIB, once again demonstrated DIB’s leadership in Islamic and Sustainable finance, with an established and strong investor following from Europe, Asia and the Middle East. “Driven by our detailed balanced growth strategy as well as the Bank’s commitment towards the Sustainability agenda of the UAE and the larger “Net Zero by 2050” goal of the nation, we are delighted to announce the issuance of our second Sustainable Sukuk. The success of DIB’s inaugural Sukuk in 2022 strongly reflected the market’s faith in the franchise and the reputation the bank enjoys in the local and international capital markets.

“The investor response for this latest US$1 billion issuance was overwhelming with more than US$3bn of orders allowing us to issue a larger size well within our pricing parameters. Despite issuing a larger size (USD$1 billion), DIB achieved a 3 times oversubscription – which itself was the largest book size seen for a GCC bank in over a year. As the country prepares to host COP 28, we remain committed to play an active role in fulfilling the UAE’s long-term sustainability objectives. We hope the success of our offering will encourage other issuers from the UAE to follow suit in this format.”

Similarly, the November 2022 deal once again had a strong investor interest from Europe, Asia and the Middle East. The Sukuk was priced after completing a comprehensive marketing exercise where DIB updated investors on its positive financial performance as well as its Sustainable Finance Framework. Despite achieving the largest size on a GCC bank deal since February 2022, the book was 2.3 times oversubscribed.

Dr Chilwan, stressed that the inaugural Sustainable Sukuk in November 2022 “was very important for DIB given our strong commitment to Sustainable Finance and the UAE’s Net Zero agenda and the Dubai Clean Energy Strategy. I was particularly pleased with the investor response which enabled us to issue a larger size (USD 750 million) well within our pricing parameters and the success of this transaction continues to highlight the confidence investors place in DIB. While we may be the first UAE bank to issue a Sustainable Sukuk, I sincerely trust we have set a precedent here for other UAE banks to follow.”

Both Sukuk issuances were issued by DIB Sukuk Ltd, its Cayman Island incorporated special purpose vehicle, DIB Sukuk Limited, on behalf of the Obligor, Dubai Islamic Bank. Standard Chartered Bank acted as Sole Sustainability Structurer, while Bank ABC, Dubai Islamic Bank, Emirates NBD Capital, First Abu Dhabi Bank, HSBC, KFH Capital, Sharjah Islamic Bank, Standard Chartered Bank and The Islamic Corporation for the Development of the Private Sector (ICD), the private sector funding arm of the IsDB Group, acted as Joint Lead Managers and Bookrunners on both transactions. Mashreq Bank participated in the February 2023 transaction as a manager and bookrunner.

Both transactions were priced after completing a comprehensive marketing exercise where DIB updated investors on its positive financial performance as well as its Sustainable Finance Framework.

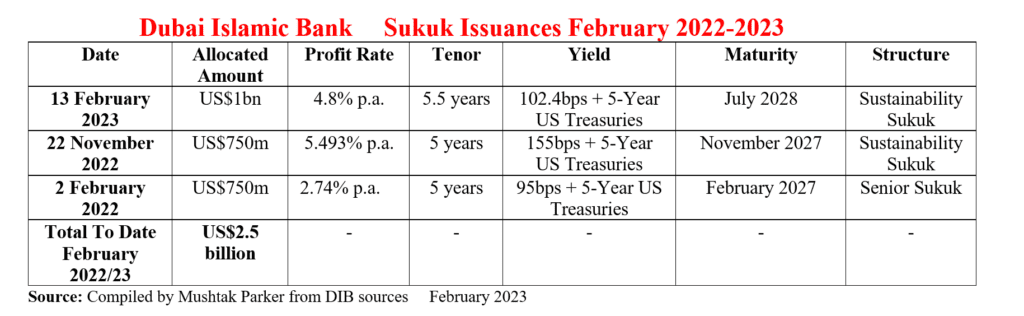

The US$1 billion February 2023 transaction was priced at a tighter profit rate of 4.80% per annum representing a spread of 102.4 bps over 5-Year US Treasuries. This compared with the US$750 million November 2022 transaction was priced at a profit rate of 5.493% per annum representing a spread of 155bps over 5-Year US Treasuries.

Both sets of Sukuk certificates are listed on Euronext Dublin and NASDAQ Dubai and are assigned an ‘A3’ issuer rating by Moody’s Investors Service and an ‘A’ by Fitch Ratings.

Prior to this, DIB successfully priced another in early February 2022 – a benchmark US$750 million Senior Unsecured 5-year Sukuk issued through its Cayman Island incorporated special purpose vehicle, DIB Sukuk Limited. This means that DIB raised an aggregate US$2.2 billion between February 2022-2023 through three Sukuk issuances.

All three issuances come under DIB Sukuk Limited’s US$7.5 billion Trust Certificate Issuance Programme established in June 2021 and amended in February 2022.

According to Dr Chilwan, DIB is committed towards a more sustainable future as it enters a decade of change to support the UAE’s ambitions towards a low-carbon economy. DIB’s ESG roadmap is set to unlock further efficiencies within the business as it integrates sustainability and climate risk into its operating models with the aim to ensure that the bank is safeguarded against the biggest environmental risks that are impacting the global economies.