These are exciting times for the issuance of sovereign domestic Sukuk. There is no doubt that the National Debt Management Centre (NDMC) of the Saudi Ministry of Finance (MoF) is setting the pace. In fact, not only has it confirmed a robust consecutive monthly (January-December) domestic Sukuk issuance programme for 2023, but the mood music relating to Sukuk as a preferred debt raising instrument is positively proactive.

The NDMC kicked off with its first issuance of the year under its Saudi Riyal-denominated Sukuk Issuance Programme with a two-tranche auction completed on 24 January 2023.

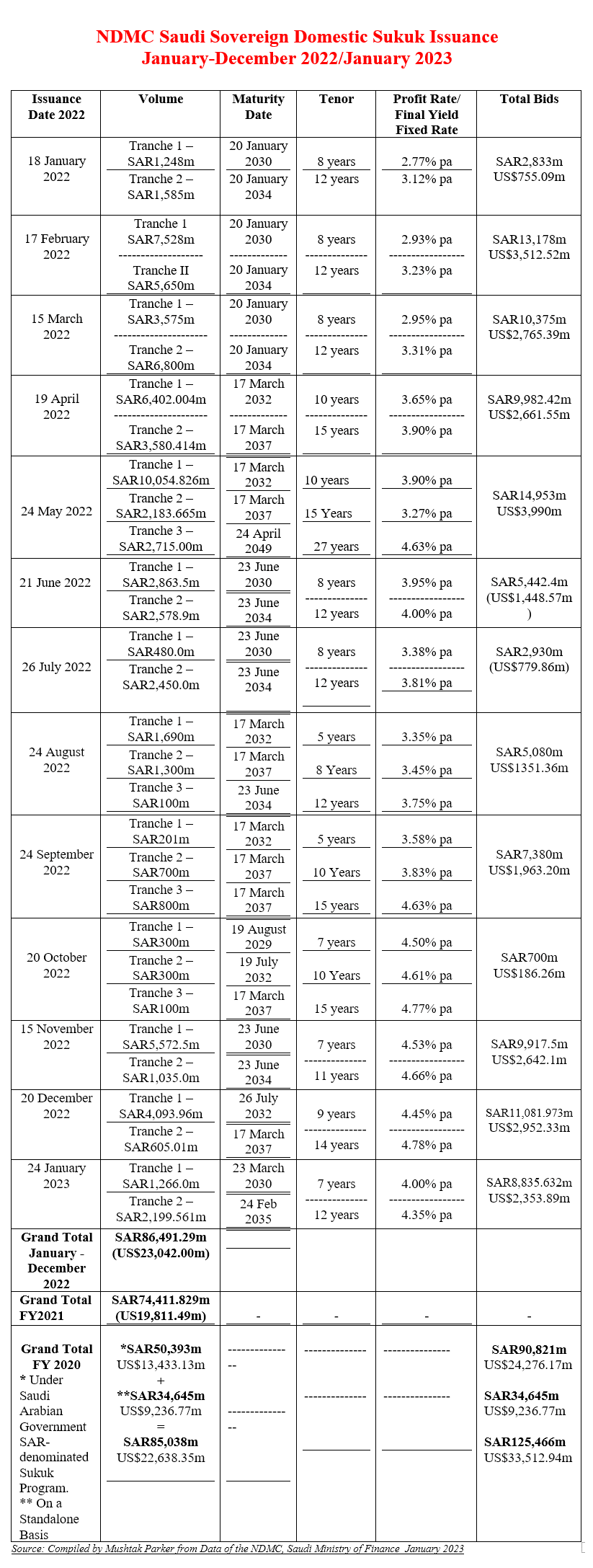

The January 2023 Sukuk auction comprised two tranches with an aggregate SAR3,465.561 million (US$923.25 million), with total bids reaching a robust SAR8,835.632m (US$2,353.89m). The two tranches comprised:

- A first tranche of SAR1,266 million (US$337.27 million) with a 7-year tenor maturing on 23 March 2030 and priced at a yield of 4.0% per annum and a price of SAR91.913. Bids received totalled SAR3,151 million (US$839.45 million).

- A second tranche of SAR2,191.561 million (US$583.85 million) with a 12-year tenor maturing on 24 February 2035 and priced at a yield of 4.35% per annum and a price of SAR87.419. Bids received totalled SAR5,684.632 million (US$1,514.43 million).

The NDMC had finished the issuance calendar for 2022 with two auctions – one on 20 December and the other on 15 November, raising an aggregate amount of SAR4,698.97 million (US$1,251.84 million) in December and SAR7,607 million (US$2,026.70 million) in November 2022. Demand for both issuances was encouraging with bids totalling SAR11,081.973 million (US$2,952.33 million) for the December auction; and SAR9,917.5 million (US$2,642.1 million) for the November auction.

The December 2022 Sukuk auction comprised two tranches:

- A first tranche of SAR4,093.96 million (US$1,090.66 million) with a 9-year tenor maturing on 26 July 2032 and priced at a yield of 4.45% per annum. Bids received totalled SAR9,176.962 million (US$2444.82 million).

- A second tranche of SAR605.01million (US$161.18 million) with a 14-year tenor maturing on 7 March 2037 and priced at a yield of 4.78% per annum. Bids received totalled SAR1,905.011 million (US$507.51 million).

The November 2022 Sukuk auction similarly comprised two tranches:

- A first tranche of SAR5,572.5 million (US$1,484.56 million) with a 7-year tenor maturing on 23 June 2030 and priced at a yield of 4.53% per annum. Bids received totalled SAR5,572.5 million (US$1,484.56 million).

- A second tranche of SAR1,035 million (US$275.73 million) with a 11-year tenor maturing on 23 June 2034 and priced at a yield of 4.66% per annum. Bids received totalled SAR4,345 million (US$1,157.54 million).

Outside the government’s domestic Sukuk Issuance Programme, the NDMC also raises additional funding from the local and international markets. In October the government raised US$2.5 billion through a first international Sukuk issuance in 2022, in addition to tapping the conventional bond market.

The NDMC did give notice that it would continue, in accordance with the approved Annual Borrowing Plan, “to consider additional funding activities subject to market conditions and through available funding channels locally or internationally. This is to ensure the Kingdom’s continuous presence in debt markets and manage the debt repayments for the coming years while taking into account market movements and the government debt portfolio risk management.” This practice will continue in 2023.

In 2022 the Saudi Ministry of Finance issued an aggregate SAR86,491.29 million (US$23,042.00 million) of Saudi-riyal denominated Sukuk for the January-December period through consecutive monthly issuances. In the same period in 2021, according to data compiled by Mushtak Parker from official MoF reports, the NDMC issued an aggregate SAR65,741.315 million (US$17,491.51 million).

The Kingdom is by far the single most proactive sovereign domestic Sukuk issuer in the world. The NDMC’s 2023 Calendar of Local Sukuk Issuances, released in January, confirms the intention of issuing domestic sovereign Sukuk consecutively for each month of the year from January to December – the only sovereign issuer to commit to such a calendar in advance.

This commitment is partly driven by the robust market demand for Saudi Arabian sovereign domestic Sukuk certificates. The NDMC’s role is to secure Saudi Arabia’s debt financing needs with the most competitive financing costs. Saudi Arabia is ahead in tapping the domestic sovereign Sukuk market because it also has an established issuance infrastructure complete with a government policy framework under its ‘Fiscal Balance Programme and Financial Sector Development Programme’, whose objectives are to add to a diversified public debt fund raising strategy and to the development of the Saudi Sukuk and Islamic Capital Market.

The NDMC Sukuk are all issued under the unlimited Saudi Arabian Government SAR-denominated Sukuk Programme, which focuses on fixed-rate instruments “to hedge against risks of potential interest rate fluctuations.”

The true figure of the Kingdom’s domestic sovereign Sukuk issuance activity assumes even greater importance if we include “the standalone Sukuk issued by the NDMC in March 2022 under the Sukuk Issuance Programme in Saudi Riyal with a total value around SAR26.2 billion (US$6.98 billion) to unify the Kingdom’s domestic issuances under the Sukuk Issuance Programme in Saudi Riyal, that represents the third phase of this initiative which was started in 2020 and it will continue until unifying all domestic debt outstanding.”

This means that the total volume of funds raised by the NDMC through domestic Sukuk issuances reached a staggering SAR112,691.29 million (US$30,021.89 million) in 2022. If we add the US$2.5 billion international Sukuk in October, the total volume of funds raised by the NDMC through Sukuk issuances in 2022 in dollar terms reached US$32,521.89 million.

The NDMC is currently working on attracting new capital, and international financial institutions in addition to selected local banks to take part in the Primary Dealers Program, to capitalize on the debt instruments arranged by the NDMC. In October, the Ministry of Finance and the NDMC signed agreements with BNP Paribas, Citigroup, Goldman Sachs, J.P. Morgan, and Standard Chartered Bank appointing them as primary dealers in the government’s local debt instruments. The cohort of international institutions join the five local institutions, namely, Saudi National Bank, Saudi British Bank (SABB), Al Jazira Bank, Alinma Bank, and Al Rajhi Bank, already in the NDMC’s Primary Dealers Programme.

According to Saudi Minister of Finance Muhammed Al Jadaan “these agreements are a continuation of the developmental steps taken towards achieving Vision 2030 objectives under the umbrella of the Financial Sector Development Program. This is primarily achieved through cooperation between relevant entities to develop the infrastructure of the local debt market and increase the liquidity of the government’s local debt instruments by attracting more capital from foreign investors. This is in addition to enabling primary dealers and market participants to play their roles in providing appropriate tools.”

In January 2023, Saudi Finance Minister, Mohammed Al-Jadaan, approved the Annual Borrowing Plan for the year which includes sovereign debt developments, a review of debt market initiatives in 2022, the 2023 funding plan and its guidelines, and the domestic Sukuk issuance calendar under the Saudi Arabian Government SAR-denominated Sukuk Programme.

The 2023 plan estimates financing needs at about SAR45 billion, and much of this has already been secured needs in 2022 through pre-funding activities.

“Despite the expectation of achieving a budget surplus during the year 2023, the Kingdom aims to continue its funding activities in the domestic and international markets with the objective of repaying debt principal that will mature during the year 2023 and during the medium-term; utilizing opportunities based on market conditions to enter into pre-funding and liability management transactions, financing strategic projects; and executing government-alternative funding transactions that will promote economic growth such as capital expenditure and infrastructure financing.

“In addition, the NDMC will continue to consider additional funding activities subject to market conditions and through available funding channels locally or internationally. This is to ensure the Kingdom’s continuous presence in debt markets and to enhance the Kingdom’s debt portfolio characteristics, taking into account market movements and the government debt portfolio risk management.”