The National Debt Management Centre (NDMC) of the Saudi Ministry of Finance (MoF) continued its 2022 Saudi Riyal-denominated Sukuk Issuance Programme on schedule with a three-tranche auction completed on 22 October 2022.

This together with the Kingdom’s first international Sukuk issuance amounting to US$2.5 billion in 2022 completed in October, and the issuance of Sukuk by quasi-sovereign entities in the GCC, suggests a return of Sukuk issuance momentum in the region despite the various uncertainties in the global economy.

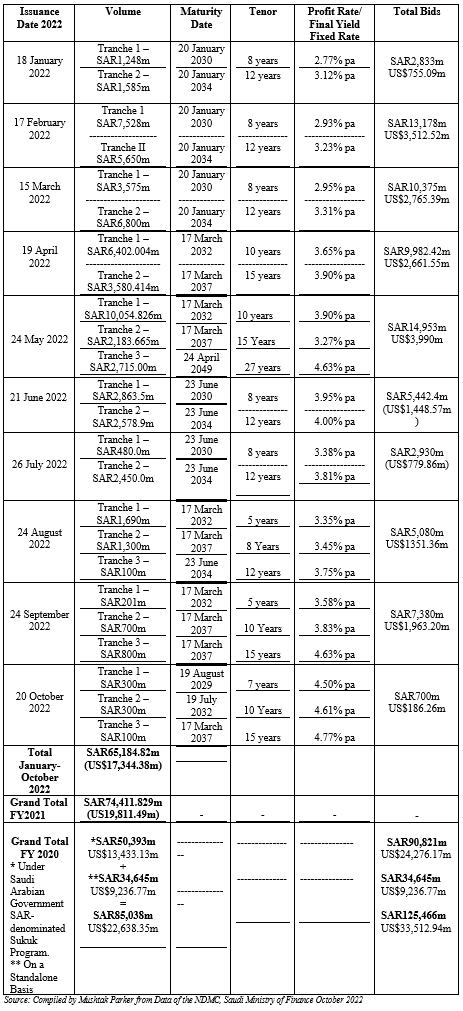

The 20 October 2022 Sukuk auction comprised three tranches with an aggregate SAR700 million (US$186.26 million), with total bids reaching SAR3.127 billion (US$830 million). The three tranches comprised:

- A first tranche of SAR300 million (US$79.82 million) with a 7-year tenor maturing on 19 August 2029 and priced at a yield of 4.5% per annum and a price of 87.93966 %. Bids received totalled SAR1.825 billion (US$490 million).

- A second tranche of SAR300 million (US$79.82 million) with a 10-year tenor maturing on 26 July 2032 and priced at a yield of 4.61% per annum and a price of 103.39916%. Bids received SAR1.135 billion (US$300 million).

- A third tranche of SAR100 million (US$26.60 million) with a 15-year tenor maturing on 17 March 2037 and priced at a yield of 4.77% per annum and a price of 85.32126%. Bids received SAR167.013 million (US$44.44 million).

This transaction follows the two auctions – one in August and the second in September 2022 – completed by the NDMC which raised an aggregate SAR4,791 million (US$1,274.48 million).

This means that in the first ten months of 2022 the Saudi Ministry of Finance issued an aggregate SAR65,184.82 million (US$17,344.38 million) of Sukuk. In the same period in 2021, according to data compiled by Mushtak Parker from official MoF reports, the NDMC issued an aggregate SAR65,741.315 million (US$17,491.51 million). In dollar terms, the figures for the two years are about the same, albeit in Saudi riyal terms it was slightly higher in 2021, perhaps impacted by a slowing down of Sukuk issuance in volume due to commodity market and global economic and geopolitical uncertainties.

The Kingdom is by far the single most proactive sovereign domestic Sukuk issuer in the world. The NDMC’s 2022 Calendar of Local Sukuk Issuances, released in January, confirms the intention of issuing domestic sovereign Sukuk consecutively for each month of the year from January to December – the only sovereign issuer to commit to such a calendar in advance.

This commitment is partly driven by the robust market demand for Saudi Arabian sovereign domestic Sukuk certificates. The NDMC’s role is to secure Saudi Arabia’s debt financing needs with the most competitive financing costs. Saudi Arabia is ahead in tapping the domestic sovereign Sukuk market because it also has an established issuance infrastructure complete with a government policy framework under its ‘Fiscal Balance Programme and Financial Sector Development Programme’, whose objectives are to add to a diversified public debt fund raising strategy and to the development of the Saudi Sukuk and Islamic Capital Market.

The NDMC Sukuk are all issued under the unlimited Saudi Arabian Government SAR-denominated Sukuk Programme, which focuses on fixed-rate instruments “to hedge against risks of potential interest rate fluctuations.”

The true figure of the Kingdom’s domestic sovereign Sukuk issuance activity assumes even greater importance if we include “the standalone Sukuk issued by the NDMC in March 2022 under the Sukuk Issuance Programme in Saudi Riyal with a total value around SAR26.2 billion (US$6.98 billion) to unify the Kingdom’s domestic issuances under the Sukuk Issuance Programme in Saudi Riyal, that represents the third phase of this initiative which was started in 2020 and it will continue until unifying all domestic debt outstanding.”

This means that the actual aggregate volume of sovereign domestic Sukuk issued by the NDMC in the first ten months of 2022 reached SAR91,384.82 million (US$24,315.67 million).

The NDMC is currently working on attracting new capital, and international financial institutions in addition to selected local banks to take part in the Primary Dealers Program, to capitalize on the debt instruments arranged by the NDMC. In October, the Ministry of Finance and the NDMC signed agreements with BNP Paribas, Citigroup, Goldman Sachs, J.P. Morgan, and Standard Chartered Bank appointing them as primary dealers in the government’s local debt instruments. The cohort of international institutions join the five local institutions, namely, Saudi National Bank, Saudi British Bank (SABB), AlJazira Bank, Alinma Bank, and Al Rajhi Bank, already in the NDMC’s Primary Dealers Programme.

According to Saudi Minister of Finance Muhammed Al Jadaan “these agreements are a continuation of the developmental steps taken towards achieving Vision 2030 objectives under the umbrella of the Financial Sector Development Program. This is primarily achieved through cooperation between relevant entities to develop the infrastructure of the local debt market and increase the liquidity of the government’s local debt instruments by attracting more capital from foreign investors. This is in addition to enabling primary dealers and market participants to play their roles in providing appropriate tools.”

An interesting development at the end of September was the announcement by Saudi Arabia of increases in government spending in 2022-24 of more than 18% (around SAR175 billion or 4-4.5% of GDP) compared to the targets previously published at the end of 2021. According to Moody’s Investors Service, “such upwardly revised spending targets point to smaller fiscal surpluses in the coming years, moderating prospects for the sovereign’s balance sheet improvement, but may contribute to reducing the Kingdom’s economic reliance on hydrocarbons, provided the spending is successfully deployed to advance government-sponsored diversification projects.”

Saudi Sovereign Domestic Sukuk Issuance January-October 2022