The Federal Government of Nigeria (FGN) continued to build up a yield curve for its naira-denominated FGN Sovereign Domestic Sukuk with its fifth offering to date on 2 December 2022 – a ₦130 billion (US$280 million) Sukuk Forward Ijarah linked to road infrastructure development.

This latest transaction issued by the Debt Management Office (DMO) of the Nigerian Ministry of Finance on 2 December 2022 was originally aimed at an initial offering of ₦100 billion, but according to the DMO “was upsized to ₦130 billion due to the over 165% subscription level. The level of subscription is evidence of investors’ confidence in the use and impact of Sukuk in the construction and rehabilitation of road infrastructure across the country.”

The proceeds of the 2022 Sovereign Sukuk, like the previous Sukuk issuances, will be used solely for the construction and rehabilitation of key road projects through the Federal Ministry of Works and Housing and the Federal Capital Territory Administration.

The DMO’s Sukuk issuance strategy is unique in that it is entirely focused on financing the rehabilitation and reconstruction of key road projects across the six geopolitical zones and the Federal Capital Territory. This strategy for various reasons could be evolved as a model for other countries – both in developed and developing economies.

According to the G20 and World Bank Sukuk are particularly suited to fund infrastructure projects although in recent years banks and corporates have resorted to Sukuk to boost Tier I and II capital under Basle requirements, refinancing existing more expensive conventional debt and for balance sheet purposes.

This latest Sukuk issuance was in fact preceded by what the DMO calls a “wide public sensitization to encourage subscription from diverse investors, particularly retail investors.” It attracted robust 165% oversubscription, which prompted the upsizing.

The 10-year Sukuk were issued on 21 November 2022 through FGN Roads Sukuk Company 1 PLC on behalf of the obligor, the Federal Government of Nigeria, and is priced at a fixed rental rate of 15.64% per annum payable half yearly. The certificates have a maturity on 1 December 2032.

The transaction involved a wide range of Nigerian financial institutions and was lead managed by Greenwich Merchant Bank; Stanbic IBTC Capital, a member of South Africa’s Standard Bank Group; Vetiva Capital Management Limited; and Buraq Capital Limited. Stanbic IBTC Bank Plc, Jaiz Bank Plc, Lotus Bank Ltd, Sterling Bank Plc, Taj Bank Ltd, Zenith Bank Plc and Greenwich Merchant Bank Ltd acted as receiving banks.

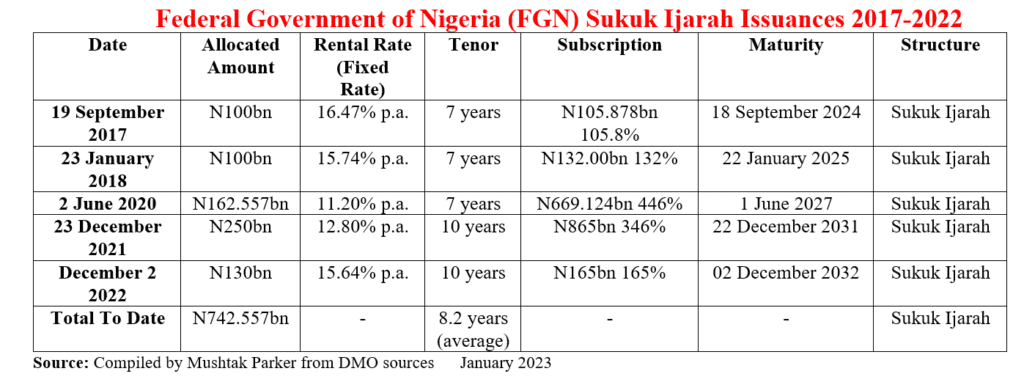

Demand for FGN domestic Sukuk has been robust since the inaugural issuance in 2017. The ₦250 billion Sukuk transaction in 2021, for instance attracted an “unprecedented subscription level of over ₦865 billion (US$2.09 billion),” which means the issuance was oversubscribed by 346%. The average subscription for the five Sukuk issuances between 2017-2022 is ₦387.4 billion for an average ₦148.1 billion offering with an average tenor at 8.2 years. Thus far in the period 2017 to 2022, the DMO has issued five domestic sovereign Sukuk totalling ₦742.557bn (US$1.61 billion).

The DMO is buoyed by the diverse number of investors (retail investors, banks, Pension Fund Administrators, asset/fund managers, insurances companies, ethical funds, Takaful operators/non-interest banks, stockbrokers, Government agencies, High Net Worth Individuals, Trustees and Unit Trusts) who supported the Federal Government’s infrastructure development efforts through Sukuk financing.

“The strong participation of retail investors, ethical funds and non-interest financial institutions in this Sukuk Offering,” stressed the DMO, “attest to the fact that the Government’s objective of promoting financial inclusion through admitting more retail investors and ethical funds into the financial system is being achieved.”

In a strong hint of issuance intent, the DMO added that it “will work to sustain the laudable achievements recorded so far in the use of Sukuk Issue proceeds for the construction and rehabilitation of Nigerian roads, and thereby, continue to enhance ease of commuting and doing business, safety on our roads, job creation, economic growth, and the prosperity of our nation.”

Prior to the latest issuance Patience Oniha, Director of General of the DMO, stressed to me that the FGN Sukuk embodies two key sustainability features – infrastructure and financial inclusion. “We consider Sukuk to be one of the useful and accepted products for raising funds,” she explained. “The proceeds from the issuance will be used solely for the construction and rehabilitation of 44 arterial roads across the six geopolitical zones of the country. Issuing further Sukuk in 2022, will depend on eligible projects in the 2022 Appropriation Act.”

The Sukuk certificates, which are guaranteed by the government, are available to both institutional and retail investors. The journey of retail investors is revealing – 5% for the debut issuance in 2017, followed by 17.33% for the second issuance in 2018, to over 18% for the third issuance in 2020.

The increasing level of participation by a more diverse and larger number of investors, stressed the DMO, “is a confirmation that the DMO’s objectives of issuing sovereign Sukuk to grow the domestic investor base and promote financial inclusion is being achieved. In addition, the high subscription level is proof of investors’ acknowledgement of the impact the first three Sukuk issuances totalling N362.577 billion (US$880 million) issued between 2017 and 2020 has had on the development of road infrastructure in Nigeria.”

According to Oniha, sovereign Sukuk diversifies the product range available to investors in the domestic financial market, widens the investor base and promotes financial inclusion by attracting several first-time retail investors.

According to the DMO, FGN Sukuk IV has several sustainability and ethical attributes. These include responsible investing (the proceeds are dedicated to tangible road infrastructure projects; financial inclusion for non-interest investors with the aim also of further developing the savings culture in Nigeria; ethical investment for investors who are ethically minded; low risk as the certificates are guaranteed by the FGN; liquidity since the certificates can be traded on the two top local stock exchanges and qualify as liquid assets for banks and other institutions; and the Sukuk certificates may be used as collateral for securing credit facilities from financial institutions.

The Sukuk certificates are listed on the FMDQ Securities Exchange, Nigeria’s largest bourse, and the Nigerian Exchange Limited. With the listing, Sukuk certificate holders can trade them while new investors have an opportunity to buy the certificates in the secondary market, thus unlocking vital liquidity in the capital market. The development impact of Sukuk is clearly visible – improved road infrastructure within and outside Nigerian cities, timely completion of designated projects and the multiplier effects associated with construction of capital projects such as roads.

This, says the DMO, “has brought reprieve to road users, improved travel times between major commercial cities, linked borrowing and government expenditure to specific critical projects, helped increase the flow of cargo and passenger traffic across major cities, and improved infrastructure delivery across the country. The impact of the sovereign Sukuk on road infrastructure in terms of job creation, travel time, safety and movement of goods have made the Sukuk a beneficial financial instrument for financing economic growth and development.”

Sovereign Nigeria could take advantage of its first mover involvement in infrastructure linked Sukuk. The five issuances to date have failed to spur a market for quasi-sovereign, corporate and social issuances. Thus far the government of Osun State is the sole other issuer.

In December 2022, Pomegranate Nigeria Limited successfully raised N2.25 billion through a 3-year Al-Ijarah Sukuk arranged and privately placed by Wealth Bridge Capital Partners Limited. The proceeds from the Sukuk would be used to fund the purchase of 40 new logistic trucks to meet recently signed contracts with the likes of Friesland Campina WAMCO Nigeria Plc, Suntory Beverage and Foods Ltd, and Seven-Up Bottling Company Plc.